Apple Inc.‘s (NASDAQ:AAPL) investors have gotten used to attractive returns over the course of the last two decades as the company stayed at the forefront of technological innovations, delivering massive 25.6% EPS growth annually since 2003.

Since then, the stock is up more than 65x, confirming American engineering ingenuity, fueling one of the major success stories of the 21st century.

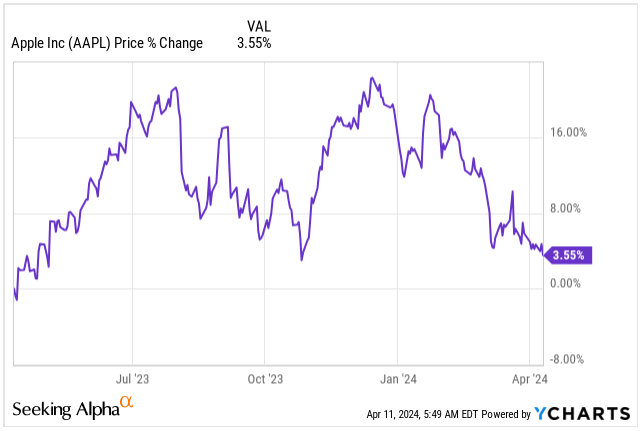

While I do not want to be short-sighted, it does appear the company has recently hit a wall with the stock being up only 3.5% in a span of 12 months, even though the AI narrative is pushing other major tech stocks higher.

Price Change (Seeking Alpha)

The lackluster performance, pushed Apple’s market cap down to $2.56T, falling behind Microsoft Corporation (MSFT) which is riding the AI tailwinds and is once again the most valuable company with a market cap of $3.15T.

In face of Apple’s challenges, I am downgrading the stock to “Sell” with execution risks going forward as the company does not have a major product breakthrough to drive its top-line growth and rich valuation not being justified, despite its high quality and superior profitability.

Business Update

Apple’s poor performance is not a result of market sentiment, instead the company is being hit by:

- iPhone’s potential (58% of NS) has reached its peak and product maturity.

- Weak sales and declining market share in China.

- Abandoning autonomous EV project after spending an estimated $10 billion.

- Falling behind in the AI strategy/race.

- VisionPro may not be the next “big-thing”.

- US Justice Department lawsuit on violating antitrust laws.

There is a lot to worry about for Apple, even though the company has overcome major challenges in the past with its great leadership, yet moving the needle for a company with annual revenue of close to $400B might be more challenging this time, without having the “next big-thing” in the pipeline.

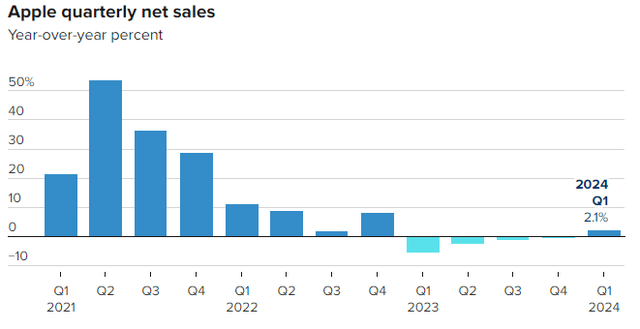

For Q1 FY24, Apple reported 2% sales growth or $116.58B, a departure from the four straight quarters of falling revenue, yet the growth is underwhelming to say the least.

Quarterly Net Sales Change % (CNBC)

The company earned $2.18 EPS, beating the expectations by $0.07 and increasing 15.3% from the same period last year, partially helped by the gross margin expansion of 290 basis points, now close to 46%.

Even though Apple’s top-line is rather stagnant, the company can keep rewarding its shareholders through increased efficiency demonstrated by the improving margins and continuous share buybacks (35% of outstanding shares repurchased in last 10 years), nevertheless, a company with a blended P/E of 26.5x must be able to grow it’s top-line to justify the rich valuation.

To give you an idea on the main sources of revenue:

- iPhone: $67.70B, YoY growth of 5.9%.

- Mac: $7.78B, YoY growth of 0.1%.

- iPad: $7.02B, YoY growth of -25%.

- Services: $23.12B, YoY growth of 11.3%.

- Wearables, Home, and Accessories: $11.95B, YoY growth of -11.3%.

The product break-down does give us a good understanding how in reality the iPhone sales are plateauing, a trend that has been ongoing ever since Q1 FY21 as shown in the graph below.

The lack of innovation in an already mature smartphone market, pushes consumers to upgrade their phones on a less frequent basis (now every 3 to 4 years), ultimately resulting in the lack of sales growth, even as the company increases prices for its models.

Revenue in million USD (iPhone) (Statista)

For the quarter, Apple showed sales growth in all regions, except for Greater China, where the sales suffered a drop of close to 13% compared to last year.

Greater China is Apple’s third-largest market, driving fear among investors that the local increased competition from companies such as Huawei, make Apple’s devices less attractive, alongside the economic slow-down in the region, which may mute the appetite for premium consumer electronics.

To give you a perspective on Apple’s sheer size, the company has 2.2 billion active devices in the market with over one billion active iPhones, giving edge to Apple’s unique ecosystem. The number of active devices is a key metric to understand the future of the company, as Apple’s Services (currently 19.8% of NS) will make up a larger portion and will be a partial driver of growth.

With the iPhone business reaching maturity, Apple’s Services alone, will not be large enough to continue driving the growth we have been accustomed to. Now, that Apple has cancelled the Apple Car project, they are laying off or transferring approximately 2,000 employees, the question remains, what will be the next major product for the company?

To build on the success of wearables such as AirPods and Apple Watch, Apple has launched the Vision pro headset, starting at $3,499, back in February.

While we will get a better glimpse of how well the pricey headset is selling during the Q2 earnings, the first few weeks have seen demand well exceeding analyst’s expectations.

Certainly, we should not be expecting a widespread adoption due to its hefty price tag and limited apps on the device, being a first generation product.

Nevertheless, the technology does have the potential to become a staple for communication, productivity, and entertainment as the price comes down, and new versions are released in the subsequent years, addressing a wider customer base. Yet, its impact remains to be seen.

Valuation

If you ask me to list five companies which I consider to be the most successful businesses, certainly Apple would be on the list.

With its great management, revolutionary thinking, and consumer-liked products, since 2003 the company managed to grow its EPS by 39.7% annually.

Over the same period of time, the average P/E was 24.54x its earnings.

The company was a great bargain for most of the 2010s, trading at an average P/E of 15.9x with average annual EPS growth of 19.7%, coinciding with the time when Warren Buffett pulled the trigger and made Apple his largest position.

Today the stock is trading at a rather rich valuation of blended P/E 26.39x, with EPS growth expectations muted as polled by S&P Global:

- 2024: $6.56E, YoY growth of 7%.

- 2025: $7.20E, YoY growth of 10%.

- 2026: $7.78E, YoY growth of 8%.

Apple has managed to deliver on analyst’s expectations or beat the expectations in 80% of instances, fueled by a strong buyback program and improving profit margins.

Even as the bottom-line growth is expected to stay on average 8.3% over the next three years, we can see the top-line growth expectations are more muted at only 4.4% over the next three years, given the company is missing a major product break-through with the potential to reaccelerate the growth once again.

Top-line Growth Expectations (Seeking Alpha)

I am not suggesting Apple is no longer a high-quality company, and the growth is still going to be “reasonable” with billions of net income being used for share buyback, yet the valuation of blended P/E 26.39x appears to be rich for a company which has uncertain future top-line growth due to lacking products in the R&D pipeline.

Over the next few years, I am expecting Apple’s valuation to contract towards 20x its earnings, given slowing EPS growth with a potential total return coming in at negative -1.3% annually.

My target price for Apple by the end of 2026 is no more than $160 per share.

Apple Valuation (FAST Graphs)

Instead, I recommend investors to consider SPDR S&P 500 ETF Trust (SPY) as an alternative investment, even though Apple currently makes up 5.6% of the ETF.

The ETF, which tracks the S&P 500 (SP500) index, is expected to deliver EPS growth of 13% annually over the next three years.

Currently valued at blended P/E of 23.57x, the valuation is slightly stretched compared to 21.19x average since 2017, yet the ETF is expected to deliver 3% faster EPS growth.

Investing into 500 companies, instead of one, carries significantly less risk, even though the concentration of technology companies has hit 29.5%.

Investors can expect up to 10.2% total return annually over the next three years by choosing the ETF, instead of Apple’s negative expected return.

SPY Valuation (FAST Graphs)

Takeaway

Apple is one of the major business success story’s of the 21st century, increasing its share price 63x since 2003.

Yet, Apple has recently hit a wall, disappointing investors with poor performance over the past 12 months as the company is facing plateauing sales of its core product, iPhone, facing declining sales in Greater China amidst a stiffer competition and economic worries, abandoning its EV project with estimated cost of $10B and falling behind in the AI strategy.

The questions remain, what’s next for the company? Is Vision Pro and growing Service sales going to be enough to drive the growth in the future? Or perhaps the company needs to look deeper in its R&D pipeline to come up with the next “big thing” to move the needle on the current $400B revenue figure.

For a consumer electronic company with a lack of product breakthroughs to drive top-line growth a blended P/E of 26.39x is very rich, presenting investors with major execution risks.

My recommendation is to sell Apple shares as the valuation will most likely contract, delivering negative returns, instead buy the SPDR S&P500 ETF Trust which is expected to deliver 5% faster annual EPS growth, alongside a cheaper valuation and better diversification.

Read the full article here