What were some strong insider buys in Q1?

We analyzed thousands of S-4 fillings to find companies that have experienced periods of unusually concentrated purchasing activity by their corporate insiders. We have attempted to emphasize companies that enjoyed buying across the board from multiple insiders, in quantities that were not recorded previously, often after a period of a selloff.

In today’s article, we will center the focus of our analysis exclusively on large-cap stocks, but the series will be followed up with a first-quarter installment covering mid-caps and small-caps with a strong insider buying record. For this article, we defined large-cap companies as publicly listed companies with a market capitalization larger than $10 billion. Our original article containing the main thesis can be read here, while the fourth-quarter update can be seen here.

Below is our list of research-worthy large-caps that in our view enjoyed a period of unusual and atypical interest from corporate insiders during the first quarter of the year and are worthy of a further dive in our view:

Charles Schwab Corporation (SCHW)

-

Active Corporate Insiders: 10

-

One-Year Performance: -37.6%

- Total Bought Back: $7,672,075

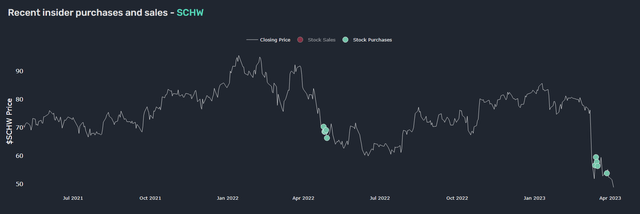

At face value, it would seem that regulators managed to contain the banking crisis at the moment, however, this does not mean by any stretch of the imagination that confidence in bank stocks has fully recovered. Investors are split down the middle amidst arguing on if we are dealing with one of perhaps best investment opportunities since the 2008 crisis and those who believe we are just seeing the first dominoes fall. Charles Schwab insiders made sure that everyone was on the same page as far as where they stood on the matter, unleashing a huge buying spree in the first quarter. After the market chewed up SCHW stock, beating it close to -40% year-to-date, insiders enacted a vote of confidence in the stock. More interesting is that this vote of confidence came after the very same insiders dumped hundreds of millions worth of SCHW stock unto the market over the past couple of years. The firm is currently being valued by the market at an estimated NTM P/E of 13.07x and an LTM P/BV of 3.61x, echoing the valuation from the 2020 period. This bumped the dividend yield up to 1.91%. Both Seeking Alpha Authors and Wall Street Analysts believe that the company will navigate its way through the crisis successfully, rating it as a “Buy”. Ten corporate insiders bought back $7.5 million worth of SCHW shares during the first quarter, at an average price of $56.91. The list of insiders, besides almost half a dozen Directors, notably includes the CEO Walter Bettinger and the CFO Peter Crawford. Charles Schwab currently trades at $51.02 per share.

Charles Schwab Q1 ’23 Insider Activity (Quiver Quantitative)

NextEra Energy (NEE)

-

Active Corporate Insiders: 7

-

One-Year Performance: -9.5%

- Total Bought Back: $2,580,137

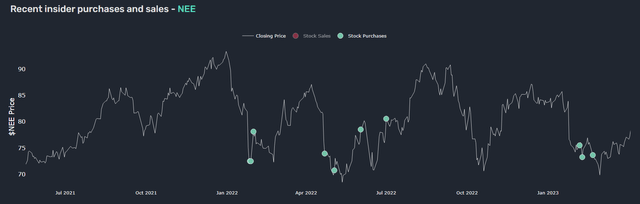

NextEra Energy is a Florida-based clean energy solutions provider and one of the most successful “green utility” companies in the world that are involved in the production, transmission, and distribution of clean energy. It provides utility services based mostly on renewable energy like wind or solar to close to 6 million customer accounts or more than 12 million people in North America. NEE held out well against broader market turmoil, generating only a -9.5% one-year return, all along rewarding its shareholders with growing dividends. Taking into account that we are dealing with a utility, even a growth and transformation-oriented one, the company does trade at a premium valuation, with the market assigning it an NTM EV/EBITDA of 17.05x and a P/E of 25.16x. NEE does pay a dividend and the current dividend yield is parked at 2.39%. Seeking Alpha Authors remains somewhat undecided on the matter, assigning the company a “Hold” rating with an average score of 3.28/5.00. On the other side, Wall Street Analysts still remain bullish and have assigned it a “Buy” rating with an average score of 4.27/5.00. Active corporate insiders include individuals like CFO Kirk Crews, EVP Robert Coffey, and almost half a dozen other directors. Insiders bought approximately $2.6 million worth of NextEra Energy stock in the quarter. They purchased it at an estimated average price of $73.83 per share. It is worth noting that NEE currently sells for $78.11.

NextEra Energy Q1 ’23 Insider Activity (Quiver Quantitative)

Energy Transfer LP (ET)

-

Active Corporate Insiders: 1

-

One-Year Performance: 11.4%

- Total Bought Back: $39,069,636

This is the third consecutive time we have had a chance to discuss this gem of a stock, whose corporate insiders developed a year-long obsession with piling their hard-earned cash back into the partnership shares. ET found its way back into the news as Chairman of the Board Kelcy Warren disclosed another big $39 million insider purchase. The last time Warren initiated such a vote of confidence was two years ago when he disclosed buying $120 million worth of ET stock. The share price has more than doubled since, not even counting the generous dividends collected along the way. To state an interesting fact in the case, insiders at Energy Transfer own almost a fifth of the outstanding shares, a testament to “aligned management goals”. ET has put another great year behind itself, beating the S&P 500 (SP500) by generating a one-year return of 11.4%. The price of the partnership effectively tripled since the 2020 crash, but ET stock still seems to be trading at seemingly low valuations. It trades at an EV/EBITDA of 7.64x, a P/E of 8.71x, and a P/FCF of 6.47x, while still offering a double-digit dividend yield. This has not been lost on SA Authors and Wall Street Analysts, who both have a high opinion of the stock, rating it on average as a “Buy” and a “Strong Buy”, respectively. We have a feeling that this is not the last time we will cover the midstream giant whose shares can currently be bought for $12.52.

Energy Transfer Q1 ’23 Insider Activity (Quiver Quantitative)

PayPal Holdings (PYPL)

-

Active Corporate Insiders: 1

-

One-Year Performance: -33.3%

- Total Bought Back: $1,985,306

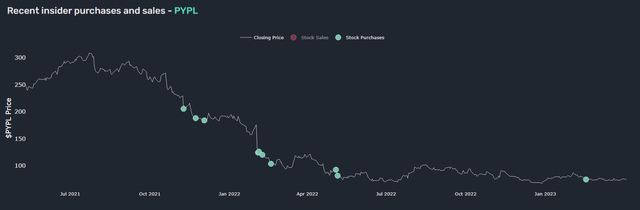

In the previous bull market, PYPL emerged as one of the most prominent, high-growth tech companies that have been propelled into the stratosphere of problematic valuations, even reaching prices over $300 per share. Since then, the company has struggled in many ways to keep up with investors’ and analysts’ expectations, losing 75% of its value. Many might claim that PYPL’s valuation is very depressed at the moment, and unfairly so. The market currently values it at 11.44x, an NTM P/E of 15.54x, and an NTM P/FCF of 13.83x, at what essentially marks a post-IPO all-time low. This helped both Seeking Alpha Contributors and Wall Street Analysts to land on the “bullish” side of the argument, with both groups of analysts assigning it a “Buy” rating. In the first quarter of the year, President and CEO Daniel Schulman bought $1.98 million or some 26 thousand shares of PayPal at an estimated $76.17 per share. The purchase is interesting as the very same CEO has been selling millions worth of PYPL shares throughout the last couple of years once the fin-tech company was trading at two or three times higher prices. Shares of PayPal can currently be bought for $74.17.

PayPal Holdings Q1 ’23 Insider Activity (Quiver Quantitative)

Occidental Petroleum Corporation (OXY)

-

Active Corporate Insiders: 1

-

One-Year Performance: 2.6%

-

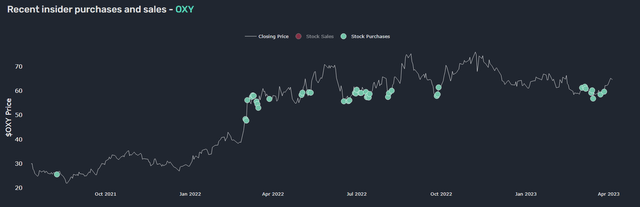

Total Bought Back: $1,037,437,136

-

Average Price: $59.77

If one could ask the old pair, Charlie Munger and Warren Buffett, where they think the buck with oil prices would stop, one would undoubtedly be welcomed with a wise and witty response that ultimately circumnavigated the question behind it. However, this quarter’s actions regarding their new favorite oil and gas stock once again tell a completely different story. The legendary insurance conglomerate Berkshire Hathaway (BRK.A) (BRK.B) has initiated another buying spree spending more than $1.03 billion to expand its OXY stake by 9%. It bought another 17.3 million shares at an average price of $59.77. This is already on top of the $8.02 billion spent in the last year that saw Berkshire become the largest stakeholder of Occidental, holding close to a quarter of the company and promoting many to speculate if a full takeover of the stock is imminent. After another year in the markets, which saw the company generate a 2.6% one-year return, surpassing the S&P 500 (SPY) by a wide margin, it still finds itself trading on the relatively “cheap” end. OXY is currently being sold at an EV/EBITDA of 5.48x, a P/E of 10.91x, and a P/FCF of 6.59x. The current price indicates a forward dividend yield of 1.15%. Seeking Alpha Authors and Wall Street Analysts love the Buffett effect and share the bullish sentiment on the oil and gas giant, assigning the company a “Buy” rating with an average score of 3.76/5.00 and 3.59/5.00, respectively. The company is currently trading at $63.44 per share.

Occidental Petroleum Corp. Q1 ’23 Insider Activity (Quiver Quantitative)

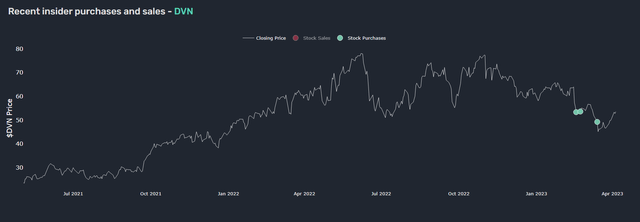

Devon Energy Corporation (DVN)

-

Active Corporate Insiders: 3

-

One-Year Performance: -13.8%

- Total Bought Back: $2,424,312

Devon Energy Corp. is the third oil and gas stock on this quarter’s large-cap insiders list. DVN is one of the leading independent energy companies that is involved in the exploration, development, and production of oil, natural gas, and NGLs in North America. Amid a challenging environment considering oil and gas prices, the company is in the middle of a rocky start to the year, falling behind the market and generating a -12.5% year-to-date return. The Oklahoma-based company is currently being sold for a very attractive forward EV/EBITDA of 4.43x, a P/E of 7.12x, and a P/FCF of 8.73x. Given the current market price, it also includes a 1.58% dividend yield. Seeking Alpha Authors remain positive on Devon Energy and have rated it a “Buy” with an average score of 4.00/5.00. Wall Street Analysts share the same view, assigning the company a “Buy” rating with an average score of 3.90/5.00. In the first quarter, shares of DVN were purchased by President and CEO Richard E. Muncrief, EVP Clay Gaspar, and Director John Bethancourt. They bought back $2.42 million worth of Devon shares for an estimated average price of $52.10 per share. It is currently trading at $53.81 per share.

Devon Corporation Q1 ’23 Insider Activity (Quiver Quantitative)

Other notable large-cap stocks with a strong insider buying record for the first quarter that have failed to make it into the shortlist include Intel Corporation (INTC), Align Technology (ALGN), EOG Resources (EOG), Phillips 66 (PSX), Corteva (CTVA), Dollar Tree (DLTR), and Essential Utilities (WTRG).

Final Takeaway

After a quite difficult year, that most investors might like to forget as soon as possible, some sort of general stability in the markets has been somewhat achieved. Sectors like tech communication, and consumer discretionary have opened the year with strong double-digit growth. However, a generally negative economic sentiment still haunts the markets, making the insider purchasing activity for the quarter that much more interesting. If any single takeaway is to be noted, it would be that oil and gas insiders believe higher oil prices are here to stay, at least as far as the mid-term is concerned. Corporate insiders in the listed companies have sent a strong message to the markets, providing us with an interesting list of research-worthy stocks.

Read the full article here