Investment Thesis

The main goal of today’s article is to present you with the allocation of the 20 largest positions of my personal dividend portfolio. I will analyze the portfolio’s diversification over sectors and industries and will explain why it still aligns with my risk-tolerance, despite the elevated concentration risk of this portfolio.

I would like to highlight that the main target of this personal portfolio is the achievement of an attractive Total Return. For this reason, I consider the companies that account for the largest proportion of my overall portfolio to be excellent risk/reward choices, providing me with a high probability of achieving attractive investment results while investing over the long term.

Among the companies that are part of the 20 largest positions of this portfolio are several that pay a relatively high dividend (such as Allianz (OTCPK:ALIZF, OTCPK:ALIZY), Shell (NYSE:SHEL), Exxon Mobil (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), and JPMorgan (NYSE:JPM), for example). Other companies, which also pay a relatively high dividend, and which I consider to be less attractive in terms of risk and reward, are underweighted in this personal portfolio (such as TotalEnergies (NYSE:TTE), Banco Santander (NYSE:SAN), Itaú Unibanco (NYSE:ITUB), for example), and therefore are not part of this analysis (since I am focusing on the top 20 positions).

The investment approach that I am following with this personal investment portfolio is slightly different from the approach with the construction of The Dividend Income Accelerator Portfolio, a portfolio I have been building from scratch since the beginning of September.

The Dividend Income Accelerator Portfolio has the objective of boosting income through dividends (while combining dividend income with dividend growth), investing at a lower risk level (through a broad diversification over sectors and industries, including some geographical diversification), while achieving an attractive Total Return is a secondary goal.

This private investment portfolio has been built much more towards the goal of achieving an attractive Total Return, with the dividend distribution being a secondary target. However, this does not mean that this portfolio is not similar to The Dividend Income Accelerator Portfolio in certain aspects.

Several companies (like Apple, AT&T, Mastercard, Johnson & Johnson, and Bank of America) that are part of this private portfolio, have already been incorporated into The Dividend Income Accelerator Portfolio. Moreover, I plan to add additional companies to The Dividend Income Accelerator Portfolio over the coming weeks and months that are already part of this private investment portfolio.

The 20 Largest Positions of my Personal Investment Portfolio are:

- Apple (NASDAQ:AAPL)

- Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL)

- Amazon (NASDAQ:AMZN)

- Mastercard (NYSE:MA)

- Visa (NYSE:V)

- Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B)

- Nike (NYSE:NKE)

- American Express (NYSE:AXP)

- Walt Disney (NYSE:DIS)

- Allianz

- Exxon Mobil

- Anheuser Busch InBev (BUD)

- Starbucks (NASDAQ:SBUX)

- Microsoft (NASDAQ:MSFT)

- JPMorgan

- Shell

- Johnson & Johnson

- Meta (NASDAQ:META)

- Tesla (NASDAQ:TSLA)

- Netflix (NASDAQ:NFLX)

Overview of the Largest 20 Companies of My Personal Portfolio and Their Allocation

|

Company Name |

Sector |

Industry |

Country |

Dividend Yield [FWD] |

Dividend Growth 5 Yr [CAGR] |

P/E GAAP [FWD] |

EBIT 3 Year [CAGR] |

EBIT Margin |

Return on Equity |

60M Beta |

Allocation |

|

Apple |

Information Technology |

Technology Hardware, Storage and Peripherals |

United States |

0.54% |

6.69% |

27.07 |

19.91% |

29.82% |

171.95% |

1.31 |

19.99% |

|

Alphabet |

Communication Services |

Interactive Media and Services |

United States |

– |

– |

22.69 |

32.74% |

27.42% |

25.33% |

1.05 |

9.16% |

|

Amazon |

Consumer Discretionary |

Broadline Retail |

United States |

– |

– |

53.29 |

9.94% |

4.77% |

12.53% |

1.18 |

8.04% |

|

Mastercard |

Financials |

Transaction & Payment Processing Services |

United States |

0.59% |

17.92% |

32.37 |

18.32% |

57.47% |

170.45% |

1.08 |

7.26% |

|

Visa |

Financials |

Transaction & Payment Processing Services |

United States |

0.85% |

16.89% |

24.99 |

15.79% |

67.15% |

46.49% |

0.95 |

6.34% |

|

Berkshire |

Financials |

Multi-Sector Holdings |

United States |

– |

– |

11.19 |

16.84% |

33.08% |

17.12% |

0.87 |

4.24% |

|

Nike |

Consumer Discretionary |

Footwear |

United States |

1.27% |

11.20% |

28.72 |

20.39% |

11.32% |

33.91% |

1.09 |

3.28% |

|

American Express |

Financials |

Consumer Finance |

United States |

1.57% |

10.01% |

13.57 |

– |

– |

31.26% |

1.21 |

2.70% |

|

Walt Disney |

Communication Services |

Movies and Entertainment |

United States |

– |

– |

48.3 |

4.58% |

8.80% |

2.72% |

1.3 |

2.65% |

|

Allianz |

Financials |

Multi-line Insurance |

Germany |

5.33% |

5.72% |

– |

-4.26% |

9.07% |

15.37% |

1.12 |

2.43% |

|

Exxon Mobil |

Energy |

Integrated Oil and Gas |

United States |

3.53% |

2.74% |

11.59 |

NM |

13.66% |

21.17% |

1.06 |

2.20% |

|

Anheuser Busch |

Consumer Staples |

Brewers |

Belgium |

1.40% |

-28.07% |

22.98 |

4.06% |

24.07% |

9.07% |

1.08 |

1.79% |

|

Starbucks |

Consumer Discretionary |

Restaurants |

United States |

2.22% |

10.97% |

24.8 |

50.95% |

15.30% |

NM |

0.98 |

1.40% |

|

Microsoft |

Information Technology |

Systems Software |

United States |

0.85% |

10.12% |

31.67 |

18.57% |

43.01% |

39.11% |

0.89 |

1.32% |

|

JPMorgan |

Financials |

Diversified Banks |

United States |

2.94% |

10.31% |

8.6 |

– |

– |

16.93% |

1.1 |

1.23% |

|

Shell |

Energy |

Integrated Oil and Gas |

United Kingdom |

4.00% |

– |

8.97 |

106.53% |

16.44% |

15.43% |

0.61 |

1.21% |

|

Johnson & Johnson |

Health Care |

Pharmaceuticals |

United States |

3.15% |

5.92% |

22.5 |

11.23% |

27.97% |

19.19% |

0.58 |

1.17% |

|

Meta |

Communication Services |

Interactive Media and Services |

United States |

– |

– |

21.87 |

14.96% |

34.41% |

22.28% |

1.21 |

1.03% |

|

Tesla |

Consumer Discretionary |

Automobile Manufacturers |

United States |

– |

– |

82.93 |

83.97% |

11.18% |

22.46% |

2.28 |

0.94% |

|

Netflix |

Communication Services |

Movies and Entertainment |

United States |

– |

– |

35.65 |

13.68% |

18.35% |

21.23% |

1.24 |

0.89% |

Source: The Author, data from Seeking Alpha

When considering the 20 largest positions of my personal investment portfolio, the following companies have a focus on dividend income

- Allianz (Dividend Yield [FWD] of 5.33%)

- Shell (4.0%)

- Exxon Mobil (3.53%)

- Johnson & Johnson (3.15%)

- JPMorgan (2.94%)

Considering the 20 largest positions of my personal portfolio, it can be stated that the company that pays the highest Dividend Yield is Allianz, with a Dividend Yield [FWD] of 5.33%. This is followed by Shell (4.0%), Exxon Mobil (3.53%), Johnson & Johnson (3.15%), and JPMorgan (2.94%).

However, it is worth mentioning that the Yield on Cost that I achieve with these investments is significantly higher. For example, I bought the Exxon Mobil shares for an Average Acquisition price of $44.13 per share. Considering the company’s current annual Payout [FWD] of $3.80, this implies an attractive Yield on Cost of 8.61%.

In regards to my investment in Allianz, it can be highlighted that it currently provides me with a Yield on Cost of 7.12%.

It is worth mentioning that several other companies that are part of this private portfolio, pay a higher Dividend Yield [FWD] than those mentioned above. However, they are not among the 20 largest positions of my portfolio (accounting for a smaller percentage of the overall portfolio) and therefore they are not listed in this section.

When considering the 20 largest positions of my personal investment portfolio, the following companies have a focus on dividend growth

- Mastercard (5 Year Dividend Growth Rate [CAGR] of 17.92%)

- Visa (16.89%)

- Nike (11.20%)

- Starbucks (10.97%)

- Microsoft (10.12%)

- American Express (10.01%)

- Apple (6.69%)

- Anheuser Busch InBev (even though the company has a 5 Year Dividend Growth Rate [CAGR] of -28.07%, its Dividend Per Share Growth [FWD] stands at 31.18%)

These dividend growth companies are crucial for ensuring that the dividend income generated by my portfolio experiences substantial growth year over year. Companies such as Mastercard (with a Dividend Growth Rate [CAGR] of 17.92% over the past 5 years) and Visa (16.89%) are key contributors in regard to reaching this objective.

When considering the 20 largest positions of my personal investment portfolio, the following currently do not pay a dividend

- Alphabet

- Amazon

- Berkshire

- Walt Disney

- Meta

- Tesla

- Netflix

Even though these companies listed above do not currently pay a dividend, some of them might start to do so in the future. Let us consider Alphabet as an example: with an EPS [FWD] of $5.74, the company could potentially pay a Dividend Yield [FWD] of 1.30% when considering a Hypothetical Payout Ratio of 30%.

This Payout Ratio would be comparable to Microsoft’s Payout Ratio of 26.70%. Given this Hypothetical Payout Ratio of 30% for Alphabet, the company’s Dividend Yield [FWD] of 1.30% would be superior to Microsoft’s Dividend Yield [FWD] of 0.84%.

Moreover, investors could simulate dividend payments from non-dividend-paying companies by selling a small portion of their holdings. Such a strategy can produce a similar outcome when compared to dividend payments. This example shows that non-dividend-paying companies can indeed be appropriate for a dividend-income-oriented investment portfolio.

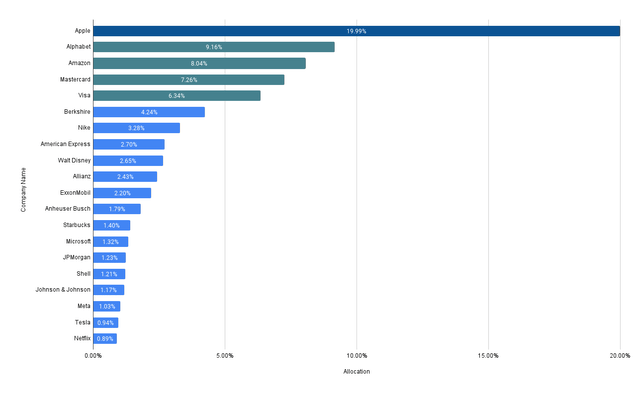

Current Portfolio Allocation per Company

Apple accounts for 19.99% of my overall investment portfolio, making it by far the largest position. The rationale for giving the company from Cupertino top position is that I consider it to be an excellent risk/reward proposition.

It is worth noting that Apple’s high proportion within the overall portfolio is also a result of the company’s strong performance since its acquisition, which has naturally increased its share of the overall investment portfolio.

Alphabet (9.16% of the overall portfolio), Amazon (8.04%), Mastercard (7.26%), and Visa (6.34%) are the second, third, fourth, and fifth largest positions of my portfolio.

Considering the 5 largest positions of my personal portfolio, I believe that Amazon comes attached to the highest risk level, which is particularly based on the company’s relatively high P/E [FWD] Ratio of 53.29. Amazon’s relatively high Valuation indicates that the price of its stock is based on relatively high growth expectations. In the case that Amazon was not able to fulfil these growth expectations, the company’s stock price could drop significantly, thus negatively affecting my investment portfolio’s Total Return. However, it is also true that Amazon’s current Valuation is significantly below its Average from the past 5 years (which is 186.78). This indicates that an investment in Amazon today is less risky than it has been on average over the past 5 years.

Given that I have a long investment-horizon for this portfolio, the risk is manageable from my point of view. However, if you are more risk-averse, and do not share a similar investment-timeline as I do, I would suggest giving Amazon a smaller proportion of the overall portfolio.

Berkshire Hathaway is the sixth largest position of my private portfolio (4.24%), followed by Nike (3.28%), American Express (2.70%), Walt Disney (2.65%), and Allianz (2.43%).

Overview of the 20 Largest positions of my Personal Investment Portfolio

Below you can find an illustration of the 20 largest positions of my personal investment portfolio (please note that this article only focuses on the largest 20 positions, therefore, their combined total does not equate to 100% of the portfolio).

Source: The Author

Combined, the five largest positions currently account for 50.79% of the overall portfolio, indicating a relatively high concentration risk.

However, I believe that each of the selected companies that represent a high proportion of the overall portfolio and are among my top 5 positions, are attractive risk/reward choices (only the Amazon positions comes attached to a higher risk level).

Given my long-term investment-horizon, I am comfortable with the concentration risk of this portfolio, especially considering that each of the companies that have a high percentage of the overall portfolio offer a favorable risk/reward profile from my point of view.

In the last chapter of this article, I will explain strategies for decreasing the concentration risk and overall risk level of this portfolio.

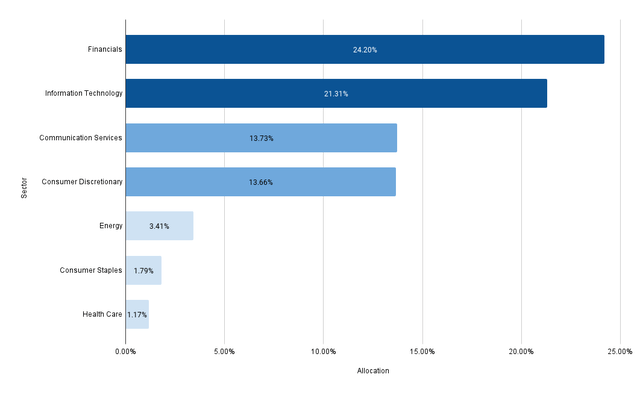

Portfolio Allocation per Sector

Considering the 20 largest positions of my personal dividend portfolio, it is worth highlighting that the Financials Sector represents the largest Sector (with 24.20%).

The Financials Sector is represented by Mastercard (7.26% of the overall portfolio), Visa (6.34%), Berkshire Hathaway (4.24%), American Express (2.70%), Allianz (2.43%), and JPMorgan (2.23%).

The Information Technology Sector is the second largest. Belonging to this sector are: Apple (representing 19.99% of my investment portfolio), and Microsoft (1.32%).

The third largest sector is the Communication Services Sector, which accounts for 13.73%. This sector is represented by Alphabet (9.16%), Walt Disney (2.65%), Meta (1.03%), and Netflix (0.89%).

The Consumer Discretionary Sector accounts for 13.66% and is the fourth largest sector of my personal portfolio. The Consumer Discretionary Sector is represented by Amazon (8.04%), Nike (3.28%), Starbucks (1.40%), and Tesla (0.94%).

The Consumer Staples Sector (with Anheuser Busch InBev accounting for 1.79%), and the Health Care Sector (with Johnson & Johnson accounting for 1.17%) represent a relatively small proportion of the overall investment portfolio.

No Sector represents more than 25% of the overall portfolio, reflecting a degree of diversification. Nevertheless, the current allocation of my personal investment portfolio is relatively concentrated: the Financials Sector and the Information Technology Sector combined account for more than 45% of portfolio, indicating a relatively high concentration risk over sectors.

However, given my long-term investment horizon, I am comfortable with the concentration risk of this personal portfolio. Focusing on specific sectors (like the Financial Sector or the Information Technology Sector) would be significantly riskier when having a short-term strategy, since a downturn in a particular sector could have a strong negative impact on the portfolio over the short term.

Diversification over Sectors of the 20 Largest positions of my Personal Investment Portfolio

Below you can find an illustration of the diversification over sectors of my personal investment portfolio (the graphic only focuses on the largest 20 positions of my portfolio; therefore, their combined total does not equate to 100%).

Source: The Author

Overview of the 20 companies with the highest proportion of my portfolio and their sectors

Financials Sector (24.20%)

- Mastercard (7.26% of the overall portfolio)

- Visa (6.34%)

- Berkshire Hathaway (4.24%)

- American Express (2.70%)

- Allianz (2.43%)

- JPMorgan (2.23%)

Information Technology (21.31%)

- Apple (19.99%)

- Microsoft (1.32%)

Communication Services (13.73%)

- Alphabet (9.16%)

- Walt Disney (2.65%)

- Meta (1.03%)

- Netflix (0.89%)

Consumer Discretionary (13.66%)

- Amazon (8.04%)

- Nike (3.28%)

- Starbucks (1.40%)

- Tesla (0.94%)

Energy (3.41%)

- ExxonMobil (2.20%)

- Shell (1.21%)

Consumer Staples (1.79%)

- Anheuser Busch InBev (1.79%)

Health Care (1.17%)

- Johnson & Johnson (1.17%)

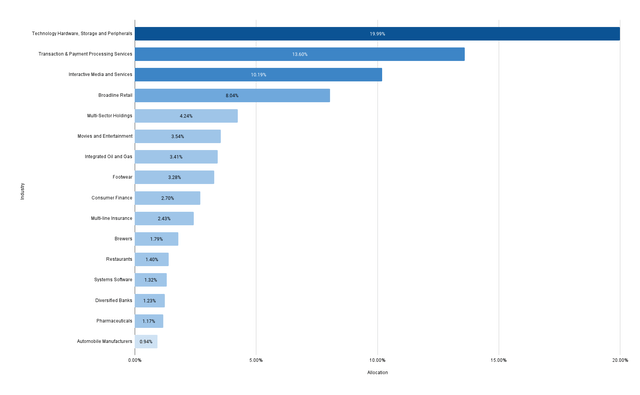

Portfolio Allocation per Industry

When considering the 20 largest positions of my personal investment portfolio, the Technology Hardware, Storage and Peripherals Industry accounts for the largest proportion. This industry is represented by Apple, which accounts for 19.99% of the overall portfolio.

The second largest is the Transaction & Payment Processing Services Industry, accounting for 13.60% of the overall portfolio. This Industry is represented by Mastercard (7.26%), and Visa (6.34%).

The Interactive Media and Services Industry accounts for 10.19% of the overall investment portfolio: while Alphabet represents 9.16%, Meta accounts for 1.03%.

The fourth largest Industry is the Broadline Retail Industry (with Amazon accounting for 8.04% of the portfolio).

All other industries account for less than 5% of my personal portfolio, indicating some degree of diversification over industries.

Diversification over Industries of the 20 Largest positions of my Personal Investment Portfolio

Source: The Author

However, when combined, the Technology Hardware, Storage and Peripherals Industry, the Transaction & Payment Processing Services Industry, and the Interactive Media and Services Industry account for 43.78% of the overall portfolio, indicating a relatively high degree of concentration risk.

Despite this, I would like to highlight again that I believe this is manageable for my risk-tolerance, particularly when considering the long-investment-horizon of my portfolio. I believe that the potential for a downturn in any of these industries would only be temporary.

The Current Risk Level of this Personal Dividend Portfolio

Over the short term, I believe this personal investment portfolio has a relatively high risk level. This belief is based on the following facts:

- Apple represents a high proportion of my overall investment portfolio, accounting for 19.99%. A substantial decline in Apple’s share price could significantly affect the portfolio’s Total Return.

- Amazon has a relatively high proportion of my overall investment portfolio, accounting for 8.04%. Given Amazon’s relatively high Valuation (P/E [FWD] Ratio of 53.29), a failure to meet growth expectations could significantly affect the Total Return of my portfolio.

- The five largest positions of my personal portfolio (Apple, Alphabet, Amazon, Mastercard and Visa) currently account for 50.79% of the overall portfolio, indicating a relatively high concentration risk. An underperformance of any of these picks (for example, due to a failure in meeting growth targets) could have a significant negative impact on the portfolio’s Total Return, indicating a notable reliance on the performance of these companies.

Over the long term, however, I believe that each of the five companies that represent the largest proportion of my investment portfolio (Apple, Alphabet, Amazon, Mastercard and Visa) offer an attractive risk/reward ratio, which is why they account for such a high proportion.

I further believe that the risk of bankruptcy for the top 5 (or even the top 20) largest positions of this personal investment portfolio is low, aligning with my investment strategy to prioritize capital preservation above all else.

Nevertheless, I would like to highlight that with the construction of The Dividend Income Accelerator Portfolio, I am implementing an investment approach that carries a lower risk-level when compared to this personal portfolio.

The strategy of The Dividend Income Accelerator Portfolio places greater emphasis on securing sustainable dividends while combining dividend income and dividend growth. At the same time, I build The Dividend Income Accelerator Portfolio with the objective to achieve a significantly higher degree of diversification over companies, sectors and industries, and less concentration risk when compared to this personal portfolio. This allows us to achieve attractive investment outcomes with a high probability while steadily increasing our wealth through the collection of dividends.

How could I decrease the Risk Level of this Personal Portfolio?

There are different strategies that I could use to decrease the risk level of this personal investment portfolio, and I will name some of them in the following:

I could buy additional shares of companies with a low Beta Factor, which could contribute to decreasing the volatility and risk level of my portfolio. Among the 20 largest positions of my personal portfolio, the following companies have a Beta Factor below 1:

- Visa (60M Beta Factor of 0.95)

- Berkshire Hathaway (0.87)

- Starbucks (0.98)

- Microsoft (0.89)

- Shell (0.61)

- Johnson & Johnson (0.58).

I believe that adding shares of Berkshire Hathaway, Shell, and Johnson & Johnson would significantly reduce the risk level of this personal investment portfolio.

Buying additional shares of Berkshire Hathaway would help to broadly diversify the portfolio, thus decreasing its risk level. Shell and Johnson & Johnson would help to decrease its risk level due to their significantly lower Beta Factor when compared to other companies that have a high proportion of the overall portfolio.

An additional strategy would be the inclusion of an ETF into the 20 largest positions of my personal portfolio to enhance diversification and reduce its overall risk level.

I could also buy additional shares of companies that pay a relatively high and sustainable dividend (following the investment approach of The Dividend Income Accelerator Portfolio). For example, I could buy additional shares of AT&T (NYSE:T) (which has a 24M Beta Factor of 0.57 and a Payout Ratio of 44.76%), elevating the company to one of the top 20 positions of this portfolio.

An alternative would be to sell some proportions of the Apple shares in a bid to decrease concentration risks. However, I am not planning to do so, since I am following a buy-and-hold approach with this portfolio. Moreover, I remain confident that Apple will continue delivering excellent results over the long term.

Currently, I am not planning to buy additional shares for this personal portfolio that is being presented in this article. The main reason is my commitment to constructing The Dividend Income Accelerator Portfolio. I am allocating my capital towards the construction of this even more dividend focused investment portfolio with the aim of providing added value to Seeking Alpha readers (since it allows readers to follow the construction and implementation of a portfolio from zero).

However, it is worth highlighting that if I currently had more capital available to invest in this personal portfolio, I would add additional shares of Johnson & Johnson, thus helping to significantly reduce the risk level.

Conclusion

The principal objective of my personal investment portfolio is the achievement of an attractive Total Return, with the generation of dividend income as a secondary objective.

I am confident that the current allocation of this private dividend portfolio provides me with attractive risk/reward prospects over the long term.

I believe that each of the companies that represent the highest proportion of this portfolio possess strong competitive advantages, are financially healthy and have promising growth potential. I am convinced that this will help to produce attractive investment outcomes over the long term.

Nevertheless, in the short term, the current allocation of my portfolio comes attached to a relatively high risk-level, particularly due to the portfolio’s concentration risk.

This is the case since the five largest positions of my portfolio represent 50.79% of the overall portfolio, implying that the risk level would be relatively high if one of these companies was not able to meet its growth targets. The concentration risk is further evidenced by Apple accounting for 19.99% of the overall investment portfolio.

However, I am comfortable with the risk level of this portfolio and it aligns with my risk-tolerance, particularly since I have a long-term investment horizon. Different strategies could help me to reduce the portfolio’s risk level (such as the additional acquisitions of companies that pay a sustainable dividend and that have a low Beta Factor). Nevertheless, I am currently allocating my capital towards the construction of The Dividend Income Accelerator Portfolio. Therefore, I am currently not planning to buy additional shares for this personal portfolio.

I believe that an investment portfolio like The Dividend Income Accelerator Portfolio is more suitable for those investors that seek sustainable dividends (while combining dividend income and dividend growth), and that are looking for a broader diversification over companies, sectors, and industries, while aiming to invest with a lower risk level. This dividend-focused approach can provide a more reliable income stream via dividends.

Whether you prioritize the achievement of an attractive Total Return, with dividends as a secondary goal (a strategy I have followed with the portfolio presented in today’s article), or you prefer a more conservative investment approach with a reduced risk level and with a stronger focus on the generation of income via dividends, with the Total Return being the secondary goal (such as reflected in the investment approach of The Dividend Income Accelerator Portfolio), the alignment of your selected investment approach with your financial goals and risk-tolerance is crucial.

Author’s Note: Thank you for reading! It would be great to hear your opinion on the allocation of my personal investment portfolio! Feel free to share any thoughts about the allocation of this portfolio or about the selection of the companies that are part of it!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here