I rate the Global X Internet of Things ETF (NASDAQ:SNSR) a Hold for the time being. SNSR is an ETF that invests in companies that are involved in the development, manufacturing, and distribution of IoT technologies. SNSR has the potential to benefit from the growth of the IoT market. The fund has almost 50% of its assets invested in its top 10 holdings, which reduces single-stock risk while emphasizing some of the most prominent businesses in the space. While I maintain a long-term bullish outlook on IoT companies, current market conditions, including high inflation and the possibility of further tightening by the Federal Reserve, are creating headwinds that prevent me from assigning a higher rating at this time.

Capitalizing on the Growth of IoT

IoT is becoming ubiquitous. What do an athlete’s watch, a manufacturing plant and a refrigerator have in common? They are likely all IoT devices. The proliferation of IoT devices is evidenced by the average of 22 connected devices per US household in 2022, with popular consumer devices including smart home appliances, wearables, and car-connected devices.

With Google Home alone in over 20 million US households, the number of IoT devices worldwide is expected to nearly triple in the next decade, driven by consumer and business adoption across industries such as manufacturing, logistics, and energy utilities. SNSR’s investments in established and emerging companies across sectors and geographies, with approximately 50% in large/mega caps and the rest in medium/small caps, is well-positioned to capitalize on this growth in IoT devices and their expanding range of applications.

While SNSR is well-positioned to benefit from the growth of IoT, the industry suffers from the same reputational holdups asl other technology equities do. Rising inflation and interest rates pose a continued challenge because at the heart of IoT’s growth is a dependence on consumer adoption of, and demand for, the innovative products that come out of the space.

Additionally, IoT may face increased government regulation as AI and other technologies are scrutinized beyond what they’ve endured in the past. Security threats are also a concern for IoT devices, which could potentially weigh on returns. Furthermore, SNSR has significant exposure to semiconductor stocks, which have rebounded nicely so far this year, but forward projections among semiconductor companies may be overstated and a revision in guidance could impact valuations.

The Hidden Costs and Risks of IoT Adoption

IoT devices are vulnerable to various security issues, including data breaches, cyber-attacks, malware infections, and unauthorized access, due to their widespread adoption, lack of standardization, and insufficient security measures. This may make consumers and businesses alike wary of using IoT devices. The IoT market is still in its early stages of development, and there is a risk that new regulations could be implemented that could stifle innovation and growth. This could hurt the performance of SNSR’s holdings and make it difficult for the ETF to generate strong returns.

Moreover, the possibility of a recession approaching could lead companies to delay making non-critical investments, such as in IoT.

Price Trend Analysis

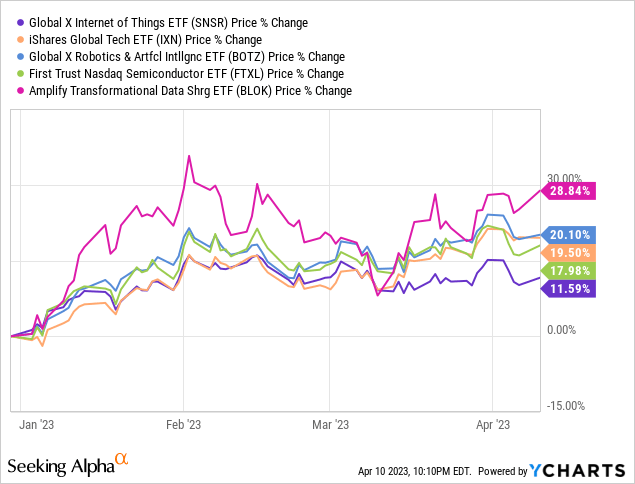

SNSR has lagged behind the broader technology sector YTD (represented by IXN) as well as other IoT-related ETFs.

Current Investment Opinion

IoT is a rapidly evolving market, with the potential to connect billions of devices and transform the way we live and work. However, there are also risks that IoT may not live up to its full potential, including competition, regulation, security, and recessionary risk. Based on my analysis, I am giving SNSR a Hold rating for now. I believe that the ETF has the potential to generate attractive returns over the long term, but the uncertainty in the market and concerns about IoT lead me to believe that it is best to wait for a better entry point before investing.

Read the full article here