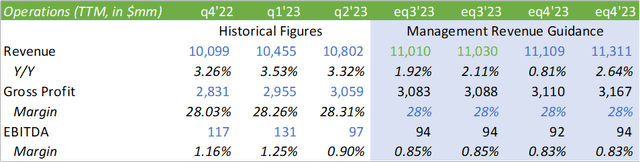

Chewy (NYSE:CHWY) is posed to report q3’23 earnings on December 6, 2023, with q3’23 revenue guidance ranging from $2.74-2.76b. On a TTM basis, this provides revenue growth between 1.92-2.11% from q2’23, a sequential slowdown from 3% in q2’23 and 4% in q1’23. Given the macroeconomic landscape and my anticipation of narrowing margins, I provide CHWY a SELL recommendation with a price target of $12.50/share.

Macro & Operations

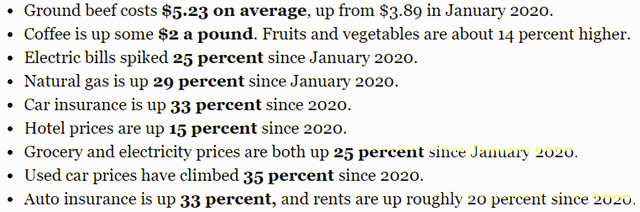

Chewy’s performance is highly dependent on the macroeconomy as consumers’ purchasing decisions are primarily derived from their purchasing power. According to a November 27, 2023 report on Bloomberg, a $100 indexed basket of goods at the beginning of 2020 now costs $119 for the same basket.

Bloomberg

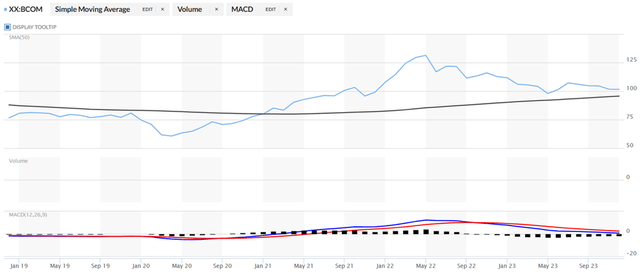

From a high level, much of the remaining pricing pressures in these goods are heavily commodity-derived, as seen on the BCOM Index. Though the broader commodities index has pulled back off its May 2022 highs, the index remains relatively elevated when compared to historical readings.

MarketWatch

Though the commodities within BCOM index don’t necessarily directly impact the consumer, the pricing of the commodities affects of the pricing of consumer products including anything from food, to durable goods, and energy consumption.

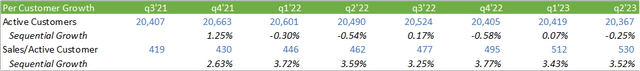

Reviewing the firm’s operations, customer growth sequentially declined in 3 of the last 5 quarters with an overall decline since q4’21.

Corporate Reports

Despite the broader challenge with customer retention, the average active customer has sequentially increased their spend q/q. Using this data, we can discern that higher quality and higher value-generating customers have remained stickier to Chewy’s platform. From a cross-selling perspective, it is my opinion that this can be beneficial in the long run as these higher quality customers may be more adept to adopting the health and pharmacy feature Chewy provides.

On a TTM basis, management’s guidance is seeking a 1.92-2.11% increase in sales for q3’23 and 4.26% for q4’23. Free cash flow for FY23 is guided to be 2.5x FY22 free cash flow, or $1,450mm. At the current market cap of $7,489mm, FCF will yield 19%.

Chewy has done a good job at managing inflationary costs as their gross margin has continued to widen through q2’23 to 28.31%. Management anticipates gross margin to remain in the 28% range for the duration of the year as inflationary pressures wane. Q2’23 EBITDA margin compressed 35bps as the firm experienced higher input, freight, and shipping costs, as well as costs associated with opening new and refurbished fulfillment facilities. Management did discern in their q2’23 call that the additional facilities should mitigate future costs. In my view, Chewy should be able to reduce shrinkage and inventory levels as they target inventory stock on a regional basis, based on recurring customer purchases.

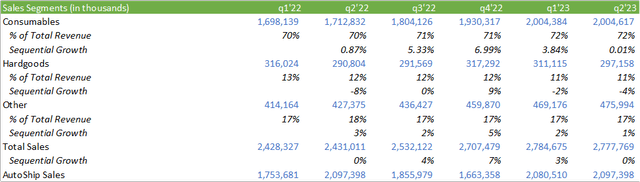

Corporate Reports

There are some factors that I will be looking for in their q3’23 earnings call, including customer preferences between wet and dry food, customer retention and growth, as well as Autoship growth. As management iterated on their q2’23 earnings call, customers are being more mindful of their budgets and switching to dry over wet food as well as reducing their purchases of treats.

According to Forbes, 3% of pet owners gave away their pets between 2021 and 2022 citing inflation, cost of rent, pet’s medical bills, and rent-related pet fees. Forbes also discerned that the average dog owner spends $730/year on their pet and that nearly 40% of dog owners have lived on a tighter budget since acquiring their pet.

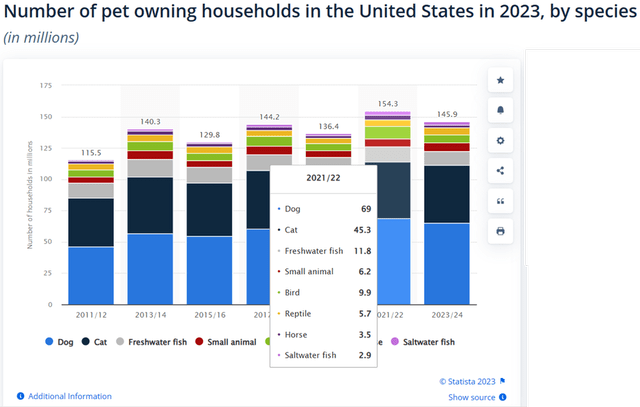

Statista

A 3rd-party research firm, The Grocer, reported that pet ownership is down 6% y/y with 62% of pet owners attempting to reduce or limit their spend on petfood. Statista also reported similar findings in lower pet ownership in 2023.

Considering these stats, I expect that pet ownership may continue to wane throughout the next year as employees continue to go back to the office and customer budgets continue to tighten.

Corporate Reports

Looking ahead to q3’23 and FY23, I anticipate continued EBITDA margin compression as the firm ramps up their fulfillment centers launched in the middle of FY23.

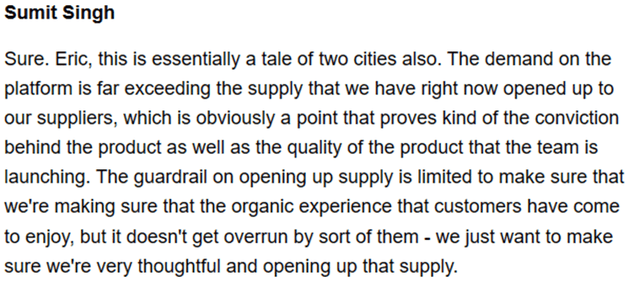

Given the pet ownership stats as listed above, I anticipate the hardgoods segment to continue to decline as 78% of those surveyed by Forbes acquired their pets during the pandemic. I would presume an owner of a single dog would not have the need for more than one dog carrier. Considering the growth trajectory of consumables, I expect the transition from wet to dry food to continue as pet owners continue to tighten the purse strings and become more budget-consciences. I do expect their “other” segment to perform as the firm continues to cross-sell into the health-related category. Management did discuss in their q2’23 letter and earnings call that sponsored ads should be margin accretive with higher demand than supply.

Seeking Alpha Transcripts

Chewy is seeking to expand operations into Canada and disclosed limited, but interesting information. Their strategy for penetration isn’t as modular as one would expect as the firm is seeking to target the Canadian market with brands Canadian pet owners are prone to buying. Management will be releasing more information relating to this expansion in their q3’23 earnings call so we should have a clearer picture on the financial impacts from this investment.

Valuation

CHWY trades at an appealing valuation of 0.69x sales with a FCF yield of 19%, on a TTM basis. Given their narrow margins, P/E and EV/EBITDA may suggest less appealing operating efficiencies as a single misstep may turn earnings back negative. The firm also faces the challenge with customer churn as active customers in q2’23 dropped by 25bps. Though this concentrates more of the efforts to higher valued customers, this limits the firm’s ability to expand their customer base on a recurring basis.

On a tactical basis, CHWY is coming into their third wave on their downward retracement. Having hit their 38.2% retracement in September 2023, CHWY should reach the conclusion of their Eliot Wave by the end of q4’23. On a technical basis, I provide CHWY a price target of $12.50, or 0.50x TTM q2’23 revenue. With this, I provide CHWY a SELL recommendation based on the macro environment, customer churn, and my anticipation of narrowing margins.

WallStreet.io

For a short position, there is significant open interest for December 8, 2023, put options between strike prices $12.50-16. Longer dated put options at January 19, 2024, have significant open interest as low as $7.50 strike. Shorting shares outright comes with its inherent risks, including unlimited downside risk. The borrowing cost for shorting shares directly is relatively cheap at 41bps. Given the liquidity in the options market, I recommend using put options for this trade.

Read the full article here