Valid Soluções (OTCPK:VSSPY) is a Brazilian multinational company with a rich history spanning over 60 years. The company operates in diverse sectors, including payment, telecommunications, identification systems, digital marketing, and digital certification, providing services to public and private entities.

Despite being a small-cap company with limited coverage compared to larger counterparts, Valid’s shares on the Ibovespa, Brazil’s stock exchange, have experienced a remarkable surge of 145% this year, making it more than a double bagger and reflecting a substantial increase in value.

In contrast to the broader Brazilian stock market, as represented by the iShares MSCI Brazil ETF (EWZ) and other Brazilian Small Caps tracked by the iShares MSCI Brazil Small-Caps ETF (EWZS), Valid has outperformed significantly.

TradingView

For investors outside Brazil, Valid’s shares are accessible through its ADR, issued with Level 1 status. This designation indicates Valid’s choice to access U.S. financial markets through a basic ADR program featuring lower reporting and accounting standards than higher ADR levels. As Level 1 ADRs, Valid’s shares trade on Pink Sheets, providing limited information compared to major U.S. stock exchanges.

In recent years, Valid has undergone a capital structure transformation, divesting assets that previously burdened its balance sheet and significantly deleveraging to become a dividend-paying company today.

While the company is expected to continue reporting robust net profits due to favorable margins in its segments, challenges lie in expanding revenue, particularly given market pressures in Argentina and sustaining high margins in the mobile segment.

Despite the substantial rise in Valid’s shares this year, my analysis indicates that the company’s ADR price trades at an exceptionally discounted valuation. Although no specific triggers in Valid’s fundamentals point to higher valuations in the short or medium term, the deeply discounted valuation forms the core of the bullish thesis. The focus is on a long-term perspective, with the potential for Valid to emerge as a strong income stock, offering attractive dividends in the coming years by maintaining robust profitability.

Valid’s Business Model

Over the 17 years since Valid became a publicly traded company in Brazil, the organization has strategically focused on three primary business verticals.

Valid’s IR

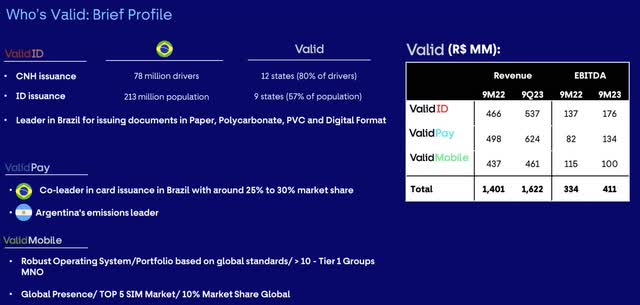

Valid ID: The first vertical, ID, is responsible for issuing most civil documentation in Brazil. This includes driver’s licenses and identity cards for São Paulo and nine additional Brazilian states. The solutions provided by this segment extend to the generation of computerized systems for database administration, biometric data collection, printing and customization of official identification documents, and solutions tailored for smart cities and traceable stamps.

Valid boasts an impressive market share, holding 80% of the CNH market and 60% of Brazil’s entire identity card market. The issuance of these documents typically involves state bidding processes, resulting in approximately 4-year contracts with various state agencies. This revenue stream, characterized by its recurring nature, contributes significantly, accounting for 30% of Valid’s total revenue and 40% of EBITDA.

ValidPay: The payments vertical is crucial in issuing nearly 30% of all bank cards in Brazil, encompassing chip cards and variable data cards. Its manufacturing facility also has a substantial presence in the Argentine market, exposing the company to the country’s economy.

ValidMobile: Finally, the Mobile vertical represents Valid’s only global business. This segment sells approximately 10% of the world’s telephone chips. The company achieved global scale in 2015 through the acquisition of Fundamenture. In this way, Valid continues its trajectory of adaptation and innovation across various sectors, solidifying its presence and making substantial contributions on the global stage.

Valid’s Financial Overview

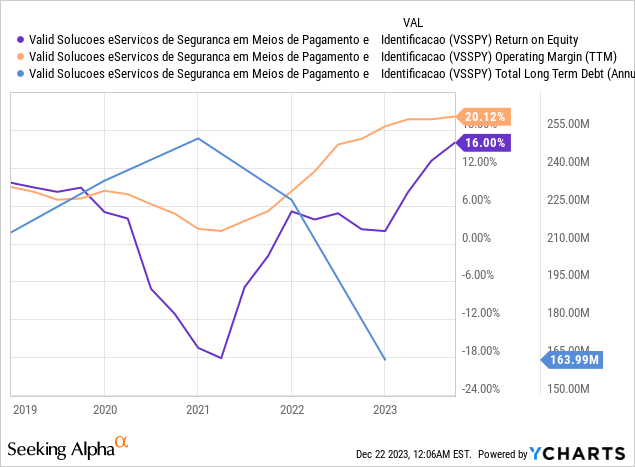

Valid has undergone significant operational and financial restructuring in recent years, substantially enhancing its EBITDA margin and overall profitability.

The company initiated a comprehensive restructuring effort, consolidating its manufacturing plants in Brazil and undertaking a dematerialization process while cleaning up its balance sheet of international assets in the U.S. in mid-2022. While causing a reduction in the top-line revenue, this strategic move simultaneously led to an increase in EBITDA and cash generation, positively impacting the company’s capital structure.

Valid’s leverage decreased from 3.2x net debt/EBITDA at the end of 2020 to an impressive 0.2x in the past quarter. Consequently, the improvements in EBITDA have translated directly into net profit over the past few years.

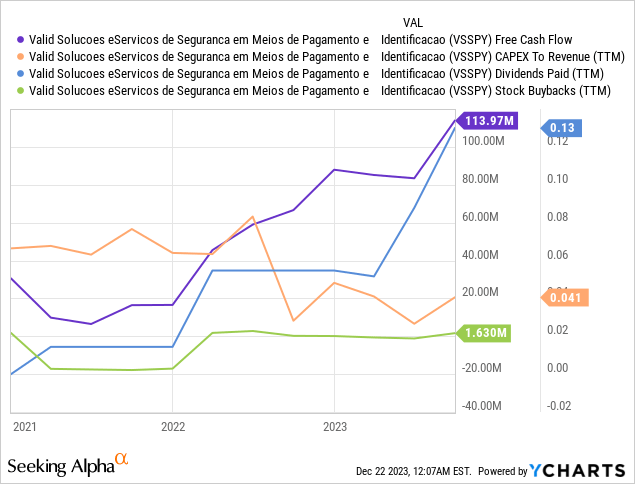

With R$434.6 million in cash and R$736.4 million in total debt, Valid has adopted a meticulous approach to capital allocation. The company consistently reduces debt and renews credit lines during Brazil’s high-interest rates and short durations. The management favors maintaining a dividend policy due to the company’s profitability.

Over the last two years, Valid has demonstrated its commitment to shareholder value by paying approximately R$20 million in JCP (interest on shareholder equity) in 2021/2022 and a more substantial amount of R$26 million in 2023. This increase in JCP payments reflects the company’s efficiency initiatives, resulting in higher profits.

The company is also focused on the CapEx and M&A binomial, exploring initiatives that contribute to optimizing its future. Valid made significant acquisitions in 2022, including Vsoft and Flex Dog, both biometric engine companies in Brazil. These strategic moves align with Valid’s commitment to meeting the market’s evolving needs, particularly in the mobile sector and subscription management platforms.

In 2021, Valid executed a capital increase that injected R$131.3 million into the company’s coffers. In 2023, Valid recently completed a share buyback program, repurchasing approximately 1 million shares. The company’s management has communicated that the buyback program has reached its limit. Subsequently, the allocation of capital returns to Valid will be at the shareholders’ discretion through JCP and dividends.

Concerning Valid’s dividend policy, while there is no fixed distribution guidance, the company distributed approximately R$0.14 per share in 2023, resulting in an average yield of 4% for the year. Over the last ten years, the company has maintained an average dividend yield of 3.6%.

Seeking Alpha

Valid’s Latest Results

Valid has undergone a significant turnaround this year, marked by a robust improvement in results. This transformation was propelled by a comprehensive restructuring, encompassing the divestment of unprofitable assets, expense reduction, and financial deleveraging. Consequently, operating margins have reached historically high levels, potentially leaving limited room for further substantial increases. Any future progress is anticipated to hinge on volume growth or price adjustments.

The Identification (“ID”) unit stands out as Valid’s primary source of operating profit. However, there may be challenges as document issuance normalizes post-pandemic in the upcoming quarters. Despite holding a significant market share in this segment, winning additional large contracts may become less likely.

In ValidPay, the Argentine operation has proven to be a standout performer, contributing to increased EBITDA, improved margins, and higher revenue. Nonetheless, uncertainty looms over the future of this unit following the presidential elections and subsequent economic changes.

The Mobile unit is displaying declining prices and margins due to the normalization of chip supply in the market. This quarter’s data from the Mobile vertical reinforces the view that the company might face challenges maintaining historically high margins.

Valid’s IR

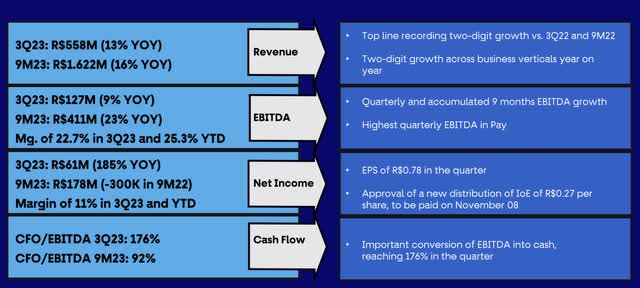

Despite a solid annual performance, Valid is beginning to struggle to achieve sequential progress. In 3Q23, EBITDA experienced a 6.2% quarter-over-quarter decrease (with a year-over-year increase of 9%, excluding the sale of the US unit), reaching R$126.5 million. The EBITDA margin contracted by 2.6 percentage points quarter-over-quarter, settling at 22.7%. However, annually, the margin expanded by 2.5 percentage points year-over-year.

Net revenue reached R$558 million, reflecting a 4.5% quarter-over-quarter increase and a substantial 12.5% year-over-year growth (excluding discontinued operations in the US). This positive performance was primarily driven by the Pay and ID lines, effectively offsetting the significant reduction in the Mobile segment.

Profit reached a record R$60.7 million, showcasing growth of 5.5% quarter-over-quarter and a remarkable 175% year-over-year, surpassing expectations by 7.5%. The company continues to demonstrate a sequential increase in net profit, affirming the success of its turnaround strategy.

Risks and Opportunities to the Investment Thesis

There are inherent risks in Valid’s business, notably cybersecurity control issues that could potentially undermine client confidence in the company’s services.

Examining the capital structure, Valid serves clients across various sectors, including government, banks, and telecommunications, operating in diverse locations. Notably, a sizable chunk of ValidPay revenue is derived from the Argentine peso, introducing natural hedges and associated risks.

Valid’s ADR may encounter distinct challenges as a small-cap company with limited coverage and market liquidity despite its impressive performance relative to the Ibovespa and its notable success within the Brazilian small-cap sector.

Despite these risks, there are growth opportunities for Valid. The company aims to capitalize on the digital transformation wave by assisting governments in enhancing citizens’ journeys. In the realm of identification (ID), many private companies have ventured into onboarding, authentication, and Know Your Customer (KYC) services, proving lucrative. However, governments have lagged in this domain.

Developed countries have successfully transformed citizens’ journeys to achieve higher Net Promoter Scores (NPS) through municipal, state, and federal digital channels, offering more efficient access to services. Brazil should follow in the same way.

Also, Valid is a corporation without a controlling shareholder, giving its managers greater ownership and autonomy. This structure can be advantageous, fostering a proactive and entrepreneurial approach within the company.

Valuation: Super Cheap

Valid trades at attractive valuation multiples, with a 5.1x P/E for the 2024 estimate and a 3.1x EV/EBITDA adjusted for 2024. The present P/E, standing at 8.5x, is notably 54% below its historical average over the past decade.

Despite the substantial appreciation of its shares on the Ibovespa (VLID3), surging by more than 145% this year amid a bullish trend in Brazilian equities, the company appears to maintain a promising outlook for reporting attractive net income.

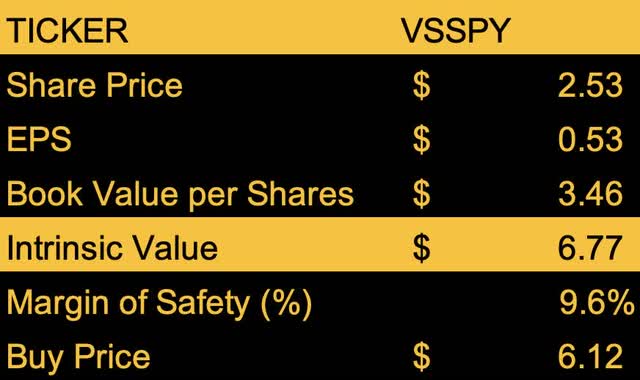

According to the Graham valuation model, Valid’s ADRs, currently trading at $2.53, are positioned below their intrinsic value of $6.77. This assessment considers their EPS of $0.53 and their book value per share of $3.46.

Table created by the author

In calculating the margin of safety, I factored in the Brazil equity premium risk of 9.6%. This premium represents the extra compensation investors demand to invest in equities rather than risk-free assets like government bonds. Despite considering this margin of safety, the target share price for Valid’s ADR would still be 141% below the current value—roughly equivalent to the increase in Valid’s Ibovespa shares throughout 2023.

The Bottom Line

Valid Soluções is a company that has reaped the benefits of transforming its capital structure throughout 2023, resulting in favorable profits. Despite the strong performance of Brazilian equities this year, Valid shares have experienced a significant rally on the Brazilian stock exchange. They maintain a highly attractive valuation, reflecting their robust financial health.

While Valid trades outside Brazil with its ADR on pink sheets, presenting challenges such as limited liquidity and information, this aspect also poses a potential risk to the investment thesis. On the flip side, given the limited market coverage, it could be viewed as a hidden value for Valid in the long term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here