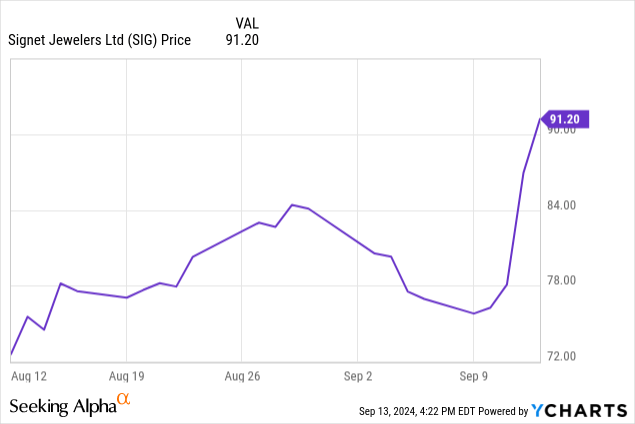

Last month, I wrote an article praising Signet Jewelers Limited (NYSE: SIG) as a strong earner and market leader trading at a fairly low price. The stock has gone up quite a bit since I wrote that piece, and is going up again today on news of a strong earnings release for the second quarter. It beat estimates and importantly included full-year guidance, which was higher than the consensus estimates suggested.

Today I want to revisit Signet Jewelers, following the new earnings announcement, to see whether the stock is still worth considering for investors, trading as it does well below the 52-week highs.

Consolidated Balance Sheet

|

Then |

Now |

|

|

Cash and Equivalents |

$729 million |

$403 million |

|

Inventories |

$1.98 billion |

$1.98 billion |

|

Total Current Assets |

$2.92 billion |

$2.58 billion |

|

Total Assets |

$6.15 billion |

$5.61 billion |

|

Total Current Liabilities |

$1.75 billion |

$1.53 billion |

|

Total Liabilities |

$3.74 billion |

$3.47 billion |

|

Total Shareholder Equity |

$2.08 billion |

$1.92 billion |

(Source: most recent 10-Q from SEC.)

Signet Jewelers’ business traditionally picks up around the holidays, and its cash on hand drags a bit during the summer. Still, Signet Jewelers’ balance sheet remains pretty solid, with a current ratio of 1.69 and a functional amount of cash on hand.

After the recent increase in prices, the company now trades at a price/book ratio of 2.10, which is almost spot on to the sector median. That seems comfortable to me, as Signet Jewelers is a strong market leader with excellent earnings.

The Risks

I won’t totally rehash the risks I listed before for the company, but a key thing I want to bring up is the difference between the company’s GAAP and non-GAAP earnings per share. They are beating strongly on a non-GAAP basis, but the strong earnings in a GAAP sense won’t be coming until the fourth quarter.

Statement of Operations – The Earnings Boost

|

2022 |

2023 |

2024 |

2025 (1H) |

|

|

Sales |

$7.8 billion |

$7.8 billion |

$7.2 billion |

$3.0 billion |

|

Gross Profit |

$3.1 billion |

$3.0 billion |

$2.8 billion |

$1.1 billion |

|

Operating Income |

$903 million |

$605 million |

$621 million |

($51 million) |

|

Net Income |

$735 million |

$342 million |

$776 million |

($46 million) |

|

Diluted EPS |

$12.22 |

$6.64 |

$15.01 |

($3.17) |

(Source: 10-K for FY 2023 and 2024 and most recent 10-Q.)

As mentioned before, the different between GAAP and non-GAAP EPS is pretty stark, with the company coming in at a non-GAAP profit in Q2 of $1.25 per share, which beat estimates by 4¢, but actually lost $2.28 on a GAAP basis.

Same store sales in the first half of the year fell slightly year-over-year for Signet Jewelers, while the company expects to come in full year between down 1.0% and up 1.5%, so that’s clearly to improve.

For the full year, the company is guiding us to expect profits between $9.90 and $11.52 per share. That’s quite a wide range, but arguably a bit stronger than the $10.56 per share that was the consensus guidance before the release.

The company is continuing with dividends at 29¢ per quarter, which is a yield of 1.33%. I would like to see that payout grow a bit, and with the company expecting to continue strong earnings going forward, it seems like they have ample opportunity to do so in the near future.

Conclusion

Even after the increase in share price, Signet Jewelers still trades at a single digit multiple to both P/E ratio and forward P/E ratio. That, and the prospect for continued growth in dividend, leads me to conclude that the company is still a buy. Perhaps not quite as exciting a buy as it was in mid-August, but there is still room for the share price to grow.

For investors, I would keep a close eye on same store sales. These should be doing much better in the second half of this year, and hope for an upcoming dividend increase again at the end of the fiscal year, which in my opinion the company can readily afford.

The Q2 guidance is a reason to be optimistic about Signet Jewelers’ prospects in the future, and reports of improving consumer sentiment should serve them well for the rest of this year at least.

Read the full article here