Tech stocks lifted the S&P 500 into the green Thursday as the market wrapped up the short trading week on a high note despite signs of a weakening labor market.

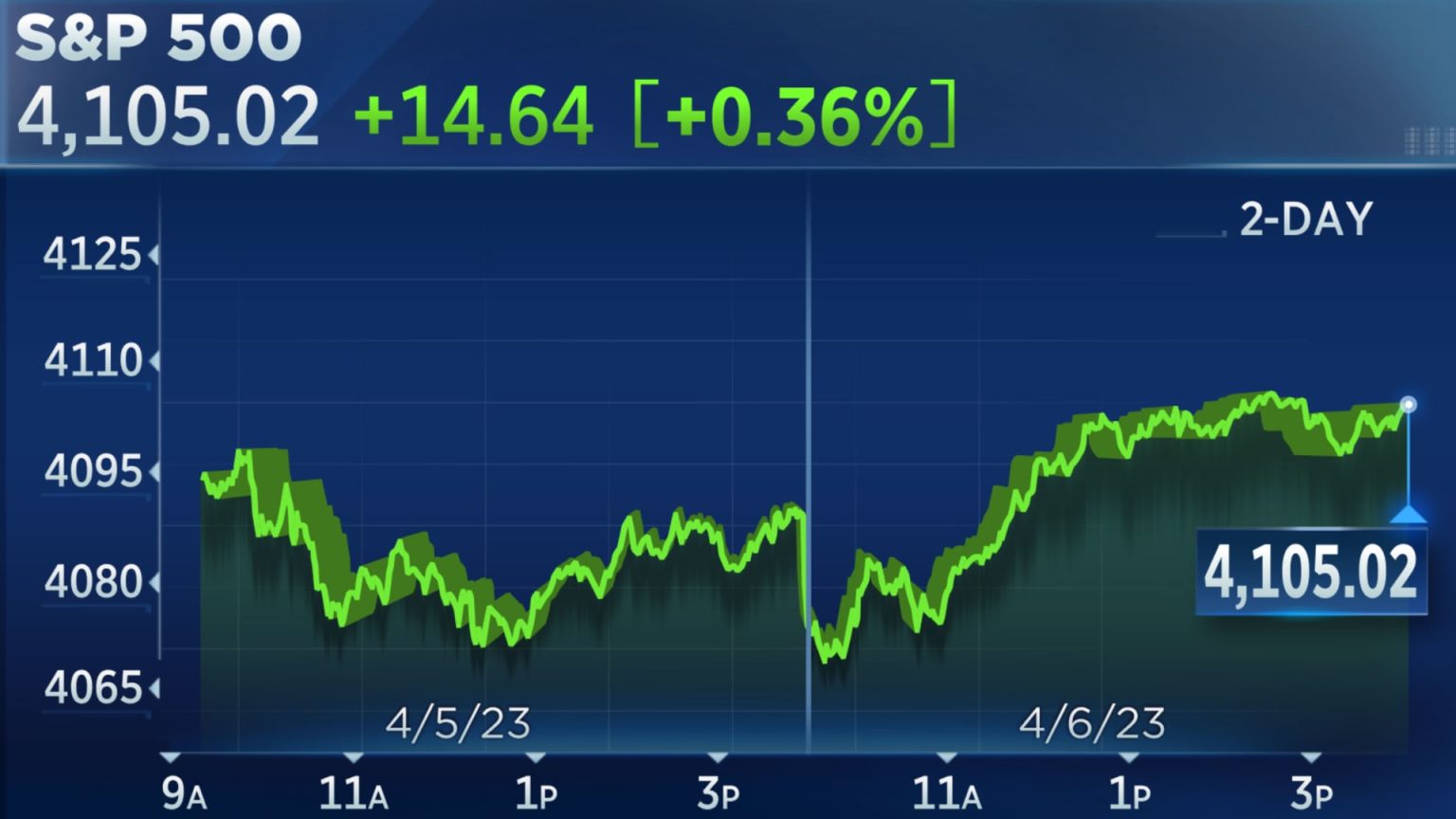

The S&P 500 rose 0.36% to 4,105.02 after losing as much as 0.50% earlier. The tech-heavy Nasdaq Composite outperformed with a 0.76% gain to 12,087.96, boosted by a 3.78% rise in Google-parent Alphabet and a 2.55% rally in Microsoft shares. The Dow Jones Industrial Average inched 2.57 points higher to 33,485.29 after losing more than 150 points at its session low.

The S&P 500 still lost 0.1% on the week, posting its first losing week in four. The tech-heavy Nasdaq fell 1.1% this week, while the 30-stock Dow rose 0.6%.

The market remained volatile as the latest weekly jobless claims came in higher than expected, adding to recent signals that pointed to slowing job growth. The expansion in private payrolls was well below expectations in March, ADP said earlier this week. Meanwhile, the number of available positions fell below 10 million in February — a first in almost two years. Job cuts have also soared by nearly fivefold so far this year from a year ago.

Over the past several months, investors had cheered signs of economic cooling on the hope that it could push the Federal Reserve to change course on its interest rate hiking campaign. But they are now wondering if the central bank has gone too far in its bid to cool inflation, tightening the economy to the point of a recession.

“The Fed built a wall with interest rates and now the economy is running into it,” said Jamie Cox, managing partner at Harris Financial Group.

Thursday capped off a shortened trading week with the market closed for Good Friday. Investors will still closely monitor March jobs report Friday morning. Nonfarm payrolls have been showing solid growth despite layoffs across tech and financial sectors, but many believe the trend is poised to reverse soon.

Jobless claims data “lends credence to the idea that the Fed’s rate hikes are beginning to cool down the labor market and slow down the economy,” said Chris Zaccarelli, CIO at Independent Advisor Alliance. “The odds are much higher that it will cause a recession – and even a significant recession – than most people are currently willing to believe.”

Correction: A previous headline misstated the day of the week.

Read the full article here