Introduction

On August 30, I wrote an article titled “Dividend Kings Are Overrated.” In that article, I explained that although dividend consistency is a great thing, dividend stocks should never be selected based on Dividend Aristocrat or Dividend King status.

That said, there are plenty of good Dividend Aristocrats on the market who are still capable of elevated growth. One of them is Air Products & Chemicals (NYSE:APD).

I was “lucky” to call the bottom on February 6, when I gave the stock a Strong Buy rating after a rather unpleasant sell-off. Since then, shares have returned nearly 30%, more than twice the 14% return of the S&P 500.

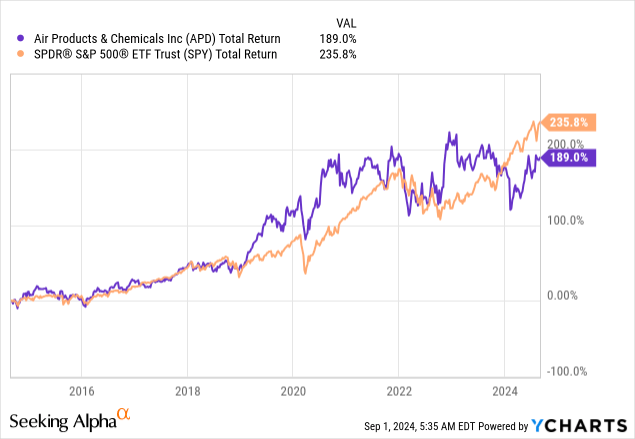

My most recent article on this company was published on May 1, when I called it “The Perfect Combo Of 3% Income, Growth, Great Valuation.” Since then, it has returned 20%. Over the past 10 years, APD shares have lagged the S&P 500, mainly due to post-pandemic issues.

Hence, in light of recent successes, it seems the company is back on track.

As we will discuss in this article, Air Products & Chemicals is doing fine. Despite challenges, the company is growing its EBITDA, upbeat about its EPS outlook, rewarding shareholders with consistent dividend growth, and benefitting from new partnerships.

So, let’s keep this intro short and get right to it!

The Return Of Growth

With more than 40 consecutive annual dividend hikes, Air Products & Chemicals is a Dividend Aristocrat. However, it is more than that. The $62 billion market cap company is the biggest hydrogen supplier in the world, an owner/operator of more than 750 production facilities in roughly 50 nations, and a company that serves more than 30 industries, making it a mission-critical company in the global chemical supply chain.

Right now, however, the global chemical industry is suffering a bit from weak global growth. Although certain cyclical areas are doing well, thanks to new growth drivers like automation, artificial intelligence, and economic re-shoring in North America, indicators like the ISM Manufacturing Index hint at very weak demand in cyclical industries.

As we can see below, the moment the ISM Manufacturing Index peaked, the APD stock price lost momentum.

The good news is that APD’s financials are increasingly good.

Last month, the company released the third-quarter results of its 2024 fiscal year. These numbers were quite upbeat, as the company saw a 5% higher EBITDA to $1.3 billion, driven by higher margins and a favorable business mix, meaning pricing offset some weakness in volumes (see below).

As a result, adjusted earnings per share rose to $3.29. This translates to a 7% year-over-year increase.

Air Products & Chemicals

If we take a closer look at its regional performance, in the Americas, EBITDA increased by 6%, supported by a 400 basis points increase in EBITDA margins. This was supported by both pricing and stable volumes.

Europe saw a 12% increase in EBITDA and a 500 basis points increase in margins. This was mainly due to new assets in Uzbekistan and declining power costs.

Both Asia and the Middle East/India struggled with weak volumes, pricing headwinds, and planned maintenance.

Air Products & Chemicals

So far, so good.

What matters is that the company is seeing success in growth projects and profitability. This bodes well for shareholders.

APD Shareholders Have A Bright Future

In its earnings call, the company announced an agreement with TotalEnergies (TTE). Starting in 2030, Air Products will supply 70 thousand tons of green hydrogen per year.

This deal both supports the company’s long-term growth strategy and shows how high demand is for green hydrogen – especially in markets like Europe.

The company also sold its LNG Process Technology and Equipment business to Honeywell (HON). The deal was worth $1.8 billion and allowed APD to focus on its core business, which includes a collaboration with Mercedes-Benz to develop fuel cell trucks and build a network of commercial hydrogen fueling stations.

Air Products & Chemicals

On top of that, the company continues to prove its operating excellence, as it has an EBITDA margin of 42%, the highest in its industry.

Even better is the fact that margins are just 30 basis points shy of their 2020 all-time high, which has brought back a lot of confidence after the company struggled to maintain its margins in 2021 and 2022.

Air Products & Chemicals

Going forward, the company continues to rely on its “two-pillar” strategy.

This strategy is what sets it apart from smaller startups in the chemical space with much more operational risks, as its two pillars are based on expanding its core industrial gases business (the first pillar) while leading in the delivery of low-carbon hydrogen on an increasingly large scale (the second pillar).

Essentially, the dual focus supports its financial growth and also makes it a leader in emerging technologies without elevated financial risks, as it has a huge core business to finance growth. Startups relying on external funding do not have that benefit.

Air Products & Chemicals

In light of investments, the company has a return on capital employed (“ROCE”) of 11%. Excluding cash, that number is 12%.

On top of that, it enjoys an A-rated balance sheet with a net leverage ratio of less than 3x EBITDA.

On a full-year basis, the company expects EPS in the range of $12.20 to $12.50. This implies 6% to 9% growth and would extend the company’s growth streak, which has an 11% CAGR since 2014(!).

Air Products & Chemicals

This is fantastic news for shareholders.

- APD has hiked its dividend for 41 consecutive years. This obviously includes the Great Financial Crisis, the 2015/2016 global manufacturing crisis, the pandemic, and the challenging post-pandemic years.

- Despite its age and long history of dividend growth, the dividend has grown by 9% per year since 2014.

- Currently, APD yields 2.5% with a 58% payout ratio.

Air Products & Chemicals

The valuation isn’t bad, either.

Valuation

Despite its recent rally, APD shares are nowhere near their highs, which makes sense, as the operating environment is still challenging.

However, it also bodes well for the valuation, as the company is one of the few stocks on the market not trading a mile above its average multiple.

Using the data in the chart below, APD trades at a blended P/E ratio of 22.7x, which is slightly below its 10-year average of 22.9x.

FAST Graphs

Using the FactSet data in the chart above, analysts expect 7% EPS growth in 2024 to be followed by 9% growth in both 2025 and 2026, respectively.

This implies a fair stock price of $336, 20% above its current price.

Although it will likely require a bottom in leading indicators like the ISM Index to allow for a sustainable rally, I believe APD remains in a great spot to return >10% per year going forward, making it a great stock for a wide range of dividend investors.

Takeaway

Air Products & Chemicals is proving its resilience and growth potential despite very challenging market conditions.

The company’s strategic focus on its core industrial gases business and leadership in low-carbon hydrogen is paying off, supported by a strong financial performance in 3Q24, an impressive margin recovery, and strategic partnerships to fuel long-term growth.

Moreover, with a return on capital employed of 11%, an A-rated balance sheet, and consistent dividend growth (41 consecutive years), I believe APD offers a compelling investment case.

Hence, even after its recent rally, APD’s valuation remains attractive, positioning it for sustained capital gains.

Pros & Cons

Pros:

- Strong Dividend Growth: APD has 41 consecutive years of dividend hikes, including during major downturns like the Great Financial Crisis and the pandemic, with a 9% annual growth rate since 2014.

- Solid Financials: The company enjoys a 42% EBITDA margin – the highest in its industry. It also has an A-rated balance sheet with a net leverage ratio of less than 3x EBITDA.

- Strategic Growth Focus: APD’s two-pillar strategy of expanding its core gases business and leading in low-carbon hydrogen puts it in a great spot for long-term growth without elevated financial risks.

Cons:

- Challenging Market Conditions: Weak global growth and cyclical headwinds could weigh on APD’s near-term performance.

- Valuation Near Historic Averages: While the valuation is far from bad, APD’s P/E ratio is near its 10-year average, which could limit short-term upside unless economic conditions improve. However, if economic conditions improve, I expect analysts to upgrade their long-term EPS growth expectations.

- Regional Weaknesses: While the Americas and Europe are performing well, Asia and the Middle East/India are facing volume and pricing challenges, which could last until we get a broader economic upswing.

Read the full article here