Both Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) and JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) have become pretty popular ETFs among investors in recent years. While both funds employ different strategies and JEPI is considered to be riskier due to the high turnover and the fact that it’s actively managed in comparison to SCHD, which has a low turnover and is considered to be a traditional dividend ETF, they nevertheless can generate decent risk-adjusted returns.

They are also highly dependent on macro conditions due to their wide diversification, but at the same time, their exposure to various sectors differs. That’s why it makes sense to believe that one can outperform the other under differing economic backdrops. Therefore, this article aims to highlight the positive and negative sides of both ETFs and help investors better understand which one would be a better fit for their portfolios in 2024.

SCHD vs. JEPI: Here’s Everything You Need To Know

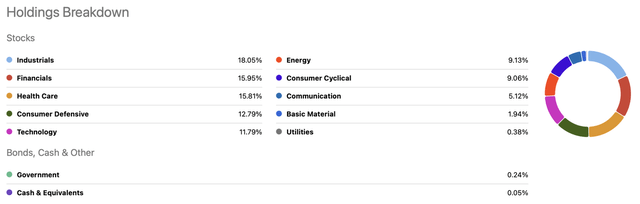

One of the biggest differences between JEPI and SCHD is that the latter has greater exposure to the energy sector and holds fewer tech stocks in comparison to the former. SCHD’s holdings are also more defensive in nature and the three main sectors to which it’s exposed the most are the industrials, financials, and health care. In addition, SCHD is less diversified since 40.44% weight of the portfolio is concentrated in the top 10 holdings out of a total of 104 holdings. Currently, the ETF has ~$48.5 billion in net assets, and its five biggest holdings are Broadcom (AVGO), Verizon (VZ), Amgen (AMGN), Coca-Cola (KO), and PepsiCo (PEP).

One of the biggest advantages of SCHD is that its expense ratio is only 0.06%, which is cheap even when compared to other ETFs that are focused mostly on holding value stocks in their portfolios.

SCHD Holdings Breakdown (Seeking Alpha)

When it comes to JEPI, it has been rising in popularity recently mostly thanks to its focus on exposing itself to the higher growth names from the tech sector and targeting a monthly high-yield distribution at the same time. This is the most unique selling point of JEPI in comparison to other ETFs such as the SCHD. What’s more, is that JEPI’s portfolio is more diverse, and despite being exposed to 135 holdings, its 10 largest holdings account only for the ~16% weight of the overall portfolio. JEPI also has minimal exposure to the energy sector in comparison to SCHD, it has a total of ~$30 billion in net assets, and its top five holdings are Microsoft (MSFT), Amazon (AMZN), Adobe (ADBE), The Progressive Corporation (PGR), and Trane Technologies (TT).

It’s also important to note that JEPI uses a covered call strategy, which is the main reason why the ETF can generate higher yields, but such a strategy also caps its upside due to the use of out-of-the-money options at the same time. However, thanks to its ability to generate higher yields, investors continue to hold JEPI in high regard, even though its expense ratio is 0.35% due to the fact that the ETF is more actively managed in comparison to SCHD.

JEPI Holdings Breakdown (Seeking Alpha)

When it comes to the performance, the chart below shows that since May 2020, which is when JEPI was established, SCHD has generated a total return of ~60% in comparison to the total return of ~50% for JEPI and ~55% for the broad market. One of the main reasons why SCHD generated greater returns is due to the larger exposure to the energy sector, which has greatly benefited from the volatility and restructuring of the energy market that began last year as a result of Russia’s war against Ukraine.

Total Return Comparison (Seeking Alpha)

However, SCHD hasn’t been performing successfully lately in comparison to JEPI and the broad market. The moment the macro conditions began to improve, and the disinflation process kicked off at the start of 2023, the high growth names to which JEPI exposed the most helped the ETF to generate a total return of 6% YTD against a negative total return of -5% YTD for SCHD.

Total Return Comparison (Seeking Alpha)

What’s more is that if we look at the valuations of the top 3 holdings of both ETFs – we’ll see that JEPI’s stocks trade at over 20 times their EV to EBITDA, while SCHD’s stocks mostly trade at significantly lower multiples. If the macro condition won’t deteriorate and growth names continue to outperform the broad market, then it’s likely that JEPI will outperform SCHD. However, in case of the worsening of conditions, SCHD could have an upper hand, especially if the energy sector once again begins to outperform all the other sectors.

When it comes to yields, JEPI has an advantage due to its covered call strategy discussed above. While SCHD has a yield of 3.65%, JEPI’s current yield is ~9%. However, the biggest advantage of SCHD is that its yield has been slowly growing at a predictable rate, while JEPI’s yield is too volatile due to its strategy and portfolio composition, which might not be a good fit for a lot of investors who are aiming to have a predictable income.

At the same time, SCHD pays dividends each quarter, while JEPI pays dividends monthly.

Dividend Yield (Seeking Alpha)

What’s Next For SCHD and JEPI?

For investors who are interested in adding SCHD or JEPI to their portfolios, it’s important to understand that the performance of those ETFs at large will be defined by the macro conditions, which would have a direct impact on the market and most of the stocks that are held by those funds.

Given the fact that the Y/Y inflation has decreased substantially since the start of the year while interest rates are not rising as fast as some people have predicted, the market may appreciate further or stay flat and won’t depreciate in 2024. Although it’s logical to think that the actions of the Federal Reserve to bring inflation down historically caused a recession, we shouldn’t forget that in recent years we’ve seen the largest non-pandemic fiscal stimulus program being implemented on a nationwide scale. The passage of legislations such as the Inflation Reduction Act, CHIPS and Science Act, and others have created a CapEx boom in the United States, which mitigated the downsides that are caused by the hawkish monetary policy and ensured that the economy is able to grow at a record rate.

Considering that despite Walmart’s (WMT) concerns about consumer spending the Black Friday sales set a new record, it’s safe to assume that we’re still far away from a soft or hard landing. While the inflation is likely going to stay at ~3% for some time due to the fiscal stimulus and result in higher interest rates for longer, the market might positively react to such a development and help both SCHD and JEPI show a decent performance next year.

However, if we experience an energy shock similar to 2022 in 2024, then SCHD’s greater exposure to the energy sector would help it outperform JEPI as was the case last year. After all, energy prices are key in the inflation argument and if they skyrocket – then the Fed would certainly act more aggressively to ensure that the inflation doesn’t follow. We’re already seeing OPEC+ preparing to possibly extend its production cuts to keep oil prices elevated while Venezuela’s potential invasion of the oil-rich Guyana could send a shock throughout the oil market. That’s why if you think that the oil trade is not over – then SCHD could be your best bet.

If you believe that the recent record increase in oil production by the United States and other non-OPEC+ members would be enough to mitigate most of the risks – then JEPI might be a better fit for you. If the oil trade is over and the disinflation process continues, then the tech stocks could continue their rise, especially as they embrace the ongoing generative AI revolution, and benefit JEPI the most due to its greater exposure to the tech sector.

The Verdict

If you can tolerate higher risk levels – JEPI would be your best bet due to the exposure to high-growth names and the lack of energy holdings in the portfolio. If you’re a conservative or risk-averse investor – then SCHD would be a better choice for you. However, I would argue that for most investors it’s much preferable to have exposure to both ETFs since you’ll be able to have more balanced returns and mitigate major downsides at the same time.

Read the full article here