Co-produced with “Hidden Opportunities.”

How much do we need to sustain a prosperous retirement?

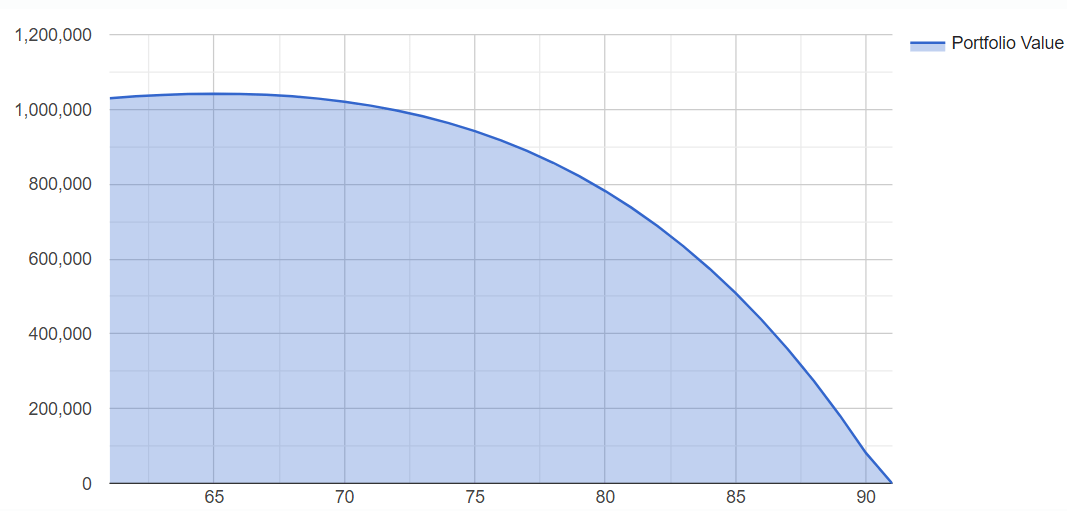

The final multiple calculation says 10-12 times your annual income at retirement age. For instance, If you plan to retire at 60 and your income at the time is $100,000 per year, you should have between $1 and $1.2 million set aside for retirement.

This calculation aims to maintain a quality of life similar to the one you enjoy before retirement. It is essential to also keep in mind the realities like higher healthcare costs, unexpected expenses, and changing conditions of global financial markets.

So you have your $1 million and are set to retire with the 4% withdrawal rule. Assuming a 25/75 equity/fixed-income portfolio, and a 3.5% inflation rate, your savings are projected to exhaust at the age of 90. Source.

fourpercentrule.com

Note: the calculation assumes no inflows from pension and Social Security, and an expected 6% return on equities and 4% on fixed-income.

Seeing the insufficiency, planners now say you need $2 million or $3 million to retire comfortably. While it is easier said than done, I believe the underlying problem doesn’t get solved by accumulating a more significant nest egg.

Traditional retirement planning requires you to work too long, save a massive amount of money, make steady withdrawals, and hope your capital outlives you. This technique is inflexible and doesn’t allow room for unexpected expenses (medical expenses, home repairs, etc.) Most importantly, accumulating a gigantic savings pile takes longer and negatively impacts your early retirement requirement.

It would be best if you had your savings to generate recurring monthly income without your direct intervention. This is also known as passive income and is our answer to tackle this limitation of traditional retirement techniques. You can make your money do all the work to generate more, and support your lifestyle. Real estate is a great way to generate passive income, and we have two great real estate investment trust (“REIT”) picks to get your passive income flowing. Let’s dive in.

Pick #1: EPR – Yield 8.6%

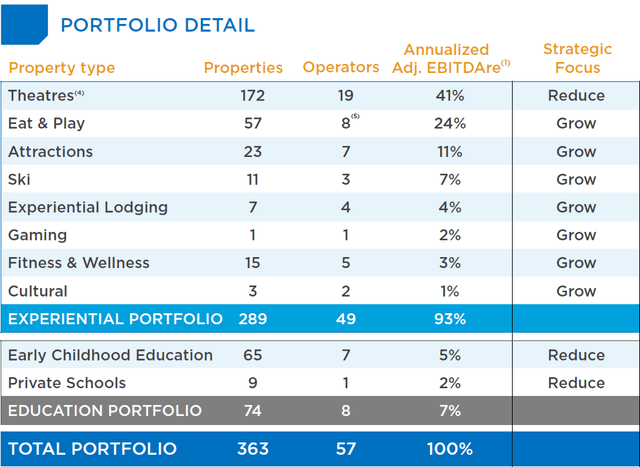

EPR Properties (EPR) is a REIT with a focus on “experiential” real estate. This means that they buy properties where people go to do things – movie theaters, golf experiences, water parks, ski resorts, casinos, museums, destination hotels, and more.

EPR is still dealing with the fallout of COVID. In particular, Cineworld Group plc (OTCPK:CNWGQ), the parent company of one of EPR‘s largest tenants Regal, has filed for bankruptcy. Through Q4, the bankruptcy filing had a negligible impact on EPR. Regal is still paying rent for its locations as the bankruptcy process continues. However, that hasn’t saved EPR’s share price. Investors hear “bankruptcy,” and they get scared.

Yet, for REITs, what matters is whether or not the tenant intends to continue to occupy the property. If you occupy a property, you have to pay rent, Period. Bankruptcy isn’t an exception. You can pay, or you can leave, but you can’t use a property without paying rent. Regal is not liquidating, and it is not going out of business. Most of its properties are continuing to be used. While Regal has rejected several leases and is closing down many theaters, as of Q4 earnings, Regal had not rejected any of EPR’s leases.

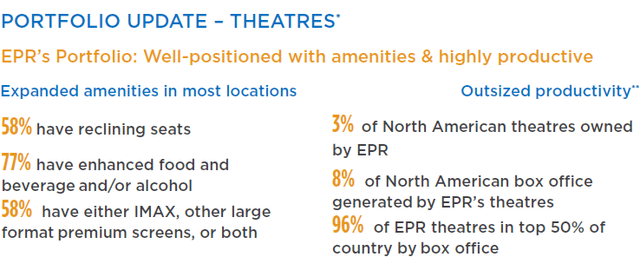

For years, management has been telling investors that EPR owns high-quality theaters. They own approximately 3% of North American theaters, and those theaters generate 8% of total box office receipts. Source.

EPR Q4 2022 Presentation

When a company is deciding which theaters to close, are they going to close the busy ones or the struggling ones? As we see numerous theaters closing in various public REITs, we see the importance of quality. EPR owns more Regal theaters than any other publicly traded REIT. Yet it will likely see fewer locations close than most other REITs (if not all other REITs).

The drama surrounding Regal is likely to be over soon as Cineworld has struck an agreement with lenders that will lead to exiting bankruptcy with substantially less debt. A year ago, Cineworld was a company that was struggling under the weight of significant debt while trying to handle the challenges of a movie business that was altered by the pandemic. After exiting bankruptcy, Cineworld will have much less debt to service, which means less interest and more cash flow available to pay for operations and to pay for things like rent. The bottom line is that Regal will be a much stronger tenant exiting bankruptcy than it was before bankruptcy.

Meanwhile, EPR has been focusing on expanding its horizons beyond theaters. This is a trend that EPR has worked on for over a decade. EPR was 100% theaters when founded and is now down to 41% of adjusted EBITDA from theaters.

EPR Q4 2022 Presentation

While EPR has sold a handful of theaters, they are diversifying primarily through investments in other types of properties. EPR was one of the early landlords of TopGolf, providing the capital for development in exchange for long-term leases on the property. Management’s willingness to consider properties outside the norm for REITs has been a strength throughout EPR’s existence.

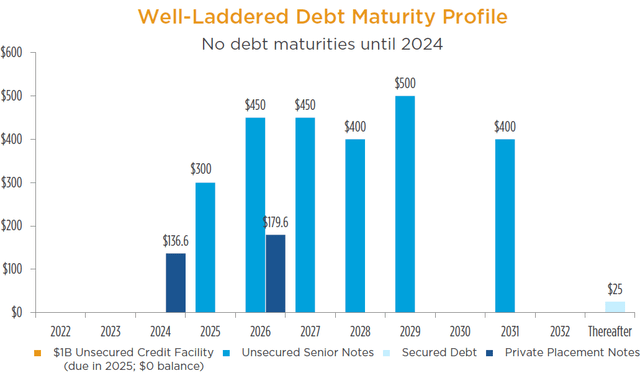

EPR is in a very comfortable liquidity position, with a $1 billion revolver that had $0 drawn at the end of last year, an investment-grade balance sheet, and no debt maturing until 2024.

EPR Q4 2022 Presentation

This will help EPR avoid needing to refinance debt while interest rates are high.

When Cinemark exits bankruptcy, which is expected within the next 3 months, we can expect management to come out with guidance for 2023. Getting rid of that overhang should be a significant positive to the share price. It is also when we can expect EPR to consider raising the dividend. The current AFFO payout ratio for the dividend is only 65%, so if the impact of Regal remains minimal, there is plenty of room for EPR to raise the dividend.

EPR management has shown an ability to navigate tenant issues with skill. During COVID, EPR’s tenants were hit harder than perhaps any other type of business. After all, the one thing EPR’s tenants have in common is that they are places where people congregate, the places people were told to avoid during COVID. Yet despite being at ground zero of the COVID pandemic, EPR managed to get through without taking on additional debt and without issuing equity. Management prudently managed the balance sheet and worked out rent deferral deals with tenants that are being paid back.

EPR has lagged the recovery as Cinemark filed for bankruptcy, and that issue should be resolved within a matter of months. Meanwhile, EPR has kept pushing forward with its investment plans and rewarding shareholders with a monthly dividend.

Pick #2: RTL Preferred Shares – Yields 9%

Economic experts expect consumers to cut discretionary expenses in this inflationary economy with increasing layoffs, monetary tightening, and a highly anticipated recession. But recent consumer spending data shows that spending in discretionary categories like restaurants, travel, leisure, and experiences continued to show healthy YoY growth. Non-discretionary “every day” goods and services typically experience inelastic demand through economic cycles and provide safe shelter amidst market uncertainty.

The Necessity Retail REIT, Inc. (RTL) is a net-lease REIT that maintains a portfolio of properties leased out to brands Americans visit and shop at daily. RTL holds stable, long-term single-tenant net-leased assets, which offer adequate resistance to economic cycles. Source.

necessityretail.com

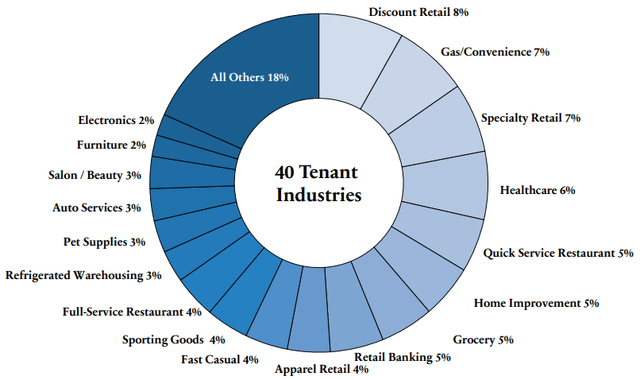

The company’s portfolio is adequately diversified across regularly utilized goods and services providers, limiting its exposure to headwinds faced by any individual sector. Source.

RTL – February 2023 Investor Presentation

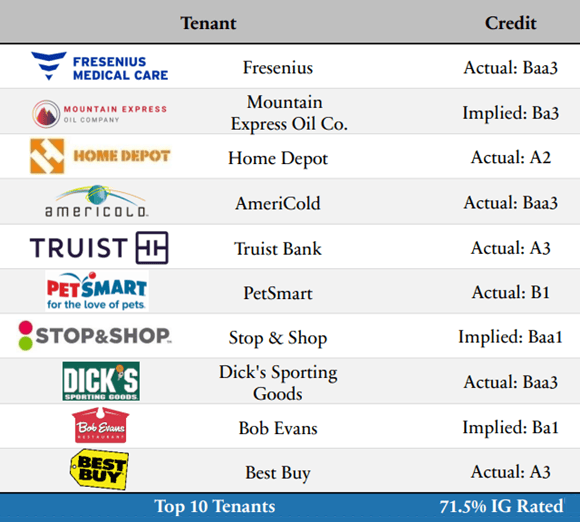

RTL manages 1,044 properties in 28 states, and 54% of the Straight Line Rent (“SLR”) is drawn from necessity-based tenants. RTL ended FY 2022 with 93.7% occupancy with a 7.2% weighted average remaining lease term. 71.5% of RTL’s top 10 tenants are investment-grade rated. Source.

RTL – February 2023 Investor Presentation

REIT valuations are negatively impacted in this rising rate environment, but RTL is pursuing this opportunistically. During FY 2022, RTL acquired 95 properties for $1.4 billion at an 8.6% weighted average cap rate and five years of Remaining Lease term.

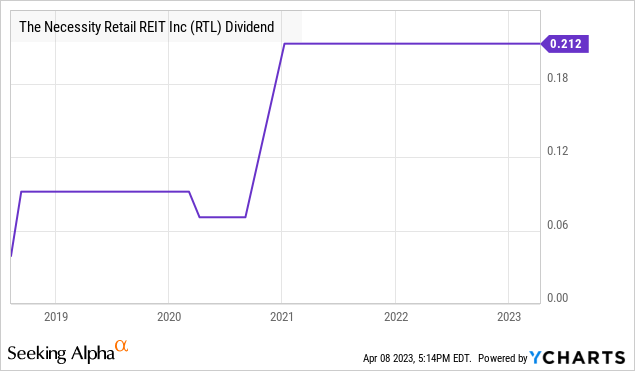

During FY 2022, RTL has spent ~$24 million on preferred dividends, $119 million on interest expenses and reported an AFFO of $140 million. This AFFO covers the $112 million spent on common stock dividends during the fiscal year. The company’s history of steady common dividend payments over the years provides additional protection to investors of its cumulative preferreds.

RTL ended FY 2022 with $88.7 million in cash and cash equivalents and maintains 2.5x coverage on interest expenses. The company has a weighted average interest rate of 4.4%, and 84% of its debt is at fixed interest rates.

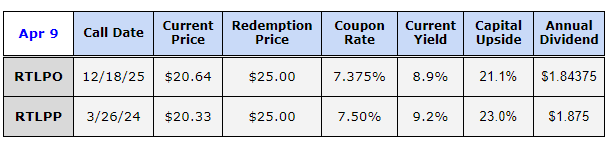

RTLPO (RTLPO) and RTLPP (RTLPP) are two outstanding preferred securities from RTL, and at this time, RTLPO offers better prospects for current income and capital gains to par value.

Author’s Calculation

Being the landlord of necessary “every day” businesses ensures operational stability and sustained profitability through recession pressures. RTLPO presents an attractive income opportunity from “The Necessity Retail REIT – Where America Shops” and lets you lock in a ~9% dividend and up to ~23% upside.

Conclusion

Everyone has different needs, wants, and goals for retirement, so there isn’t a one-size-fits-all plan that will work in any scenario. Indeed, a financial planner can’t tell you how much you must save to ensure a stress-free retirement. Nevertheless, everyone tries to come up with a seven-figure number for you to work towards, which has been on a notable rise in recent years.

It is possible to retire with a $1 million nest egg in 2023. At High Dividend Opportunities, we are proponents of passive income generation through dividends. We maintain a comprehensive portfolio of 45+ equities carrying an average yield of +9%. Keeping aside a portion for emergency expenses and other miscellaneous requirements, and investing 80% of these savings ($800,000) in such a portfolio, you can generate ~$80,000 yearly and potentially reinvest a good portion of this income to ensure portfolio and income growth over time.

Retirement doesn’t have to be complicated, nor does your plan have to be set in stone. The sooner you generate passive dollars, the more ready you get to hang up the boots and lead the post-retirement life you dreamed of. Two picks with up to 9% yields to get you started. By saving your dividend income and re-investing it, you have the possibility to multiply your future income and even more!

Read the full article here