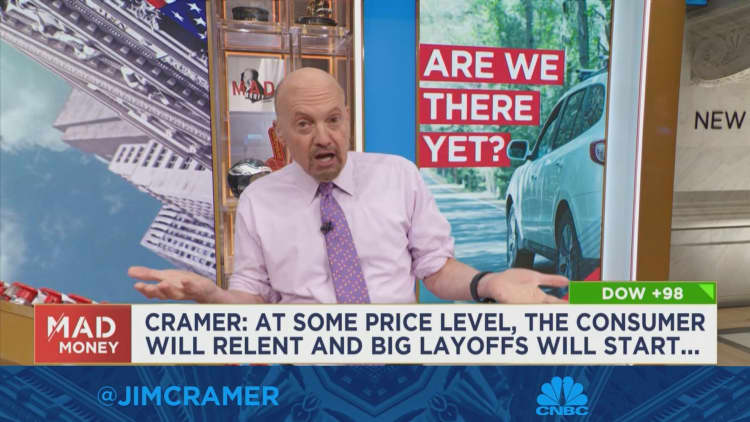

It’s going to be tough for the Federal Reserve to beat inflation without declines in the auto and housing industries, CNBC’s Jim Cramer said on Tuesday.

When the Fed raises interest rates, investors typically expect the housing, auto and retail industries to suffer. But that hasn’t been the case during this economic cycle, partially due to persistent supply chain issues, he said.

related investing news

“You want to break the back of inflation, you need to break the back of the auto and housing industries,” Cramer said. “Unfortunately, the Fed has failed in doing so — and it didn’t even matter that a bunch of banks failed.”

CarMax shares jumped nearly 10% today after beating its fourth-quarter earnings expectations, pushing up Lithia Motors, AutoNation and even Carvana, he said.

“The Fed’s trying to promote pain here to slow the economy and you won’t get true pain unless some businesses go under,” Cramer said. “But that’s just not happening here.”

Cramer said without significant layoffs from more industries, the same cycle will continue, with marginal institutions staying afloat, partially due to strength in the stock market.

If the Fed is going to defeat inflation, it needs to see some marginal businesses go under, he said. And once enough companies collapse, there’s a real chance of slowing things down.

Read the full article here