Outline:

Vermilion Energy Inc. (NYSE:VET) had a rollercoaster share price performance in the past years. First, they paid out high dividends over the years, but then they had to cut it as debt mounted. COVID-19 hit the company in the same way as it did to others – share prices crashed – then, share prices recovered driven by recovery of demand and an explosion of energy prices when the Ukraine war let TTF skyrocket.

But where did the money go? At times, VET guided magnificent FFO and FCF implying high FCF yields and the potential for shareholders to get rewarded. Especially those (like me) who held the shares through the previously mentioned crises. For 18 months, we hear about debt reduction… for 18 months shareholders hear about revised debt targets… for 18 months VET pays meager dividends and share repurchases, do not reduce the share count by the shares bought back. For 18 months, shareholders wait for their reward and do not get it.

Over the past three years, VET has returned 2.3% to shareholders out of the cash generated from operations. Those returned via share buybacks had a limited impact as explained below. However, VET was not shy to guide for dividend payouts and share buybacks and pointed to the past as having returned about CAD40 per share in dividends. Those times are long over.

Cash Generated:

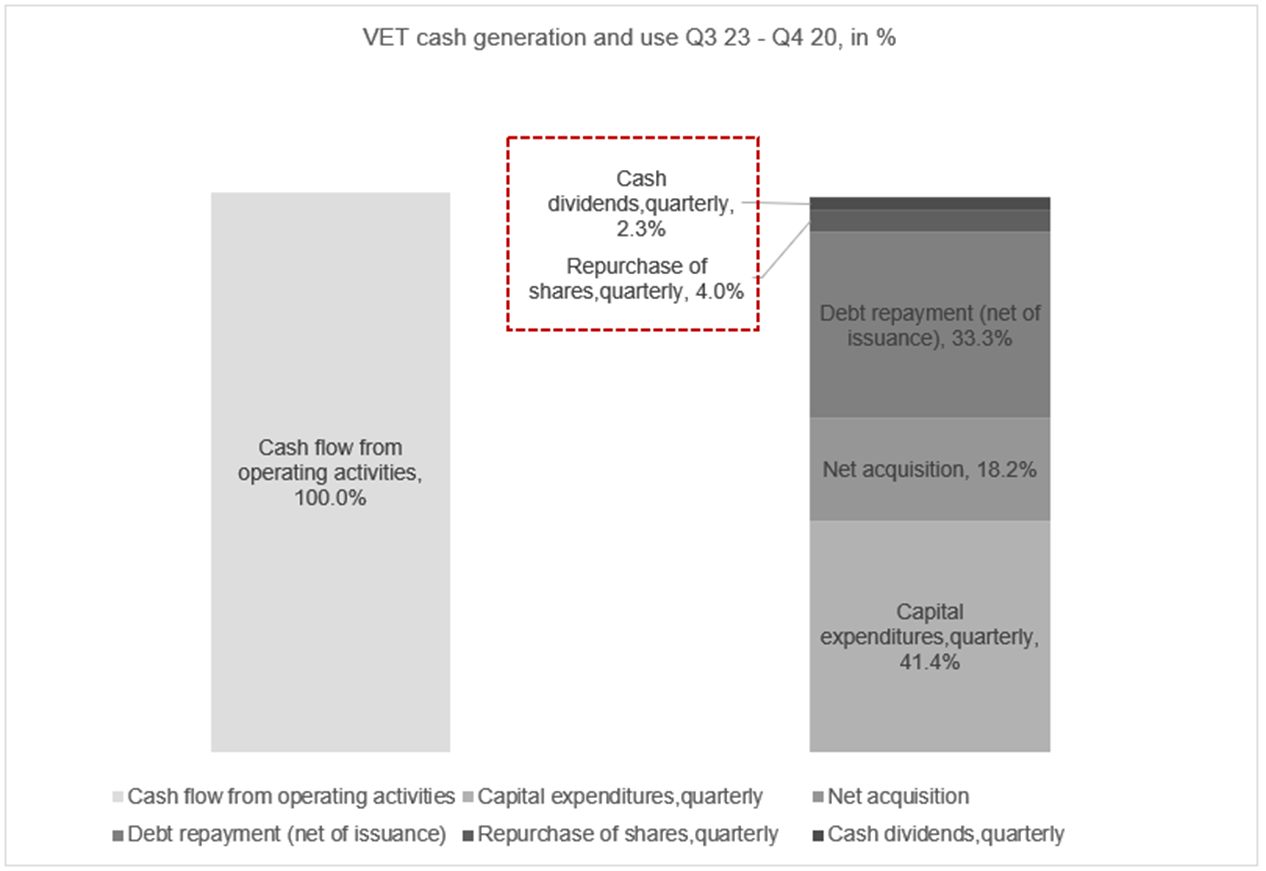

Since Q4 2020, VET generated CAD3.46bn in cash from operations. The cash then was spent on various items:

The majority of cash generated between Q4 ’20 and Q3 ’23 of CAD3.4bn was allocated to capex (41%), debt reduction (33%), and net acquisition (18%). A meager 6.3% was returned to shareholders via cash dividends (2.3%) and repurchase of shares (4%).

VET & own calculations

Debt:

Let’s have a look at debt – debt levels targeted were already achieved, but capital allocation was not revised. For example, with the Corrib release at the end of November 2021, VET guided for a net debt/FFO target of 1.5x to be achieved in FY ’22.

29/11/21 – Corrib acquisition:

(Original to be found here).

“As we approach and achieve further debt and leverage targets, it is our intention to augment our return of capital to shareholders through one or a combination of base dividend increases, special dividends, and/or share buybacks. Our next leverage target is 1.5 times net debt to trailing FFO at mid-cycle pricing which implies an absolute net debt level of approximately $1.2 billion. We expect our return of capital framework to be a staged approach that will increase over time as further debt targets are achieved while retaining the flexibility to adjust when necessary. Throughout the past 18 months, we have significantly increased FCF per share, and we expect the Corrib acquisition to further enhance FCF per share in the future.”

Already in Q1 ’22, the net debt/FFO stood at 1.2x and ended the year at 0.8x. However, the capital allocation was slow to adjust while leverage targets were achieved. Then on 01/11/23, another new debt target of CAD1bn was set to be achieved in Q1 ’24. With the 2024 budget, VET then increased the quarterly dividend to CAD0.12 per share. This implies an annual yield of around 3% (CAD0.12 quarterly @share price of CAD15.86).

VET & own calculations

While debt repayment was certainly reasonable as VET overlevered in the past years by paying excessive dividends, it seems as if capital allocation swung to the other extreme returning hardly any cash generated to shareholders (2.3% of operating cash flow returned to shareholders in the form of cash dividends).

Capex:

Capex should have the effect of at least increasing the production of VET or maintaining output levels. However, production in fact fell from 87.8k boe/d in Q4 ’20 to just 82.7k in Q3 ’23. Not even the acquisitions changed VET’s output, even though an additional 18% of the total cash generated was allocated towards it.

VET & own calculations

Share Buybacks:

Given an emphasis on share buybacks over dividends and returning cash to shareholders, the share count should have been reduced. However, since the cash bonanza began in Q4 2020, shares have actually increased by 2.5m.

VET & own calculations

Looking at the time period when share buybacks started in Q3 22, shares have declined by less than the amount bought back. VET spent cash in the amount of ~CAD137 million and since July 2022 VET notes to have bought back and retired ~7.2m shares. Over the period, shares only declined by 1.6m. Part of the cause for the share count not being reduced is the usage of the shares as M&A currency. However, the acquired companies do not change production levels – as described earlier. This is just disappointing to shareholders that held on to shares during the COVID-19 pandemic and were not paid when energy prices skyrocketed.

Conclusion:

I sold my shares after finalising my analysis and I believe VET’s resources to pump oil are limited. If I had to make a guess, I would assume shareholders cannot expect a proper return of capital despite a changed dividend policy (a yield of ~3% is not enough given low debt levels and high cash generation – 3% yield: dividend per share payment of CAD0.12 quarterly @share price of CAD15.86). I am also not confident in the future production of VET. It seems they are having a hard time keeping output at levels of the past despite increased capital expenditures.

The valuation of ~26% FCF guidance for FY ’24e (CAD700 million FY ’24e with original press release to be found here) does not matter anymore. In my view, shareholders will not participate in any bonanza of big FCF generation. The payout of dividends is meager at its best. The capital return in the form of share buybacks does not change any share count and obviously, any investment in development in order to increase production does not yield any additional barrels being pumped out of the soil. The past investments in production kept production flat at best.

Surely, VET could further increase the dividend payment in the future and shares could re-rate. However, in my view, the assets do require high amounts of capex to keep up production levels and the cushion for VET to pay attractive levels of dividends is limited. VET might be something for other investors and they might have more luck. I, however, waited long enough and will turn to other opportunities.

Thanks for reading!

Read the full article here