I’m sure this quote from Warren Buffett has been cited many times by Seeking Alpha authors:

“It is wise for investors to be fearful when others are greedy, and greedy when others are fearful.” (Investopedia)

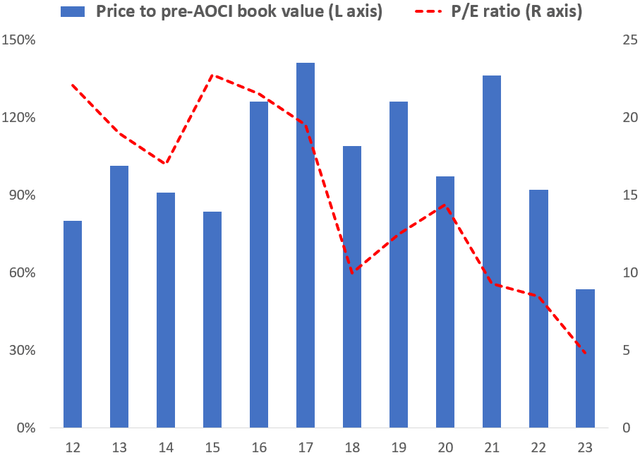

It is no stretch to say that investors currently are seriously fearful about regional banks. For example, here is a valuation history for Zions Bancorporation (NASDAQ:ZION) (Note that my book value calculations for ’22 and ’23 exclude “AOCI”, or “accumulated other comprehensive income.” More on that later.):

Zions Bank, Yahoo Finance

Sources: Zions Bank financial statements, Yahoo Finance

ZION stock is by far cheaper today than it has been since the ’08 Financial Crisis. That is serious fear! But a rational look at Zions, a fairly typical regional bank with concentrations in Utah and California, says that serious trouble is extremely unlikely. In my view, only a financial system meltdown followed by an economic depression would make this stock overpriced at present. The rest of this article presents my reasoning.

The four bank risk management issues

Banking, more than most businesses, is heavily about risk management. When I read financial company reports that feature growth or disruptive technologies, etc. and spend little time on their risk management, my only investment interest is on the short side.

Banks’ four major risk management issues are:

- Liquidity

- Interest rates

- Credit

- Capital

Clearly for Zions today, risk management is the only issue. Its current E/P ratio (the standard P/E reversed) is 21%. If Zions can roughly hold its current EPS forecast of about $6 and never grow again, I will be one seriously happy investor. So, let’s review those risks.

Liquidity risk

Since Silicon Valley and Signature Bank’s blow-ups, we all know a lot about bank liquidity risk, so I’ll be quick. As of year-end 2022, $38 billion of Zions’ $72 billion of deposits was uninsured. That is a lot, but not too surprising for a bank focused on business customers. Should those business customers be worried? No, for two reasons.

First, uninsured depositors rarely, if ever, have lost money in a bank failure. A Google search didn’t come up with anything, and as a thrift analyst through the S&L failures of the ‘80s/’90s and the Great Financial Crisis, I don’t recall any. Why? Because the government fears the consequences of doing so – widespread panic about the financial system.

Second, as we’ll see, Zions is actually a conservative bank with far less risk than implied by its valuation.

Despite these reasons, could there be a run on the bank? Sure, we could get what I’ll call a Twitter Panic. The U.S. dollar is a “fiat” currency, meaning that its value depends on all of us accepting it as a means of universal payment. Similarly, we have a “fiat” banking system in the sense that it can exist only if we depositors are confident that banks are stores of value. If we choose to panic just because we do, we can take down the banking system. And talk ourselves into a depression. We’ll see. But we also know that the government and the Fed will do their best to avoid that outcome.

So, while I can’t assign a 0% value to a liquidity crisis at Zions, I will say it’s a very long shot.

Interest rate risk – The problem.

Here’s where it gets interesting. At the start of 2022, Zions owned $25 billion of investment securities, whose market value was almost exactly equal to the price Zions paid for them. By year-end, Zions recognized a non-cash loss (for securities not sold) of $3 billion on these securities. Accounting practice says that these non-cash losses aren’t recognized through a bank’s income statement, but are subtracted from shareholders’ equity, or capital. That’s the ”AOCI” I was talking about above. Zions’ reported capital was therefore $5 billion instead of $8 billion.

Further, Zions reported that the market value of its $55 billion of loans declined by $2 billion during ‘22. This loss of value for the banking industry was highlighted in this recent article in the Wall Street Journal. One could therefore say that Zions’ capital is now down to $3 billion, or a mere 3% of assets. Banks should have more than double that capital ratio. Getting pretty scary, huh?

Interest rate risk – the reason for the problem.

Our economy creates substantial amounts of interest rate risk. You may have. Do you have a 30-year fixed rate mortgage? And is your cash in money market funds? The financial institutions on the other side of those two transactions now have a 30-year fixed rate asset with a liability whose interest rate will change every year or less.

When interest rates rose last year, your 30-year mortgage interest rate didn’t move, but you should be earning more on your savings. Great for you. The financial system allows us to take this beneficial interest rate risk by absorbing the risk itself. Banks can typically offer us this service without too much of a cost. But not always. Like last year:

“2022 was the worst-ever year on record for U.S. bond investors, according to an analysis by Edward McQuarrie, a professor emeritus at Santa Clara University who studies historical investment returns.” (CNBC)

It is therefore not surprising that banks like Zions faced some challenges last year.

Or did it?

Interest rate risk – maybe there was no problem!

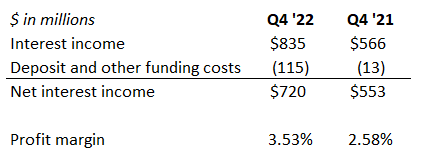

From my example above, it should follow that Zions’ deposit costs should be rising far faster than the yields on its loans and securities, thus putting a squeeze on its interest income. But let’s check. Here are those numbers for Q4 ’22 and Q4 ’21:

Zions Bank financial statements

Source: Zions Bank financial statements

Zions’ interest income increased by 30% last year! Its profit margin – called its “interest margin” – rose by 36%! And it remains confident about its interest income for this year, or at least it did the last time it discussed this issue:

“We expect full year 2023 net interest income to increase at a rate in the high single digits relative to FY22”. (Zion investor presentation, February 2023)

How does this jibe with the balance sheet analysis I went through above?

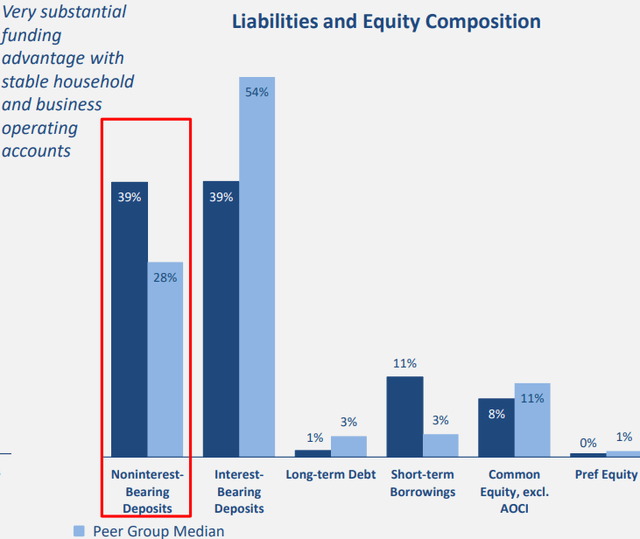

What is missing is the recognition that banks have two sides to their balance sheets – assets and liabilities. We have only looked at the asset side so far, and its loss of value due to higher interest rates. We’ve ignored the liability side. So let’s look at it now:

Zions investor presentation, 2/23

Source: Zions investor presentation, February 2023

Non-interest bearing accounts made up 39% of Zions’ total funding at the end of 2022! After a year of rising fed funds, 39% of its deposits are getting 0%. And it paid only about 1% on the interest-bearing deposits during Q4 ’22. That $40 billion of free funding certainly gained a substantial amount of value over the course of the year. But it was the secret sauce that drove Zions’ interest income higher:

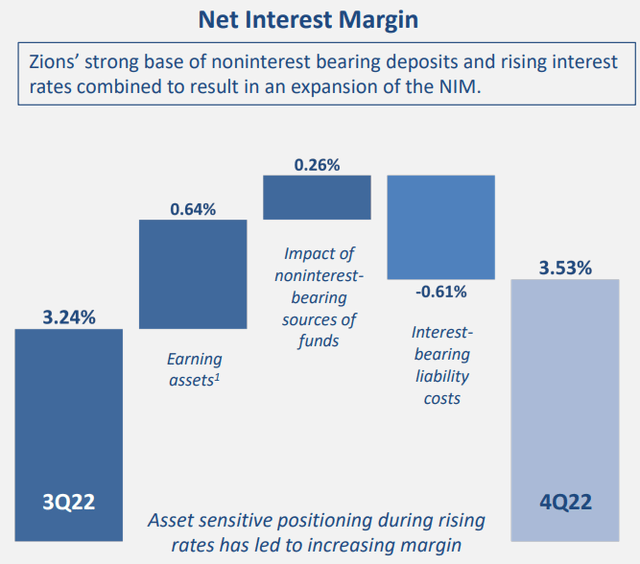

Zions investor presentation, 2/23

Source: Zions investor presentation, February 2023

Zions’ deposit costs were in fact quite stable last year, as measured by its “deposit beta,” which is the amount of change in deposit costs relative to the change in market interest rates. Beta maxes at 100%, and the lower the better. So, this is good news: “Our deposit beta is just 5% thus far this cycle.” (Zion investor presentation, February 2023)

So yes, the off-the-charts terrible bond market last year eroded $5 billion of value from Zions’ assets. But its low-cost and stable deposit base increased in value, very likely by a similar amount.

Oh, and by the way, interest rates have declined this year-to-date and the inverted yield curve says the Federal Reserve will be easing in the not-too-distant future.

Credit risk. Defaults will increase, but not nearly enough to derail earnings.

Yes, a recession beginning over the next year is a real possibility. But recessions are not automatic killers for bank earnings. For example, Zions’ loan chargeoff rate during the 2001 recession peaked at 0.35%, or about $1 a share at today’s loan size and share count. The killer is a recession preceded by several years of weak lending standards, like the ‘07/’08 debacle.

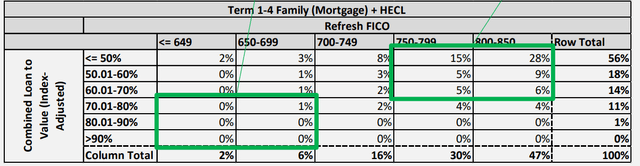

But Zions’ loan standards are solid today. For example, Zions had a gain of $3 million in charge-offs during Q4, meaning it collected more on unexpected recoveries from previous charge-offs than it lost on new ones. And I’m pretty confident about its credit risk going forward. The company provides loan-to-value (LTV) data on its real estate loans, where probably the greatest risk lies for banks today. Take a look, first at home mortgage loans:

Zions investor presentation, 2/23

Source: Zions investor presentation, February 2023

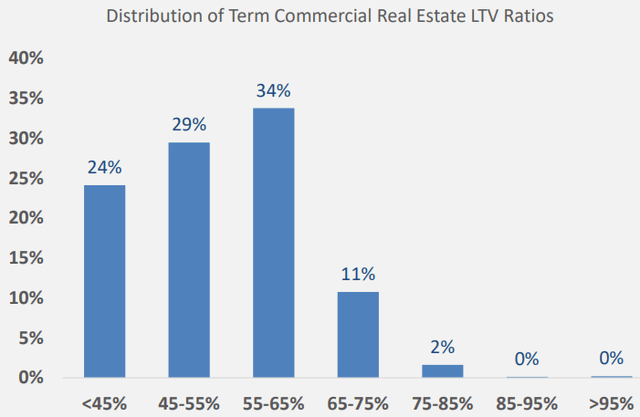

Very conservative. No subprime, no low downpayment. Now the LTVs for commercial real estate loans:

Zions investor presentation, 2’23

Source: Zion investor presentation, February 2023

As conservative as the home mortgages. Yes, Zions will suffer some office building defaults, the most dangerous lending category for banks today because of tech industry turmoil and the work-from-home trend. But they represent only 2% of assets.

Capital risk.

Banks have complex regulatory capital rules, with different measures of capital that are compared to both total assets and assets adjusted for their credit risk. No need to get into the details here. Let’s look at one measure – “Tier 1” capital to risk-weighted assets. As of the end of 2002, Zions’ minimum requirement was 8.5%, which it comfortably exceeded with a 10.5% ratio. Note that for regulatory purposes, the AOCI capital adjustment is not used.

So far, so good. But the Silicon Valley and Signature bankruptcies have embarrassed the regulators and enraged their bosses in Congress and the White House. Tougher capital rules may be in the offing, like adding more interest rate risk components or increasing the minimum capital ratios. If so, Zions could have to temporarily:

- Increase its hedging costs.

- Limit its loan portfolio growth, or even shrink.

- Suspend its share repurchase program.

- In the worst case, raise capital.

Placing odds on these possibilities is impossible. Only the last one, the capital raise, would be a serious problem for my Buy rating. I believe the odds of a forced capital raise are small, because the cumulative required capital raise for the banking industry could be huge, and therefore materially disruptive to the economy. So would forcing banks to restrain their lending. More likely there will be more talk than action by the regulators, with the hope that investors’ worries will fade.

Wrapping up – the Buy rating

I’ve argued above that Zions’ book value excluding the AOCI charge is reasonable, considering that the extra value of its deposits in this higher interest rate environment at least offsets the loss in value of its securities and loans. And earnings should take only a temporary one- or two-year nick from office and some other loans in the possible recession ahead.

That leaves Zions’ valuation at only 54% of book value and a 5 P/E. I’ll take that all day. You should consider doing so as well, if you can get over the fear.

Read the full article here