Investment Thesis

SoFi Technologies (NASDAQ:SOFI) shares have experienced a significant slump since their peak in 2021 of $28.26. Fast-forward to today, shares have declined nearly 78% to $6.54. SoFi has been experiencing slower revenue growth, and earlier some operational losses, which I think are the main drivers for this drop. However, I think there’s potential for a turn around due to recent developments. I am now more bullish on them than I was when I last wrote on them last fall.

In the last two consecutive quarters, SoFi has shown improvement in their financials, achieving GAAP profitability as promised by management last fall. Promises made, promises kept.

Despite this positive shift, shares continue to face downward pressure. This is likely caused by speculation over potential loan defaults and deteriorating credit quality within SoFi’s asset portfolio. I believe this speculation is incorrect and misguided, which I will expand on further later in this article.

I believe SoFi’s Q1 results further enhanced my bullish outlook, with their adjusted net revenue hitting a record of $581 million, 26% year-over-year growth.

Given their still strong performance, and the company’s trajectory towards sustained profitability, I am upgrading my rating on SoFi to a strong buy. I believe their recent operating performance discussed above indicates a strong possibility for a true turn-around in stock price. I think that the market’s current concerns regarding loan default rates appear to be overstated, and the company’s improving fundamentals suggest significant upside potential for investors.

Why Am I Doing Follow-Up Coverage?

Since my last report of SoFi in November, the market has outperformed SoFi. While the S&P 500 has increased by 29.67%, SoFi has actually decreased by 14.40%. While this may seem concerning, since my last report SoFi has reached profitability for two quarters in a row (I noted last time how the company was expecting to be first profitable in Q4). I think this is very telling for their future.

As a counter to the promised performance, short interest has remained high, at around 17.7%. This could be a silver lining: if the stock increases towards what I think is its fair value, short sellers will have to cover. Since short interest is especially high right now, telling me the market is overly bearish, and this could result in a nice upward bump in share prices.

The big reason I believe shares have underperformed the market since my last piece in November is due to investors moving their worries from the question of profitability (the company has now proved they can operate on a GAAP profitable basis) to loan defaults as this could dent profits and leverage ratios which could put the fintech in a tough situation. This concern over loans has caused short interest to jump from 117.49 million shares on October 31st (one day before I wrote about them in November) to 183.81 million shares as of May 31st.

It’s a legit concern if it were not for management’s careful navigation of the loan market (see below). I believe the company is cognizant of the loan environment and is managing this well. This creates a large discrepancy, in my opinion, between the market’s view and what I believe is the underlying data. Given this, I believe SoFi needs follow-up coverage.

Deep Dive Into Loans

SoFi’s loan portfolio has become a key concern for many investors, but looking at it deeper, I disagree.

If we dive deeper into their borrower base, in the first quarter of 2024, the median FICO score for new direct deposit accounts was 744 (this is a prime credit-rating). I believe this indicates their customers are part of a high-quality borrower base, one that is more reliable when it comes to paying off loans. As mentioned in my last coverage of SoFi, their company’s risk management is evident in their underwriting practices, with delinquency and charge-off rates of personal loans actually declining in Q1 vs Q4 2023 (10Q pg. 21).

While deposits are currently expensive due to higher interest rates, this strategy is attracting customers to SoFi’s fintech platform. In Q1 2024, SoFi’s total deposits grew by a record of $3.0 billion, which is an increase of 16% during the first quarter to $21.6 billion by the end of the quarter. Ninety percent of these deposits came from direct deposit members. This high-quality deposit base provides a stable funding source. Keep in mind, deposit bases are falling at many other financial institutions. SoFi is bucking the trend.

Looking at their actual default rates, I believe there again isn’t much to be concerned about. Ending March 31st of this year, the annual default rate weighted average for personal loans equaled 4.8%. Flash back to December 31st, 2023, the default rate was also equal to 4.8%. Similar results can be seen in their student loan sector, with the default rate equaling 0.6% for both March 31st 2024 and December 31st 2024. If these numbers were to dramatically increase, then it would warrant a call for concern, but until then, I am not worried.

I think it is unlikely default rates will increase significantly from here, based on SoFi’s access to their customer’s credit quality. This enables SoFi to make more informed lending decisions and better manage risk. In fact, to get a loan from SoFi is actually fairly hard. Customers need a credit score minimum of 680.

In essence, I agree with management’s outlook on their loan book and business. I think their guidance may even end up being conservative as management knows the pressure they are under from short sellers. This view to side with management in a lot of cases actually runs against analyst estimate revisions, which have come down significantly for multiple forward fiscal years for the company.

While it is important to keep an eye on loan default rates, SoFi’s management appears to have a firm grasp on credit quality. Considering annual default rates have not seen an increase from December 2023 to March 2024 (as default rates in other sectors like credit cards have moved higher), I am not worried.

Forward Growth Looks Promising

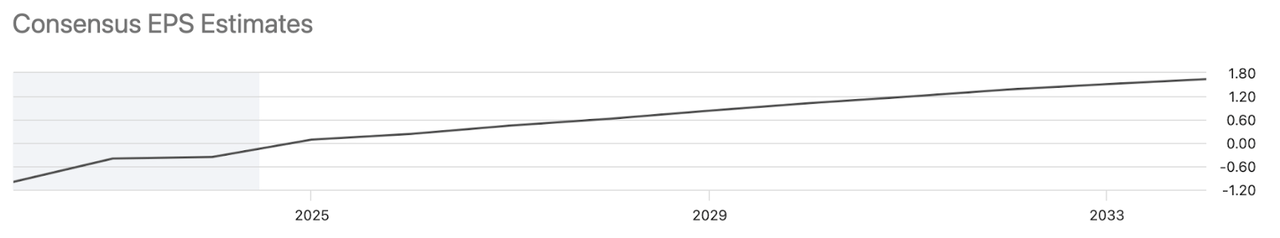

Looking ahead, SoFi expects to achieve GAAP Net Income of $165-175 million and Diluted EPS of $0.08-0.09 for the full year 2024. Farther into the future, their EPS and revenue prospects are promising. Below is a graph of SoFi’s EPS predictions up to December 2033.

SoFi EPS Forecasts (Seeking Alpha)

Right now, the EPS prospects for 2024, as mentioned above, are expected to reach $0.08-0.09, but by 2033, they are expected to hit $1.64 (20x EPS growth)! Similar expectations are held for revenue, as seen below.

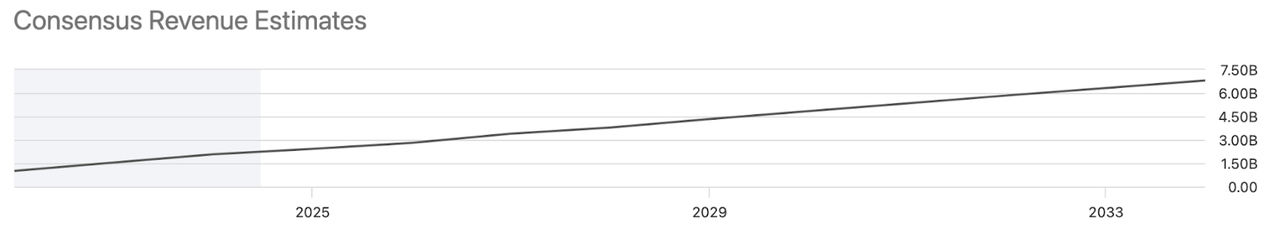

SoFi Revenue Forecasts (Seeking Alpha)

For 2024, revenue is predicted to reach $2.43 billion, while for 2033, revenue estimates are $6.81 billion. Based on these prospects, I think SoFi has a promising future ahead, despite the market’s concerns over default rates.

Insiders Are Buying

I believe Insider transactions can provide valuable insights into a company’s prospects, as insiders can only purchase stock based on public information and during specific trading windows. As famous investor Peter Lynch said, “insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.“

As of just 7 days ago, the CEO of SoFi, Anthony Noto, made an insider buy totaling $199,110. Including this purchase, Noto has made insider buys 4 times this year, resulting in a total of $797,342. Since SoFi has become a publicly traded company, Noto has made 92% of insider purchases. Continued insider trading by Noto indicates that SoFi’s future is promising. Insiders cannot trade on insider information, but they can choose not to buy shares if they saw something that was bearish on the horizon.

Generally, it is legal and actually expected of company executives to have a foot in the game and own shares of their company. In fact, this can even be seen as a good sign to outsiders, as it shows the confidence from executives in their own company. Therefore, I think Noto buying more shares, totaling up to almost $800,000 is a strong sign of confidence in SoFi’s future.

Valuation

SoFi’s forward Price/Sales ratio of 2.76, is only slightly above the sector median of 2.47, by about 11.38%. While the company has a bank-like balance sheet, I still think they should be valued higher due to their impressive growth and strong technology angle. Looking at SoFi’s revenue growth predictions for 2024, the company has projected adjusted net revenue of $2.39-2.43 billion, representing a 15-17% year-over-year increase. This growth rate significantly outpaces the sector median revenue growth of 5.12%. Looking at SoFi’s 12 month (so 2024 to mid-2025) revenue growth rate of 22.30%, this outpaces the sector median by an even more impressive 335.96%.

Given the strong revenue growth, I now believe the stock now deserves to trade at a 50% premium to the sector median forward price-sales multiple, representing roughly a 35% upside potential from today’s prices. With this, investors will be paying at a 50% premium to have access to a stock with a growth projection of 335.96% above the sector median. I think this well satisfies the investment philosophy of Growth At A Reasonable Price (GARP).

The reason I believe paying a 50% premium here has to do with other financial institutions. Larger financial firms like JPMorgan Chase (JPM) trade at a 17.87% premium forward P/E above the sector median. But their revenue growth is 71.47% above the sector median.

Investors here pay a 17.87% premium to access an investment ran by strong management that grows 71.47% faster than the sector median (a ratio of about 1:4). In our case, we are looking to pay up to a 50% premium to access management that is producing growth at a 335.96% premium above the sector median. I think this (from a comparative standpoint) a good deal.

In my previous coverage, I argued the fair value was $9.56/share. This 50% premium would provide a fair value estimate of $9.81/share. I am upgrading my price target slightly given the fact the company is now demonstrating consistent profitability.

Risks

I believe SoFi’s future is promising, but we have to dive into the risks. The primary concern revolves around the company’s loan book risk. Although SoFi’s management appears to have a firm grasp on credit quality, with a weighted median FICO score of 744, a severe economic downturn could still lead to increased defaults.

With this, the broader economic environment presents additional challenges. As of Q1 2024, the economy is showing signs of slowing, which could impact loan demand and potentially lead to higher default rates. While SoFi’s diversified revenue streams provide some buffer, a significant economic contraction could erode my bull thesis.

However, management appears confident in their ability to navigate these challenges. During the Mizuho Technology Conference, Chris Lapointe, SoFi’s interim CFO stated:

So we were turning over the balance sheet quite frequently in selling loans much more quickly than we otherwise wanted to. What the bank provided us was a low cost, sticky funding source. 90% of our member deposits today are coming from direct deposit members – Mizuho Technology Conference.

By turning over loans quicker, SoFi can lower default and credit risks by passing loans to banks for them to likely package them into CLOs. I think this nullifies a major basis for investors’ concerns over default and credit risks.

Bottom Line

SoFi has demonstrated remarkable resilience and growth in a challenging economic environment. The company’s improving profitability metrics, and strong member growth, set them up for long-term success. With GAAP profitability and substantial revenue growth projections, I believe SoFi appears well-positioned to overcome current market skepticism.

While risks persist, particularly regarding potential loan defaults in an economic downturn, SoFi’s risk management and high-quality borrower base provides me reassurance. The company’s valuation relative to their growth prospects suggests significant upside potential for investors willing to weather short-term volatility.

With this, I’m upgrading to a strong buy rating on SoFi, seeing a clear path for shares to rebound as the market recognizes the company’s improving fundamentals and still strong long-term potential.

Read the full article here