With one of the most valuable natural gas pipeline systems in the country in Transco and an attractive valuation, Williams Companies (NYSE:WMB) look like an attractive stock at current levels.

Company Profile

WMB is a diversified midstream operator. It owns interstate natural gas pipelines; gathering, processing and treating assets; NGL marketing services, and crude oil transportation and production handling assets.

The company operates in four segments. Its Transmission & Gulf of Mexico segment includes its large interstate natural gas pipelines Transco, Northwest Pipeline, and MountainWest, as well as related natural gas storage facilities. The segment also includes natural gas gathering and processing and crude oil production handling and transportation assets in the Gulf Coast region.

WMB’s Northeast G&P segment consists of its natural gas gathering, processing and fractionization assets in the Marcellus and Utica shales. Its West segment, meanwhile, comprises its natural gas gathering, processing and fractionization assets in the western U.S. The segment operates in the Rocky Mountain region the Barnett Shale, the Eagle Ford Shale, the Haynesville Shale, and the Mid-Continent region, including the Anadarko and Permian basins.

WMB recently closed the acquisition of MountainWest in February. The deal added about 8 Bcf/d of transmission capcity and 56 BcF of storage. The deal was done at about an 8x multiple.

Opportunities & Risks

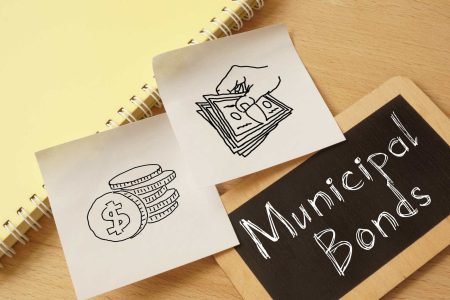

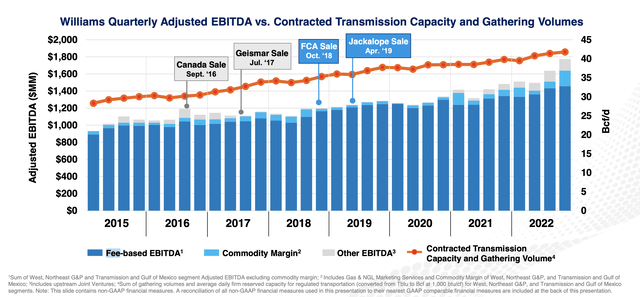

WMB is a huge midstream operator that handles about a third of the natural gas production in the U.S. The company is predominately fee-based and the bulk of its contracts come from demand-pull customers. So, while WMB does face some price and volume risk, these are the type of contracts and customer base a midstream company would want for stability.

Company Presentation

Over two-thirds of WMB’s customers are utility and power companies, which is the most stable customer a natural gas transmission company can have. Only 8% of its contracted capacity comes from producers.

Company Presentation

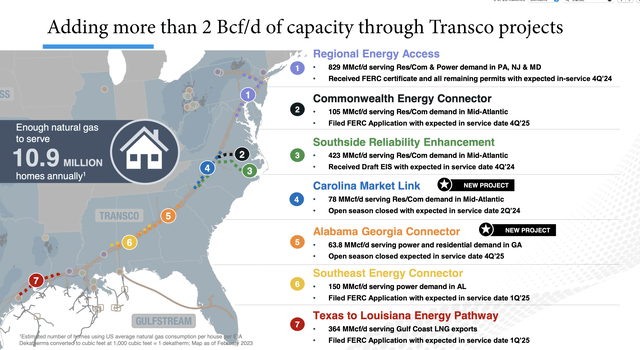

WMB’s Transco System is arguably the most valuable natural gas pipeline system in the U.S. In 2022, Transco accounted for a whopping 31% of WMB’s $6.4 billion in EBITDA. Between 2019-2022, the company was able to add $380 million in fully-contracted fee-based revenue to the system through various projects. Even better, the system continues to have a lot of growth ahead of it.

WMB currently has 7 Transco projects underway, which would add more than 2 Bcf/d day of capacity to the system. Expected in service dates are between Q2 2024 and Q4 2025, so these projects will be accretive in later years.

Company Presentation

Of course, constructing interstate pipelines in the Northeast comes with risks, just ask Equitrans (ETRN) and the issues it has had trying to get its Mountain Valley Pipeline up and running. That pipeline began being constructed in 2018, but legal and environmental issues have kept the last 20 miles from being built on the 303-mile system. However, WMB recently noted at its analyst day that FERC is changing the way it evaluates projects and is requiring an environmental impact statement, which bodes well for the industry.

Discussing its Transco opportunities at its analyst day, COO Michael Dunn said:

“The Mid-Atlantic on Transco is going to be a tremendous growth engine for us. And if you think about what occurred there during Winter Storm Elliott, the utilities were really surprised about the demand that occurred on the natural gas utility basis there and the electric generation that was required. They had a pretty significant margin of error there. It was about 10% miss on the electricity demand based on the actual temperatures and wind that they saw. That is a significant miss when you’re thinking about planning for your peak days. And I think that’s going to have some of the utilities there rethinking their peak day scenarios and, as you heard Alan talk about, what they’re thinking about from their capacity margins that they have to have out there and ready to go and available. So that’s going to really bode well for us establishing new capacity into that region. And then the LNG footprint in the Gulf Coast is going to be another growth engine for us on the Transco system.…

“We have 7 there right now or soon to be 7 with the 2 new ones that you see here on the list. And so I’m highly confident in our team’s ability to execute projects. And I’m even much more confident now about the ability for us to receive permits from the FERC with where I’ve seen a little bit of a change in posture from the FERC. So very optimistic about those changes. I’ll talk more about REA here in a moment, but our 2 new projects, our Carolina Market Link and the Alabama Georgia Connector, these are projects serving residential, commercial and power generation in the Mid-Atlantic and Southeast. And as I said, there are huge opportunities for the Transco organization. And I am incredibly excited about the opportunities that we’re looking at in our backlog today.”

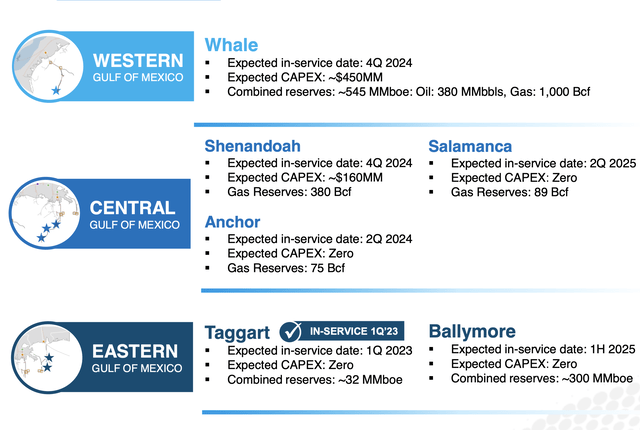

Outside of Transco, the company is targeting the Gulf of Mexico as a growth driver. It currently has 6 deepwater GOM projects underway, many of which require no initial CapEx from WMB. It is expecting its GOM adjusted EBITDA to double as a result of these projects by 2025.

Company Presentation

Overall, WMB has shown a great return on its growth projects. From 2019-2022 it has a 17.5% return of invested capital. That has helped increase its adjusted EBITDA by nearly $1.6 billion from 2019 to 2023 (estimated).

Despite the number of growth projects WMB is working on, like many midstream companies, WMB’s primary focus has been on strengthening its balance sheet over growth. The company has taken its leverage from 4.8x in 2018 down to 3.55x at the end of 2022. Over the same time period, its grown its dividend from $1.36 to $1.70. Meanwhile, its dividend coverage ratio was a robust 2.37x for 2022. WMB is looking to grow its dividend by over 5% in 2023.

Overall, these metrics show a disciplined midstream operator that is able to pursue attractive growth projects, keep its balance sheet strong, and grow its dividend. That is generally what income-oriented investors want to see in these companies.

Valuation

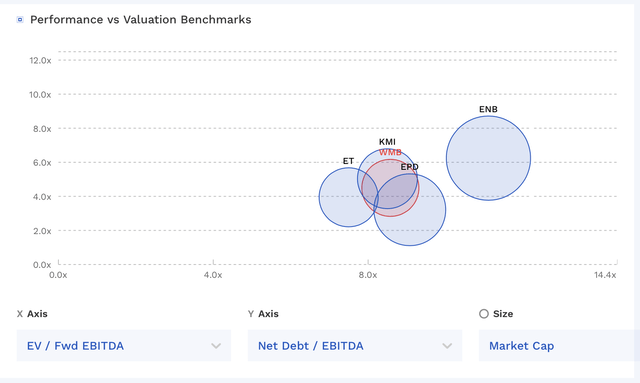

Turning to valuation, WMB trades at 8.6x the 2023 EBITDA consensus of $6.58 billion. Based on the 2024 EBITDA consensus of $6.72 billion, it is valued at 8.4x. If you adjust for the MountainWest acquisition, it would raise the multiple to about 8.8x and 8.6x, respectively.

The stock has an attractive free cash flow yield of about 11.8% based on my 2023 projections calling for $4.25 billion in FCF. The stock has a yield of about 6%. As such, the dividend is very well covered and has plenty of room to grow.

WMB trades in the middle of where other large midstream operates are currently trading.

WMB Valuation Vs Peers (FinBox)

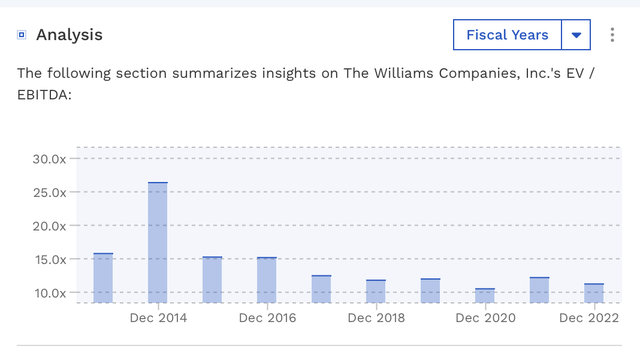

It trades at a much lower multiple than it did pre-pandemic.

WMB Historical Valuation (FinBox)

Conclusion

WMB offers a nice combination of growth, stability, a solid balance sheet, and dividend growth. The company, meanwhile, has arguably the most important and valuable natural gas pipeline system in the U.S. in Transco. While the company will have some commodity-price headwinds in 2023, its fee-based contracts and demand-pull customers are extremely attractive and defensive in nature.

Trading at under 9x EV/EBITDA with some nice projects that will hit in the 2024 through 2025 time frame, the stock looks like a “Buy.” I see upside to $42, which is an under 11x multiple based on the 2024 consensus.

Read the full article here