Investment Thesis

The Brink’s Company (NYSE:BCO) just reported its third-quarter results, in which I saw that the company managed to improve its margins and elevate its top-line growth significantly from the historical growth rate, so I wanted to take a look at the company’s financials to see if it is worth investing my capital. Even under conservative GAAP valuations, the company is trading at a discount, therefore I initiate my coverage of BCO with a Buy rating.

Briefly on the Company

BCO is the leading global provider of cash and other valuables management solutions. You can often see them at banks and other financial institutions protecting high-value products. Jewelers hire them to protect the merchandise. Most often I would see the employees working at the ATMs, putting some money in, or doing some troubleshooting. The company also has digital payment solutions, as more and more transactions are done cashless.

Financials

As of Q3 ’23, the company had around $900m in cash and equivalents, against $3.2B in long-term debt. The debt figure is quite high. It’s almost as high as its market cap and that will put off a lot of investors who tend to avoid such companies that over-leverage. I would say they are missing out on some quality companies as long as the debt figure is manageable. So, is the debt anything to be worried about? Well yes and no. Yes, it is manageable if we look at how analysts think of what manageable debt is, which is an interest coverage ratio above 2, and as of Q3 ’23, the company interest coverage ratio was just over 2. This means that EBIT can cover annual interest expense twice over. In my view this is a bit too close to comfort because any bad year could easily erase that ratio, so I always try to look for at least 5x. So, no, in my opinion, it is not ideal. Furthermore, the company’s debt is mostly variable rate debt, which means any further interest rate hikes, which are likely, will be very bad for the company. Especially now that interest rates will stay higher for longer. I will have to assign a higher margin of safety because of this.

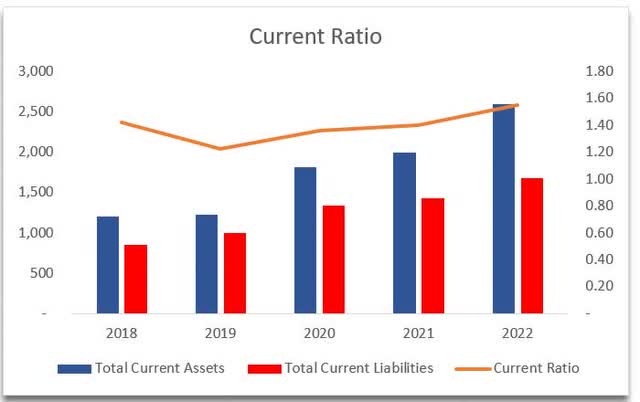

The company’s current ratio has been decent over the years and right at the lower end of what I consider to be an efficient ratio, which is 1.5-2.0. The reason I think this is a good range to be in is because anything over 2 I would consider to be a wasted opportunity for the further growth of the company, as it looks like the management is hoarding capital and not using it efficiently. Anything under 1 is inherently riskier since it looks like the company isn’t able to pay for its short-term obligations and looks like it may have a liquidity issue. So, the company in my opinion is in a good spot and has no liquidity issues.

Current Ratio (Author)

In terms of efficiency and profitability, the company looks to be doing not too well, however, if we look at the competitors, which I found on their 10-K report, we can see that the company excels in ROE, while is in the middle in terms of ROA and ROTC. The Low ROA and ROTC numbers seem to be industry-wide, so I won’t penalize them too much. ROE seems to be much better compared to the competition, which tells me that the management is efficient at allocating shareholder capital much more efficiently than the adversaries and has the potential to grow its profits in the future, thus creating value for shareholders.

Efficiency and profitability vs comps (Seeking Alpha)

In terms of revenues, the company has been growing quite poorly over the last decade, however, in the last three quarters that seems to have changed. Q1 saw 10% growth, Q2 saw 7%, and Q3 saw 8% growth, so something seems to have shifted, which I will cover in the comments on the outlook section.

Historical Revenue Growth (Author)

In terms of the company’s margins (GAAP), these have been relatively stable over the years, which isn’t ideal in my opinion, especially when there is very little top-line growth. I would have liked to see more from the management to improve the company’s efficiency and profitability through cost-cutting initiatives that would improve its earnings, but it looks like nothing has worked or has been done and that’s disappointing. Nine months ended September ’23, the company’s gross margins saw a slight decrease, operating margins stayed relatively the same, while net margins stood 150bps lower compared to the end of FY22. There is still one more quarter and that may change, however, it looks unlikely.

Margins (Author)

Overall, looking at the historical metrics doesn’t say much about how the company might do, especially after looking at how well the company has grown in terms of sales over the last 3 quarters, which has been much better than how it performed in the past. Nevertheless, I will have to take this performance with a grain of salt, since the company did see this type of growth in the past y/y, only to go nowhere the year after, as evidenced by the graph below.

Revenue growth in percentage y/y (Author)

Comments on Outlook

I was pleasantly surprised by the last year of improved growth. The company introduced its three-year strategic plan to improve profit growth and margins by 2024, and it seems like it is going quite well. In the plan, the management said that the company will focus on digital payment solutions, as this is where the future is. A lot of transactions are still done via cash, however, digital payments are becoming more prominent, especially in developed countries, so I like the fact that the company is taking such initiatives and is not falling behind its competition. The improvements in margins are evidenced in the latest quarter transcript, where margins expanded 230bps y/y, while cash generation continued to accelerate and was up 200% y/y, which is amazing. This is exactly what I wanted to see from a company like BCO, that doesn’t have much going for it in terms of top-line growth, and the other way to award shareholders is via making the company much more profitable and efficient.

The strategic plan also included a top-line growth goal of around 7% going forward, which it seems that it has accomplished in the last three quarters as I mentioned above. Does that mean this is going to be the new norm going forward? Only further earnings reports will show us how the strategy is going to perform in the end, but I have faith in the company. Nevertheless, I will approach my valuation analysis with a conservative mindset for an extra margin of safety.

The cash pile that the company is sitting on could be a great way to complement the company’s inorganic growth. The last acquisition the company did was back in October ’22, when the company acquired NoteMachine for around $179m. So, it’s been over a year now and the company has been quiet on the M&A front. I wouldn’t be surprised if the company announces something next year, as the whole of ’23 has been relatively quiet.

As I mentioned earlier, there are more ways to award shareholders than just showing that it can grow its top line. Another way it can do it is through share repurchases. I like this type of initiative only if the company cannot put that capital back into the company and if the share price is considered cheap or fairly valued, which I will look at in the next section. Recently the company announced another $500m share repurchase program, with the CEO Mark Eubanks saying:

“Given our strong recent performance and outlook for the future, Brink’s Board of Directors has authorized a $500 million share repurchase program, double the size of our last two programs. The size of the program aligns with the expected increase in our free cash flow generation as we accelerate progress on our strategic objectives. The authorization allows us to continue to return capital to shareholders as a meaningful part of our capital allocation framework designed to maximize shareholder value creation.”

Overall, I am optimistic about the company’s outlook. It seems that the 3-year strategic plan has been going great and will be a success in the end as witnessed by improved top-line growth and margins.

Valuation

I will approach my valuation analysis with the usual conservative mindset, as that will give me much more margin of safety than praising the company’s potential, even if the potential is real.

For the revenue growth, I went with the analysts’ estimates for the next two years as these seem to be very likely to happen considering the year the company already had in the last 3 quarters. After that, I decided to be conservative, and overall revenue growth ended up being around 2.65% over the next decade. I didn’t go with the average 7% CAGR that the management expects because I would like to have a higher margin of safety. I also made two other cases for a range of possible outcomes. Below are those estimates.

Revenue Assumptions (Author)

In terms of margins and EPS, the company likes to report adjusted metrics instead of GAAP. That way their EPS and margins look much better than they are. I decided to go with GAAP margins to give myself even more margin of safety. Below are my assumptions for margins and EPS. Non-GAAP reconciliation figures can be found here under “The Brink’s Company and subsidiaries Non-GAAP Results Reconciled to GAAP (Unaudited) – continued” title, but there is so much playing around with numbers that I decided to go with GAAP numbers for the model.

Margins and EPS assumptions (Author)

For my DCF model, I went with the company’s WACC of 6.5% as my discount rate and 2.5% terminal growth rate. On top of these estimates, I decided to add another 15% margin of safety for that sleep-well-at-night feeling knowing that I bought a company at a great price. With that said, BCO’s conservative intrinsic value is $99.31 a share, which implies that the company is trading at a pretty heavy discount to its fair value.

Intrinsic Value (Author)

Risks

The competition, although not too fierce, may be able to take away some potential from BCO, especially if the management drops the ball in terms of bad acquisitions that do not synergize well with the company.

Speaking of acquisitions, the company may take on more variable rate debt, which will have a big impact on the company’s profitability since it leaves the company open to interest rate risk. The future of high interest rates is certain as the FED is going to keep them higher for longer. To be honest, I wouldn’t be surprised if interest rates stay high, or at least higher than it was pre-pandemic. The pandemic brought extremely low-interest rates, which was not the norm in the past, so I would expect the rates to stabilize in a strong economy at 2%-3% as the graph below shows.

Historical Interest Rates (Advisor Channel)

The company may not reach its full potential because it is not widely covered by the Street, as it doesn’t look very enticing, and rather looks boring, which is not what investors are looking for, however, if a company can prove itself, investors should flock.

Closing Comments

So, it seems that even under GAAP regulations, the company is trading at a discount to its fair value, which means the risk to the downside for me is minimized because of the conservative estimates I used for my model. The risk/reward profile seems very enticing, especially if the company can grow at its goal going forward, the company should perform well. Furthermore, it looks like the share repurchase program of $500m is a good initiative because the share price is trading at such a discount to its fair value. The management recognizes that also.

I believe the company will perform well over the next 5 years and will certainly reward its shareholders. There are always going to be some obstacles over time, however, if the long thesis is unchanged by the noise, I would take these obstacles as good entry points for accumulation. I will be looking at opening a small position in the next couple of weeks, once I shift some capital around.

Read the full article here