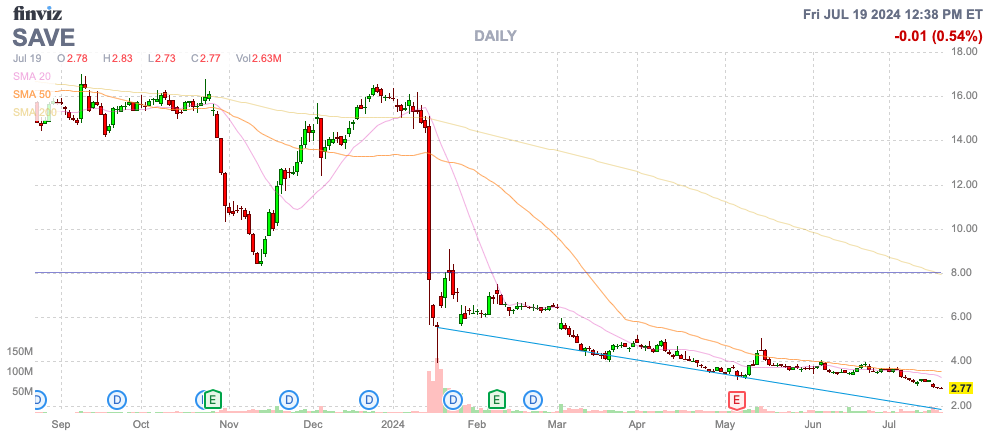

In no huge surprise, Spirit Airlines, Inc. (NYSE:SAVE) is set to report a weak Q2 as domestic yields dipped due to overcapacity. The airline sector is quickly adjusting capacity to match what’s actually record passenger travel in a sign of how the sector has evolved over time. My investment thesis remains Ultra Bullish on the stock with a fare turnaround set to occur in the next 30 days.

Source: Finviz

Domestic Weakness

Spirit Airlines released weak preliminary numbers back on July 16. The company will report official numbers in early August and provide investors with key guidance for the current Q3.

The airline now expects revenues of $1.28 billion this quarter, compared to the prior $1.32 to $1.34 billion estimate. Spirit Airlines expects to report a large loss as the airline continues to struggle to reset the business following the termination of the lucrative merger with JetBlue Airways Corporation (JBLU).

Spirit Airlines suggests passengers have been pinching pennies by avoiding non-ticket fees leading to sales missing estimates with per-passenger revenues below expectations at $64. The lower spend by passengers is a sign of both the competitive nature of fare pricing and the potential bite of inflation on passenger willingness to spend extra.

The domestic sector has felt pressure from overcapacity as the market has struggled to adjust capacity due to the reopening of international travel. At the same time, fuel costs remain elevated while the airlines have been unable to adjust fares higher.

Per Delta Air Lines, Inc. (DAL), the sector was running at 8% capacity growth with demand up just 4%, leading to oversupply on domestic routes. The industry is quickly cutting capacity with both Delta and United Airlines Holdings, Inc. (UAL) now confirming an inflection point in August with both reducing capacity growth by year-end.

United made the following related statement on their Q2 earnings release on July 17:

Looking forward, we see multiple airlines have begun to cancel loss-making capacity, and we expect leading unit revenue performance among our largest peers in the second half of the third quarter. United has long been preparing for the moment when industry-wide domestic capacity would adjust – it’s now clear that the inflection point is just 30 days away.

With a solution to the capacity issue already in the works, the airline isn’t in such a dire situation as the market would suggest. TD Cowen threw out the bankruptcy risk, but the airline has liquidity of more than $1.2 billion and a reversal in the yield equation quickly flips the switch here. Analyst Thomas Fitzgerald predicted Spirit Airlines wouldn’t be profitable until 2026, but the major airlines have already confirmed a flip in the yield environment in less than 30 days now.

A big issue is highlighted in the fuel costs. The airline forecasts spending ~$409 million on fuel in Q2 ($2.78/gallon on 147 million gallons), yet Spirit Airlines produced operating income last year with fuel costs at $391 million while capacity was up slightly. The airline even somewhat handled massive fuel costs of $559 million in Q2’22 when capacity was considerably lower at the fuel consumption of only 130 million gallons and the cost was $4.30 per gallon

The data from the last two years highlight how volatile a rebound in passenger demand and shifting airline traffic has made capacity difficult to plan in the short term. The airline doesn’t have a structural problem that won’t be solved with capacity adjustments in the industry.

Big Risk/Reward

Back in July 2022, JetBlue Airways offered more than $30 per share to acquire Spirit Airlines when the stock was already trading around $20. The opportunity here is for the stock to at least return to these levels.

After the merger was blocked by the Department of Justice in early March, Spirit offered up plans to become cash flow positive in short order. Those plans were delayed as the market shifted and both Spirit and JetBlue failed to make timely capacity adjustments while in the midst of the merger.

The stock only has a market cap here in the $300 million range for an airline producing over $5 billion in annual revenues. If the airline returns to cash flow positive, the stock will soar from these levels.

Spirit hasn’t fully adjusted to the shifting market where the legacy airlines are capturing more premium revenues while still offering discount tickets for the back of the plane to compete with the ULCCs. The airline continues to promise some shifts in the business plan as mentioned in the July Investor Update as follows:

Spirit has begun to execute its transformation plan to better align with the current market dynamics. As the Company progresses on its transformation strategy, it anticipates that over time it will be able to drive improvement in total revenue per passenger segment.

CEO Ted Christie discussed plans to work on a more compelling product and a possible solution is to offer a premium service for the front of the aircraft. After all, Spirit Airlines is a leader in the industry with 187 seats per flight providing plenty of opportunity to implement premium options, possibly learned during the merger work with JetBlue Airways.

Source: Airlines.org

During Q1, the airline only charged an average fare of $48.08 per segment with total passenger flight segment fees of $117.03. The opportunity is to boost prices for a more premium service, especially considering the load factor only averaged 80.7% in the March quarter, leaving nearly 20% of the average flight empty and available for a premium offering collecting a higher fare.

The stock trades below $3 on the weak guidance in a sign the market has bankruptcy fears. Spirit Airlines has ~$3.3 billion in debt and plans to announce some details on working with bondholders on the 2026 convertible notes.

Takeaway

The key investor takeaway is that the airline industry is better at adjusting capacity to demand now. Spirit Airlines trading below $3 is a sign the market doesn’t trust in this process, providing the opportunity for a high risk/reward outcome. Investors definitely have to assume a negative outcome is possible and invest accordingly.

Read the full article here