Introduction

I’ve been thinking a lot about retirement lately.

Don’t get me wrong. I’m not going anywhere. As I have written in prior articles, I don’t yet have the capital to retire in most developed nations – at least not comfortably and without the need to take significant financial risks.

And even if I did, I wouldn’t stop covering macroeconomics, dividend strategies, and other topics we frequently discuss.

What I have been doing is thinking about different ways to improve the yield of my portfolio if I were to make the decision to increase its cash flow – for whatever reason. After all, the biggest part of my dividend portfolio consists of dividend-growth stocks, not high-yield investments.

In general, I’m extremely careful when it comes to high-yield stocks, as a lot of companies that offer a high yield have slow growth. It gets even trickier when dealing with companies that pay close to 10% (or more!). After all, if it sounds too good to be true, it probably is.

When dealing with yields of 10% or more, one slowly but steadily enters “Madoff” territory, although there are obviously many exceptions!

Bernie Madoff promised his investors a steady return of 10% to 12% per year, regardless of market conditions. – Metis Ireland

I believe one exception is Starwood Property Trust (NYSE:STWD), chaired by billionaire investor and CEO of Starwood Capital Group, Barry Sternlicht.

In my most recent article, written on July 7, I called it “The Gold Standard In CRE Investing.” However, I went with a Hold rating due to challenging macroeconomic conditions.

After all, Starwood is one of the biggest lenders in commercial real estate, which makes it prone to macroeconomic headwinds.

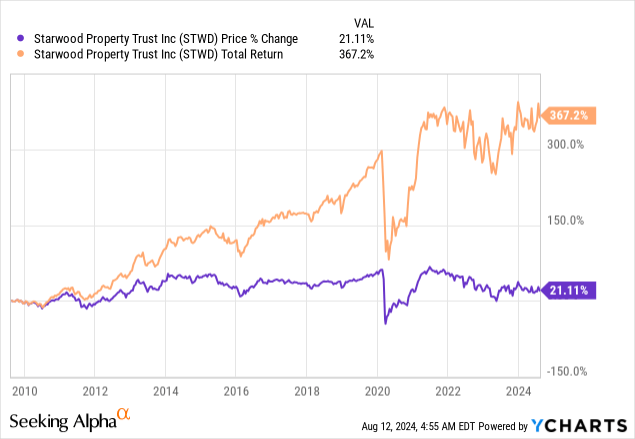

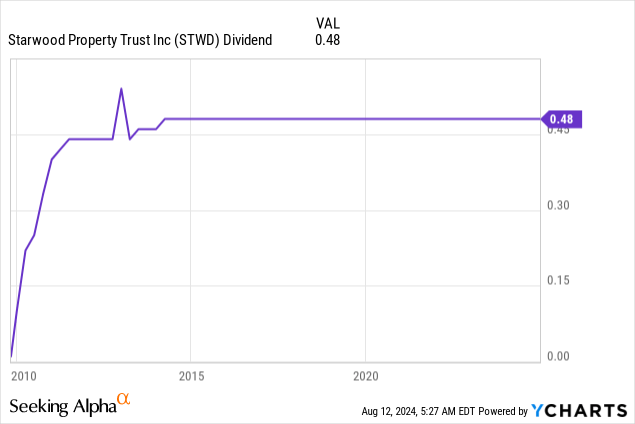

Since then, the stock has returned 3%, beating the S&P 500 by more than seven points. On a side note, the chart below shows the magic of dividends. Excluding its dividend, STWD has returned just 21% since 2009. Including dividends, that number is close to 370%!

In this article, I will use its just-released quarterly earnings as well as new macroeconomic developments to re-assess the giant and explain why it would be my go-to 10% yield if I needed to improve my cash flows.

So, as we have a lot to discuss, let’s get right to it!

Times Are Tough

Commercial real estate has been in a tough spot since the end of 2021. Back then, rising rates started to bite. As the Fed has kept rates elevated since then, the pressure only increased, as companies that got cheap financing before the pandemic now had to refinance at higher rates.

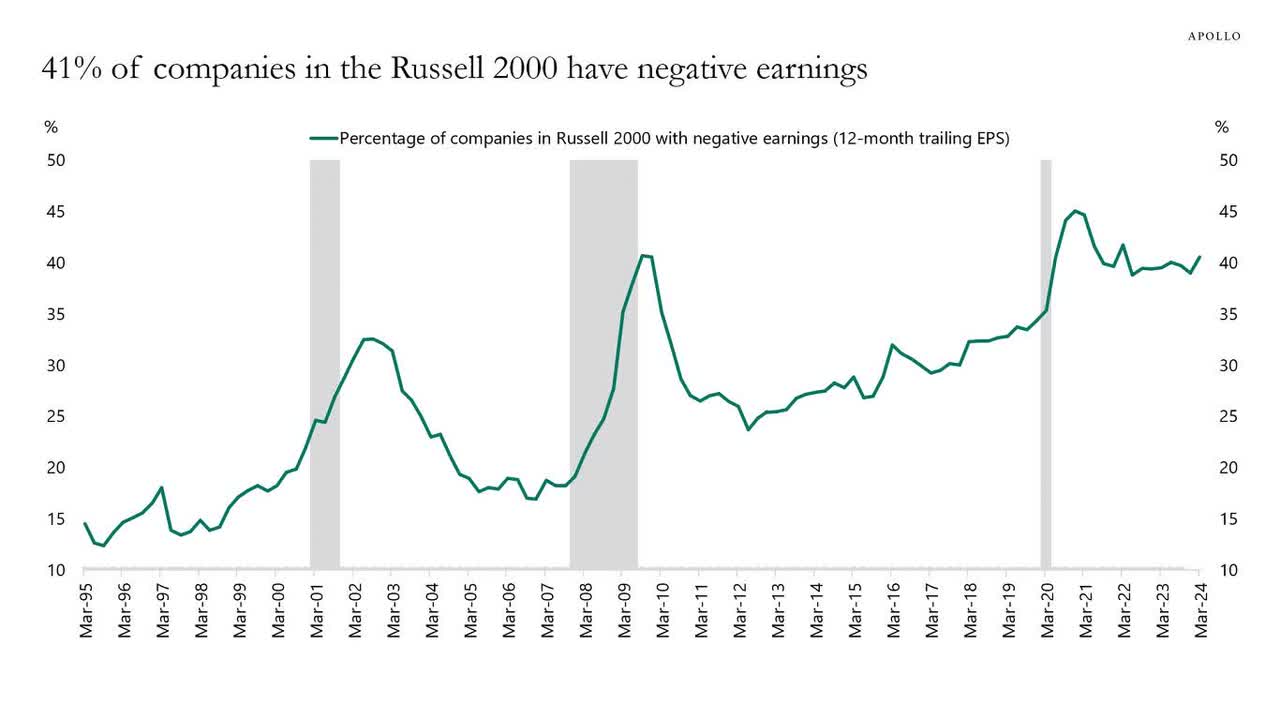

This hit smaller companies harder than bigger companies. Earlier this year, more than 40% of Russell 2000 companies had negative earnings, the highest number outside of any recession since Bloomberg started collecting this data.

Apollo Global Management

Especially, areas that enjoyed a lot of funding started to suffer. This includes multifamily housing. I added emphasis to the quote below:

Apartment deals marked delinquent or in special servicing and financed with commercial mortgage backed securities loans jumped 185 percent in late June from January, according to a report by CRED iQ.

“We’ve noticed a spike in multifamily since the beginning of the year,” said report author Mike Haas.

That surge marked the largest increase among any commercial real estate asset in the period.

The data signals the deterioration of multifamily loans isn’t only ramping up, it’s mushrooming. – The Real Deal

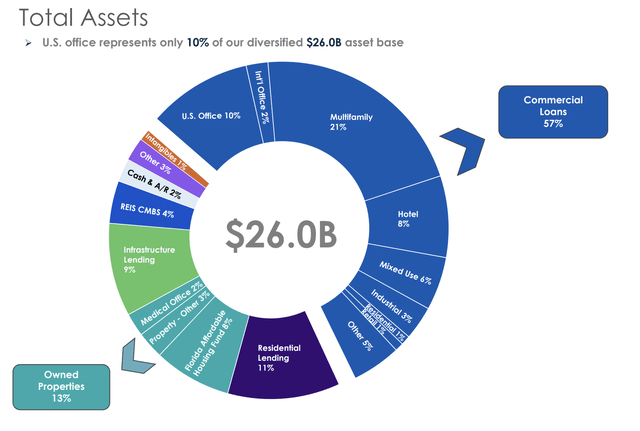

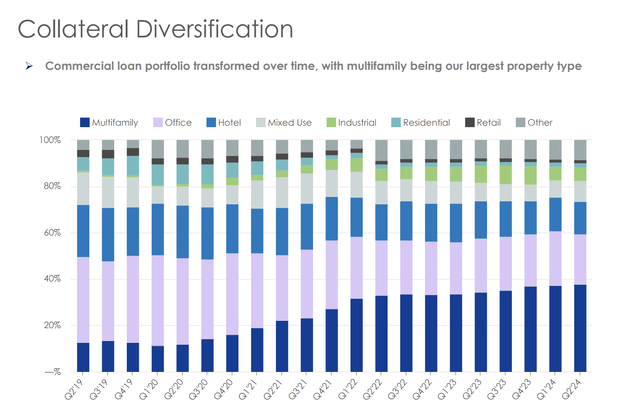

This is bad news for Starwood, which is one of the biggest multifamily players in its industry. Slightly more than a fifth of its $26 billion asset portfolio consists of multifamily loans.

Starwood Property Trust

The good news is that demand is coming back, as “smart money” is witnessing a chance to participate in what could be a highly profitable distressed investment cycle.

John Brady, global head of real estate at Oaktree, is similarly blunt about what’s ahead: “We could be on the precipice of one of the most significant real estate distressed investment cycles of the last 40 years,” he wrote in a recent note on the US. “Few asset classes are as unloved as commercial real estate and thus we believe there are few better places to find exceptional bargains.” – Bloomberg

It also helps that Starwood is far from distressed – very far.

Starwood Remains In A Great Spot

In its just-released second quarter, the company reported distributable earnings (“DE”) of $158 million, or $0.48 per share.

This is enough to cover its $0.48 quarterly dividend. The company has paid a $0.48 quarterly dividend since 2014. Currently, this translates to a yield of 9.8%.

Although the 100% payout ratio looks like the dividend is in danger, that is not the case, as the company has more than $4 in unrealized DE gains. This also explains why the Board already approved the dividend for the third and fourth quarters.

That said, one of the reasons why the company has refrained from boosting its dividend is its focus on balance sheet health and its core business. The company has always kept leverage in check. While it knew it could have grown the business much faster by using debt more aggressively, it also knows that elevated debt can become an issue when macroeconomic headwinds start to bite.

As a lot of lenders are often prone to steep sell-offs and loan weakness during recessions, I believe STWD has made the right call to put safety over growth.

I also have the feeling that a lot of investors agree with me, as I often hear that most are satisfied with the 10% yield and the safety the company brings to the table.

Based on this context, during the second quarter, the company committed to $925 million of new investments. 62% of these investments went to non-commercial lending purposes, which now account for 57% of its total assets.

As one can imagine, this diversification reduces its exposure to any single market segment and improves its stability in various economic conditions.

For example, while commercial lending remains a significant part of the company’s portfolio, they have also expanded into residential lending, property, infrastructure lending, and special servicing.

Another great example is its commercial loan portfolio, which was overweight office loans before the pandemic. Since then, the company has significantly diversified, putting a bigger emphasis on multifamily lending, an area that is still much more profitable and stable.

It has also turned distressed office properties into multifamily units, lowering risks and adding new revenue streams.

Starwood Property Trust

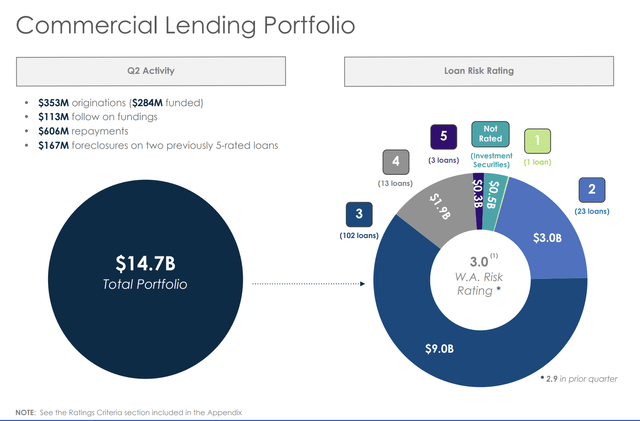

Going back to my comments on debt stability, STWD’s $14.7 billion commercial loan portfolio has a weighted average risk rating of 3.0, which indicates a well-balanced risk profile.

According to the company, despite a small increase in the risk rating from 2.9 in 1Q24, 97% of performing loans have some form of rate protection, including rate caps, interest reserves, guarantees, or fixed rates, which protects STWD against interest rate volatility.

Starwood Property Trust

Moreover, the company increased its CECL (current expected credit losses) reserve, mainly due to office weakness.

On the topic of CECL, our reserve increased by $33 million to a balance of $380 million, of which 70% relates to office. Together with our previously taken REO impairments of $183 million, these reserves represent 3.6% of our lending and REO portfolio and translate to $1.78 per share of book value. – STWD 2Q24 Earnings Call

In 1Q24, the CECL reserve accounted for 3.4% of total lending and REO portfolios, which shows a slight increase to the new number of 3.6%. Although this is a move in the wrong direction, the company maintains a strong portfolio.

It also helps that liquidity is strong.

With $9.9 billion of credit capacity under existing financing lines, $4.5 billion in unencumbered assets, and a current liquidity position of $1.2 billion, the company believes it is in a great spot to weather any storms and capitalize on new opportunities.

Moreover, the company’s adjusted debt to undepreciated equity ratio decreased to 2.29x, the lowest in more than two years.

Adding to that, during the 2Q24 earnings call, Mr. Sternlicht noted that the company has been able to capitalize on higher interest rates due to its significant floating-rate loan portfolio.

Essentially, this structure allows the company to earn more when rates rise.

Additionally, because the company has low leverage – especially compared to its peers – it is better protected when rates fall. I added emphasis to the quote below.

So you won’t see us drop dramatically if interest rates do hit the 3% SOFR that you’re seeing now in the chart from next June. And we’ll have to monitor, but it will be less of an impact for us. It was on the way up. Also, we have 40% of our assets and other asset classes that are doing other things and not necessarily related to our loan book.

[…]

So in general, we’re feeling pretty good about where we sit and if we have problems in the loan portfolio, there isn’t a lender in the United States that probably doesn’t. But we are on top of them and we’re managing through them, and we look forward to coming out the bright side of this storm. – STWD 2Q24 Earnings Call

So, what about its valuation?

Valuation

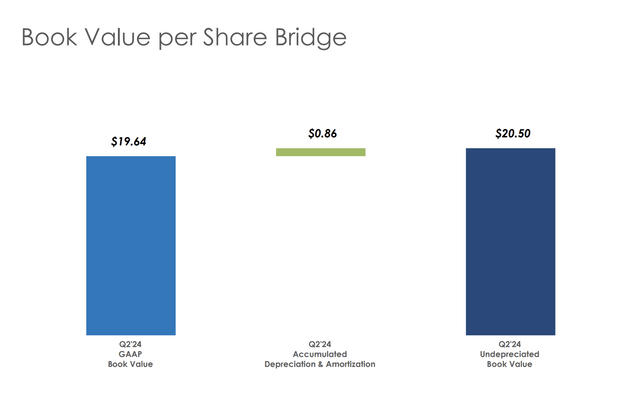

Starwood Property Trust ended the second quarter with an undepreciated book value of $20.50 and a GAAP book value of $19.64. The difference between the two numbers is close to $0.90 in accumulated depreciation and amortization.

Starwood Property Trust

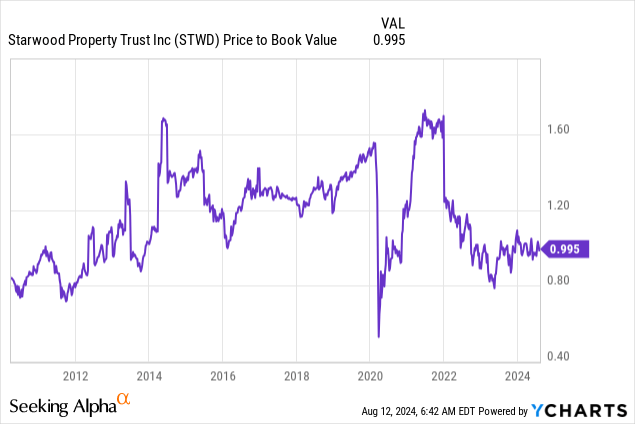

As STWD shares are currently trading at $19.53, the company continues to trade below its book value.

Before the pandemic, the company regularly traded 20% above its book value. That makes sense, as STWD is one of the best in its sector.

Currently, the company trades at a discount, as the market has distanced itself from companies that could suffer if commercial real estate takes an even bigger hit. That’s also why I have consistently given STWD a Hold rating.

While I will stick to this Hold rating, it does not mean that STWD is a poor investment – it only means I do not expect significant capital gains in the mid-term.

I also do not rule out steeper corrections if the Fed is unable to achieve a “soft landing.”

However, If I were looking for income, I would probably start buying STWD at current levels, adding to my position on future corrections – especially if the Fed needs to break an egg to achieve its inflation goals.

Given STWD is a fantastic business in a tough environment, I think that’s the best way to build wealth in this segment.

Takeaway

If I were looking to enhance my portfolio’s cash flow, Starwood Property Trust would be my top pick for a 10% yield.

Despite the challenging environment for commercial real estate, Starwood stands out due to its diversified portfolio, strong balance sheet, and commitment to its dividend.

While I maintain a Hold rating, due to potentially lasting macroeconomic headwinds, STWD’s stable dividend, strategic debt management, and opportunistic investments make it a compelling choice for everyone looking for income.

Bulls vs. Bears

Bulls Say:

- Attractive Dividend: With a 10% yield, STWD provides a reliable income stream, supported by its earnings, making it a top pick for income investors.

- Diversification Strength: The company’s move into non-commercial lending and other asset classes has reduced risk.

- Robust Financial Position: Low leverage, a lot of liquidity, and a focus on balance sheet health position STWD to weather economic downturns and capitalize on new opportunities.

Bears Say:

- Commercial Real Estate Exposure: STWD’s significant exposure to commercial real estate, especially multifamily lending and offices, exposes it to ongoing market headwinds.

- Limited Upside Potential: I believe the stock is unlikely to see significant price appreciation in the near term, making it less appealing for those seeking capital gains.

- No Dividend Growth: Although I fully agree with the company’s decision to pick dividend safety over growth, the absence of dividend growth is not necessarily beneficial in light of inflation.

Read the full article here