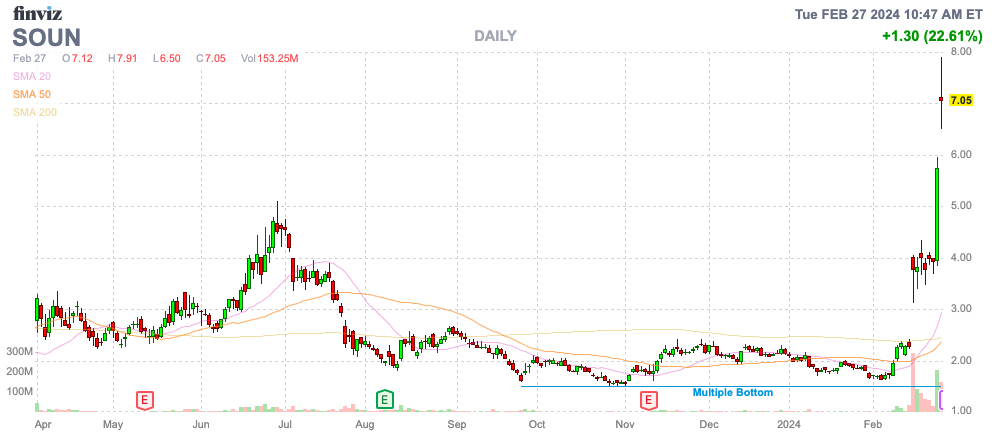

SoundHound AI, Inc. (NASDAQ:SOUN) is one of the prime go to artificial intelligence (“AI”) stocks to play the volatile AI boom. The company is more than just a company with “AI” in the name, but the voice AI stock probably doesn’t warrant the recent massive rally. My investment thesis is more Neutral on the stock following the massive rally above $7.

Source: Finviz

Big Investors Of SoundHound AI

In a surprise move, SoftBank Group (OTCPK:SFTBY) apparently bought 1.1 million shares of SoundHound AI for a minimal investment of $2.3 million. Even after the big rally, the investment is only worth $7.5 million.

The investment is minuscule for an investment firm with billions of dollars in investments. The big rally is likely a bet on SoftBank making a larger investment.

At the same time, the news reported Nvidia (NVDA) took an investment in SoundHound AI. The chip company apparently invested in the voice AI company back during an investment round in 2017 and acquired another 1.73 million shares at a later date, but the investment was apparently reported now due to the Nvidia venture fund crossing the threshold for officially reporting holdings.

Either way, neither investment by SoftBank or Nvidia is material. Regardless, the small investments by these influential companies has brought massive attention to SoundHound AI and their AI products leading to the stock soaring to $7.

SoundHound Has Lots To Prove

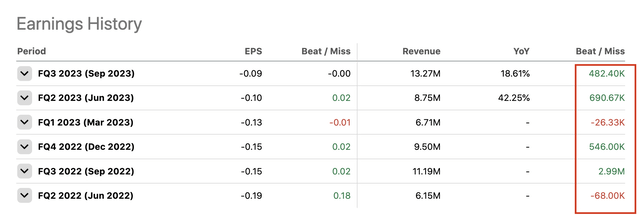

SoundHound AI enters Q4 ’23 earnings after the market close on February 29 with investors having big expectations for the voice AI company. In the past, the company has disappointed the market over and over with the failure to report material upsides to expectations for accelerating growth.

The consensus analysts estimates are for SoundHound AI to report the following numbers for Q4:

- EPS -$0.06

- Revenue of $17.75M (86.8% YoY).

The real key is the guidance for 2024 and how quickly the opportunity in voice AI ordering for restaurants ramps up. SoundHound AI discussed the opportunity ahead after acquiring SYNQ3 with 100,000 restaurants in the pipeline for the AI ordering product and 10,000 already signed.

Management never provided complete guidance of the run rate opportunity with the SYNQ3 business, but the company guided towards the SoundHound AI order book being worth $25 million. The natural implication was a $50+ million ARR opportunity on the 10,000 signed restaurants for a company with a revenue base of only $50 million based on Q3’23 revenues of $13 million.

This issue is that SoundHound AI needs to prove how the restaurant ordering revenue opportunity can quickly expand to the predicted $1 billion potential. The company lists 100,000 restaurants in the pipeline, but the current consensus revenue targets don’t add up to 10x the ARR opportunity. The space is not void of competitors, with Wendy’s long suggesting a test run with Google (GOOG) and the dynamic nature of AI suggesting a quick market implementation of this technology over the next couple of years.

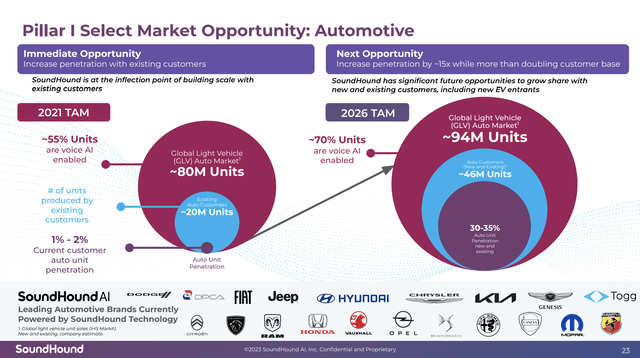

In addition to the voice AI ordering product for restaurants, SoundHound AI is heavily involved with automotive voice AI products. The company has a large cumulative bookings backlog of $342 million for this sector based on deals averaging 6.5 years.

Source: SoundHound AI Q3’23 presentation

The company forecasts current customer auto unit penetration is only 1% to 2% with a goal of moving to over 30% unit penetration by 2026. SoundHound AI already has a large built up growth rate from the automotive business, so any growth from AI restaurant ordering should lead to substantial growth.

While the AI restaurant ordering product and vehicle AI chat product offer a lot of promise, SoundHound AI only forecast Q4 ’23 revenues of $16 to $20 million. The consensus estimates forecast revenues dipping below $12 million in the current quarter and not really topping the Q4 ’23 revenue total until reporting over $24 million in Q4 ’24.

The stock has soared above $7 on the excitement in the AI sector. SoundHound AI now has a market cap approaching $2 billion with meager revenues of $69 million forecast for 2024. The company has no history of smashing estimates, so investors need to prepare for a potentially disappointing quarterly report with a lot of new investors snapping up the stock above $5 likely expecting blowout numbers.

Source: Seeking Alpha

The company raised a lot of cash back in 2023. SoundHound AI had a cash balance of $110 million at the end of September, so the company doesn’t need the cash, but more capital could help the voice AI business expand faster.

Investors should not be shocked by any attempt to raise cash with the stock soaring. SoundHound AI burned $54 million in cash from operations YTD through September, and the goal to be adjusted EBITDA positive in Q4 ’23 will limit cash burn in the last quarter, but the guidance for sequential revenues declines in the 1H’24 should lead to more cash burn in the short term.

Takeaway

The key investor takeaway is that SoundHound AI, Inc. appears to have a bright future, but the recent stock rally is pricing any too much hype in the near term. The voice AI company still needs to prove the ability to execute the business plan to warrant the current rally, much less reward shareholders with a higher stock price above $7.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here