Vornado Realty Trust’s (NYSE:VNO) Series O Preferreds (NYSE:VNO.PR.O) are my single largest preferred position, forming 22% of my fixed-income securities portfolio. VNO’s balance sheet, the preferreds deep discount to par value, and pending Fed rate cuts formed the basis of this investment decision. The preferreds are trading for $14 per share, a substantial 44% discount to their $25 per share liquidation value with a $1.1125 per share annual coupon driving a healthy 8% yield on cost. Hence, my purchase comes with significant capital upside on a gradual return to liquidation value on the back of Fed rate cuts.

Seeking Alpha

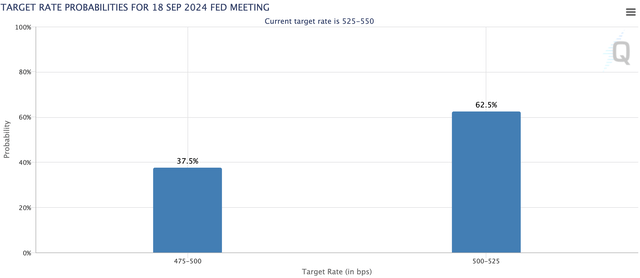

The CME FedWatch Tool has placed the probability of a rate cut at the upcoming September 18 FOMC meeting at 100% with a not insignificant 38% chance that the Fed will opt for a larger 50 basis point cut to its range. With inflation still above the Fed’s target, we will likely get the smaller 25 basis point cut, the first since the onset of the pandemic and in over two and a half years since the Fed embarked on its fight against inflation. A dip in the Fed funds rate should kickstart the positive duration feature of fixed income, where prices increase when interest rates fall on the back of a reduction in the discount rate on the present value of future cash flows. This healthy macro backdrop for the preferreds performance is significantly more certain than when I last covered VNO.

CME FedWatch Tool

Debt Maturities, Lease Expirations, And Leasing

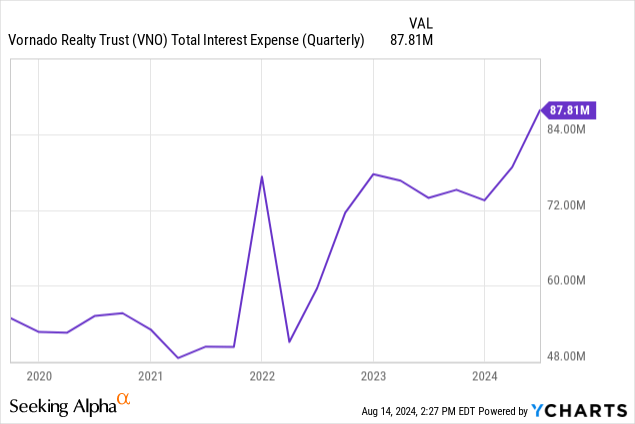

VNO’s balance sheet depth and the best-in-class nature of its property portfolio were on display during the second quarter. The REIT generated FFO of $0.57 per share, beating consensus and up 2 cents sequentially from its first quarter. However, it dipped from $0.72 per share a year ago due to a ramp in its cost of capital. Second quarter interest expense was $88 million, the highest level in five years and up $14 million from VNO’s year-ago comp. Getting this back down will be heavily contingent on the pace and extent of pending Fed rate cuts.

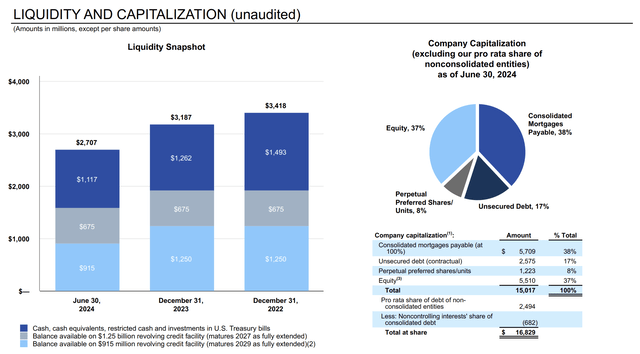

However, VNO’s balance sheet remains extremely strong with cash, cash equivalents, restricted cash, and investments in U.S. Treasury bills of $1.12 billion as of the end of the second quarter. Broader liquidity was healthy at $2.7 billion with the inclusion of $1.6 billion undrawn under the REIT’s revolving credit facilities. All four of VNO’s publicly traded preferreds are perpetual, with the Series O issued on 9/13/2021.

Vornado Realty Trust Fiscal 2024 Second Quarter Fixed Income Supplemental

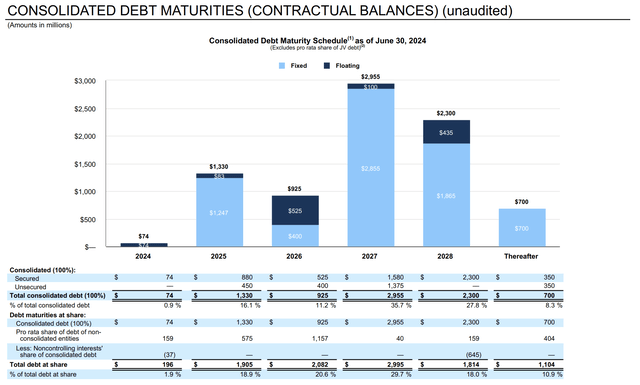

The core risk for most REITs in an environment where the Fed funds rate is currently at 23-year highs comes from upcoming debt maturities and lease expirations. VNO has addressed the bulk of its 2024 maturities with just $74 million left this year. 2025 will see a material $1.33 billion come due for repayment, around 16.1% of total consolidated debt. Addressing the 2025 maturities could be done in the shadow of rate cuts with VNO’s management proving adept at securing debt extensions and with revolvers that provide more than enough depth to fully address the amounts coming due.

Vornado Realty Trust Fiscal 2024 Second Quarter Fixed Income Supplemental

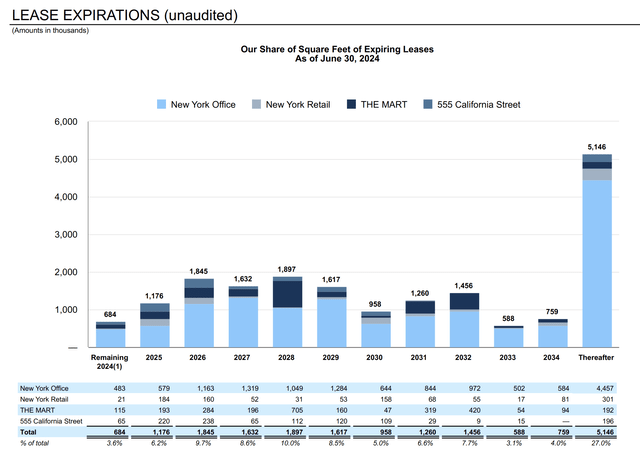

VNO’s lease expirations are well staggered with 3.6% of its total leases set to expire in the second half of 2024. 6.2% of total leases expire next year but the majority of leases are not set to expire until the next decade. VNO generated second-quarter revenue of $450.27 million, down 4.7% over its year-ago comp but beating consensus by $13.4 million. Occupancy across the REIT’s portfolio was 88.3%, up 10 basis points sequentially from 88.2% in the prior quarter.

Vornado Realty Trust Fiscal 2024 Second Quarter Fixed Income Supplemental

With the REIT’s debt maturities extremely manageable and its lease maturities well staggered, the sequential occupancy gain forms a bright spot as office properties continue to struggle to find a footing in the post-pandemic work-from-home zeitgeist. VNO has leased a total of 1.6 million square feet through the first half of 2024 at an average rent of $130 per square foot, excluding the Bloomberg lease would place leasing volume at 666,000 square feet with starting rent of $95 per square foot and a 9.1% cash mark-to-market. Critically, the REIT has a significant level of borrowing, including its floating rate revolvers that should see the preferreds perform well in direct response to rate cuts through the next year in the event consumer inflation continues to fall. There is a risk that inflation shoots up again and the September rate cut comes to form the sole reduction for a while after. I think the preferreds are in a strong position to perform strongly over the next few years.

Read the full article here