Written by Nick Ackerman.

Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) has a value-oriented portfolio and provides significant diversification to dividend-paying stocks. The fund tracks to the Dow Jones U.S. Dividend 100 Index. That provides plenty of diversified exposure across 100 dividend stocks, but it isn’t simply focused on high yields. Instead, there is a quality tilt there, as the payers have to have some history and better relative financial metrics.

Dow Jones U.S. Dividend 100 Index. Measures the stock performance of 100 high dividend paying U.S. companies with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios.

For instance, when the selection process starts for the index it tracks, they need to have a minimum of 10 years of consecutive dividend payments. Some additional considerations are the market cap of the company needs to be at least $500 million, which includes another hurdle with average trading volume, but that’s relatively low.

Once those hurdles are met, then they are sorted by indicative annual yield. Those in the top half are eligible securities. So, there are a lot of steps that need to be met before hitting the annual yield level. However, it isn’t simply just the highest yielding from that basket. Instead, it then gets screened further for eligible securities to get it down to the 100. That includes a screen for free cash flow to total debt, return on equity and a 5-year dividend growth rate.

Providing access to this passive index also comes cheap; SCHD charges just 0.06%. The average ETF charges 0.48%, but it seems lately that there have been more and more active funds that can keep expenses higher. SCHD is rebalanced quarterly and reconstituted annually.

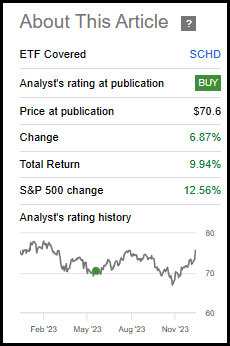

Since our update earlier this year, shares have provided a respectable return.

SCHD Performance Since Prior Update (Seeking Alpha)

We started to play SCHD earlier this year with options and looked at it for implementing the option wheel strategy. That said, the price hasn’t been the most cooperative, with a price that has been relatively weaker through most of this year due to the value-oriented tilt of the portfolio. Growth has been the area of the market getting most of the attention, but more specifically, the Magnificent 7. That has resulted in there being more opportunities to write puts than covered calls after taking that initial assignment.

However, the environment turned more recently with the Fed signaling that they are looking to cut rates three times next year. In the longer run, the Fed is still anticipating a rate closer to 2.5%. Of course, these are only projections and are subject to change – and more than likely will change – perhaps materially. Still, the trend is to expect a lower rate environment and that we are beyond the peak of this cycle, which should bode well for SCHD.

Fed Projections For Interest Rates (Summary of Economic Projections (highlights from author))

And with that news, it sent shares of SCHD higher as its underlying portfolio started to rebound, but that was only after significantly higher risk-free Treasury Rates began to surge before beginning to pull back in November. Just as quickly as Treasury Rates surged, it seemed they came falling back to Earth in just a dramatic fashion.

Ycharts

However, it still presented a period where we were able to write more puts on SCHD at the $65 strike price to bring in a premium of $0.50, entering that trade on October 25, 2023.

Suffice it to say, with the surge we’ve seen now in the ETF, the trade expired worthless, and we locked in that premium. The shares are actually up just over 10% since we entered that trade.

Ycharts

In hindsight, I should have been more aggressive and written puts closer to the share price at the time. At the time, it seemed that rates were set to continue to surge, and we still allowed for a cushion of a 5.3% decline before breaching the $65 strike as shares were closer to $68.60.

In fact, this surge puts us quite close to the $76 share price of where we took assignment of these shares originally going back to March 17, 2023.

Recap of Previous SCHD Option Trades Thus Far

Here is a recap of all the option trades on SCHD we’ve been able to do this year:

- January 13, we wrote puts at $76, collected $0.62, and that initial trade expired worthless.

- On February 17, we wrote more puts at $76 with an expiration of March 17, but we actually had an early assignment on March 11. This was when the bank crisis started to kick off. Still, in that trade, we collected $0.90 in premiums.

- Then, on April 3, we were able to write some covered calls at the $76 strike price and bring in a premium of $0.52. That trade expired worthless.

- The market then took another turn lower. On May 15, we were able to write puts at a $67 strike price, taking in $0.40, which expired worthless.

- On July 19, we were able to turn around and started writing covered calls once again at the $76 strike. We did so and received $0.43 in premium.

- That takes us up to this latest trade on October 25, where we wrote more puts at $65 and received $0.50 in premium.

Overall, the idea was to write more covered calls. Sometimes, the market doesn’t work out in the way you plan for, and you can adjust to the different circumstances, which includes turning to write more puts to reduce your cost basis potentially.

Since we were long some shares due to that assignment in March, we also collected all four dividends this year from the fund, working out to $2.658 in dividends as well as the $3.37 received in options premiums. For the original shares assigned, the initial premium received plus the two covered call transactions resulted in $1.85 in option premiums.

Going Forward

Going forward, SCHD is at a level where we could easily write more covered calls once again at the $76 level. That being said, and maybe it’ll look silly in hindsight, but I’m waiting for a potential Santa Claus rally still. If we get that, and it wasn’t already pulled forward with the latest equity surge, we could write covered calls at higher strikes and potentially pull in some capital gains, assuming the shares are called.

With that being said, SCHD is perfect for this strategy, in my opinion, because there is no rush to write covered calls. I could be just as happy sitting on shares of this ETF over the long term and being patient. The diversification and dividend-oriented approach make it an easy holding to fit into any other well-diversified or even a non-well-diversified portfolio and helps make it even more diversified. For me personally, several of the top ten holdings within SCHD are holdings that are already carried on an individual basis as well.

Verizon (VZ), Home Depot (HD), AbbVie (ABBV), Texas Instruments (TXN), Merck (MRK) and BlackRock (BLK) are all positions in my portfolio already.

SCHD Top Ten Holdings (Schwab)

Broadcom (AVGO) is on my watchlist and has climbed to SCHD’s largest holding due to an incredible stock performance throughout this year, but it has received another surge after its latest earnings report. Previously, it was their second-largest holding after Pepsico (PEP). PEP has seen quite the fall, but the packaged food companies in the consumer staples space have been relatively weaker overall.

These are areas of the market that have been racing higher on the back of the Fed’s expectations for acknowledging that rate cuts will need to be more aggressive going forward. Inflation is coming down, and they let inflation run hot for too long, shooting past their targets. Now, they look like they want to avoid overshooting to the downside to get that “soft landing.”

With all that being said, several of these value and dividend-oriented plays are still looking fairly attractive and cheap relative to their historical ranges and price targets. As rates are set to come down, their historical valuations can start to make more sense as those pressures ease. We might not go back down to the zero rate environment – at least barring a substantial economic downturn – but even in those scenarios, dividend payers can be more attractive as defensive plays.

AVGO might be on the more expensive side, but with AI potential, some of that could be warranted. I’d still be looking for a correction there before entering. That said, something like VZ is a perfect example of something very attractively valued. The shares are still trading with an over 7% yield, a forward P/E of less than 8x and a price target of ~41%.

VZ Fair Value Yield Range (Portfolio Insight)

ABBV is working through their Humira patent cliff that they reached this year, so that might be a noisy picture. However, at less than 14x forward earnings, the stock doesn’t seem overly expensive. Analysts are still expecting earnings growth going forward after getting through 2023. The stock also sports a ~4% dividend yield, with the average analyst price target closer to ~$170 would also suggest some further potential upside.

The sector weightings continue to favor industrials, healthcare and financials, the same as what we saw earlier this year.

SCHD Sector Allocation (Schwab)

Given the solid portfolio, the fund has a strong track record of dividend growth, and we can put down 2023 as continuing that trend. Of course, the underlying index that the fund tracks nearly ensures it’s stacked with dividend growers. I suspect it would take a deep and widespread economic downturn before threatening a material reduction in the dividend; even then, during 2020 Covid, the dividend growth had its second-best year.

SCHD Dividend History Chart (Seeking Alpha)

However, it was only a 3.77% increase this year, likely disappointing some. Still, in my opinion, growth is growth. This is especially true for the environment that we have just gone through with significantly higher interest rates. That causes debt costs to balloon at companies to rates not seen in decades. Therefore, more cash flow is going toward debt payments, and this was a year of stabilization as companies grappled with this changing environment.

SCHD Dividend Growth History (Seeking Alpha)

Next year could easily return to another double-digit dividend growth year if rates ease and companies are finding their footing. That’s why I’m not disappointed here: We all knew the interest rate environment shifted, and that means more prudent management is required.

Conclusion

Overall, it’s easy to be patient before generating additional ‘income’ through options writing with SCHD and hold the long term—the portfolio diversification and adding just more of what I’m already holding with a steadily growing dividend stream. The prospects for SCHD look promising as we go forward with the potential for more upside with the changing rate environment. I would also suspect that the trend of higher annual dividend payouts will continue well into the future.

Read the full article here